Three Leading Growth Stocks With Insider Ownership Exceeding 11%

In the past year, the United States stock market has shown resilience with a 19% increase, despite a recent 7-day dip of 3.2%. In this environment, growth companies with high insider ownership can be particularly compelling, as such ownership often signals confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Growth Rating |

PDD Holdings (NasdaqGS:PDD) | 33.6% | ★★★★★★ |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 28.6% | ★★★★★★ |

Li Auto (NasdaqGS:LI) | 31.3% | ★★★★★★ |

FTC Solar (NasdaqGM:FTCI) | 32.7% | ★★★★★★ |

Finance of America Companies (NYSE:FOA) | 17% | ★★★★★★ |

Alkami Technology (NasdaqGS:ALKT) | 14.4% | ★★★★★★ |

Cipher Mining (NasdaqGS:CIFR) | 19.6% | ★★★★★★ |

Establishment Labs Holdings (NasdaqCM:ESTA) | 11.2% | ★★★★★★ |

BBB Foods (NYSE:TBBB) | 23.8% | ★★★★★★ |

EHang Holdings (NasdaqGM:EH) | 33% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

PDD Holdings

Simply Wall St Growth Rating: ★★★★★★

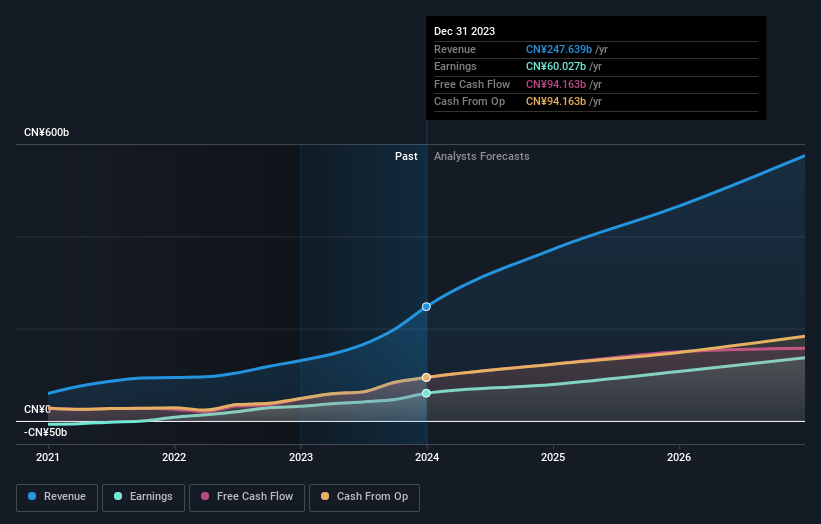

Overview: PDD Holdings Inc., a multinational commerce group, manages a diverse portfolio of businesses and has a market capitalization of approximately $164.93 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, totaling CN¥247.64 billion.

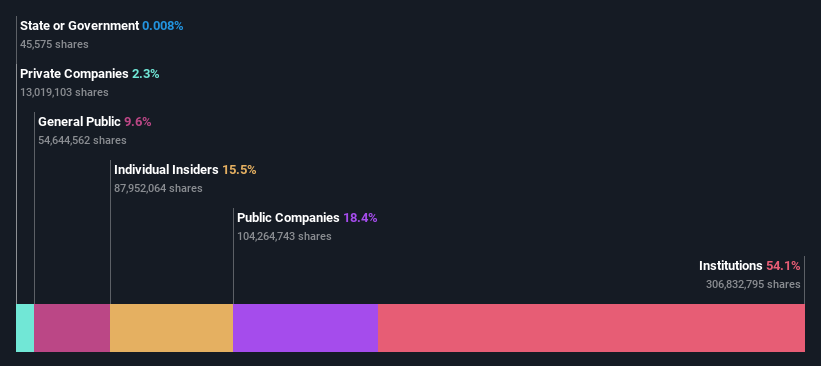

Insider Ownership: 33.6%

PDD Holdings has demonstrated robust financial growth, with its full-year sales reaching CNY 247.64 billion, nearly doubling from the previous year, and net income soaring to CNY 60.03 billion. This growth trajectory is supported by a high forecasted annual revenue increase of 20.8% and earnings expected to grow by 23% annually over the next three years. Despite recent shareholder dilution, PDD's strong insider ownership aligns interests with long-term investors, enhancing its appeal as a growth-oriented company with substantial market outperformance potential.

