Three Australian Dividend Stocks To Consider With Yields Up To 6.6%

The Australian stock market, as represented by the ASX200, is showing signs of steady growth with a predicted increase of around 0.35% this morning. This comes after major US indices broke their six-day losing streak, providing some positive momentum in the global markets. In this context, dividend stocks can be an appealing option for investors seeking regular income streams. Given the current market conditions and upcoming economic data releases from Australia's Bureau of Statistics, it's important to carefully consider stocks with strong fundamentals and sustainable dividend yields.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Nick Scali (ASX:NCK) | 5.01% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.70% | ★★★★★☆ |

Joyce (ASX:JYC) | 6.93% | ★★★★★☆ |

Korvest (ASX:KOV) | 6.67% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.65% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.65% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.54% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.35% | ★★★★★☆ |

PRL Global (ASX:PRG) | 6.36% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.23% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

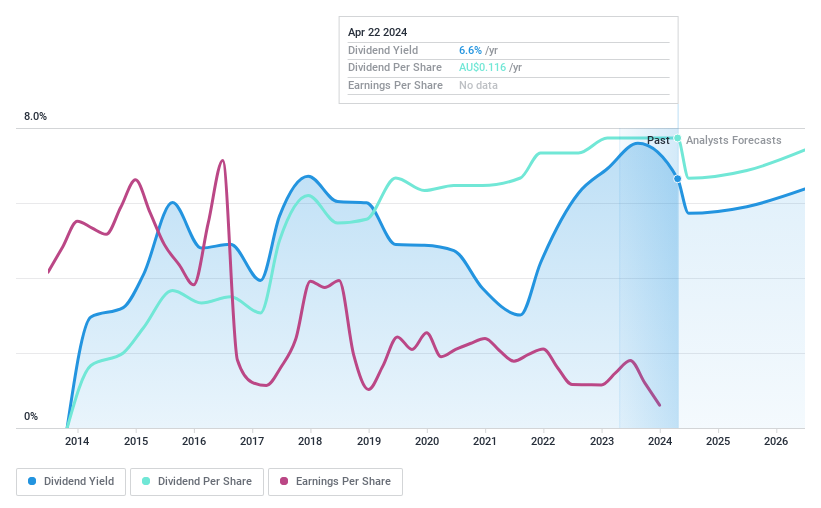

Centuria Capital Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Centuria Capital Group, operating primarily in Australia, is an investment manager that focuses on marketing and managing investment products with a market capitalization of A$1.44 billion.

Operations: Centuria Capital Group generates its revenue through various segments, with the largest being Property Funds Management at A$178.53 million, followed by Co-Investments and Non-Operating Items contributing A$53.33 million and A$51.53 million respectively. Other significant revenue streams include Development (A$40.07 million), Benefit Funds (A$10.35 million), Investment Bonds Management (A$9.79 million), and Property and Development Finance (A$17.46 million). The company also earns a minor income from its Corporate segment amounting to A$2.38 million.

Dividend Yield: 6.6%

Centuria Capital Group, trading at 52.2% below its fair value, offers a dividend yield of 6.65%, ranking in the top 25% of Australian market dividend payers. Despite an unstable track record and volatility over the past decade, recent dividends are covered by earnings (76.1%) and cash flows (73.5%). However, profit margins have decreased from last year's 6.5% to current 3.1%. Earnings are projected to grow by 21.41% per annum despite a recent half-year report showing reduced sales and net income