Estée Lauder Companies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estée Lauder Companies Inc. operates globally, manufacturing and selling a range of skin care, makeup, fragrance, and hair care products with a market capitalization of approximately $52.85 billion.

Operations: The company's revenue is primarily derived from skin care ($7.48 billion), makeup ($4.43 billion), fragrance ($2.56 billion), and hair care products ($0.63 billion).

Insider Ownership: 11.4%

Estée Lauder, a notable player in the beauty industry, is navigating mixed financial waters with forecasted earnings growth of 34.5% annually over the next three years, outpacing the US market's expected 14.4%. Despite this robust profit outlook and high insider ownership indicating aligned interests with long-term shareholders, challenges persist. The company grapples with a high debt level and non-cash earnings predominance, alongside modest revenue growth projections of 7.2% annually compared to the broader US market's 7.9%. Recent strategic expansions into online platforms like Amazon’s Premium Beauty store signify adaptation to evolving consumer shopping behaviors, potentially bolstering future performance.

Sea

Simply Wall St Growth Rating: ★★★★☆☆

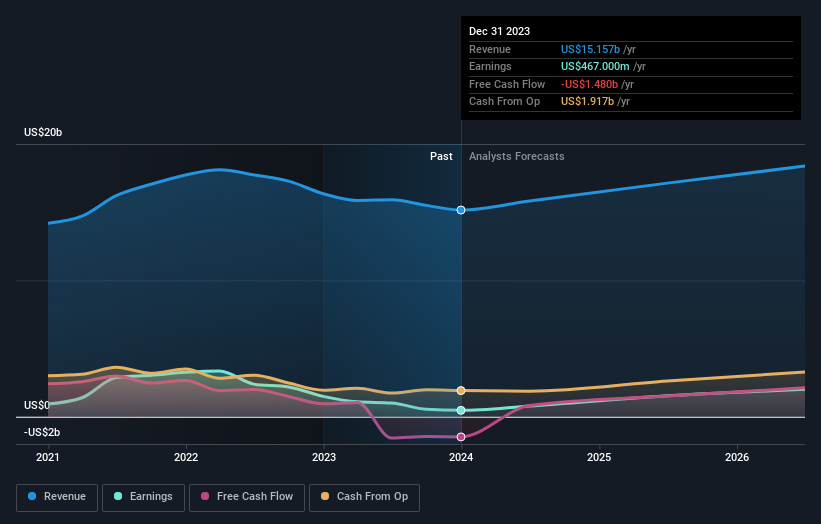

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other regions globally, with a market capitalization of approximately $33.68 billion.

Operations: The company generates revenue through its e-commerce segment with $9.00 billion, digital entertainment at $2.17 billion, and digital financial services contributing $1.76 billion.

Insider Ownership: 15.5%

Sea Limited, despite recent financial turbulence with a significant shift from net income to a net loss in its latest quarterly report, shows promising growth prospects. The company's earnings are expected to increase significantly at 37.7% per year, outstripping the US market forecast of 14.4%. Additionally, Sea's revenue growth is also projected to surpass the market average at 11.4% annually. However, it is trading at a considerable discount of 41.5% below its estimated fair value and has faced one-off items affecting its earnings quality this year.

Seize The Opportunity

Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 201 more companies for you to explore.Click here to unveil our expertly curated list of 204 Fast Growing Companies With High Insider Ownership .

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St , where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include NasdaqGS:PDD NYSE:EL and NYSE:SE .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance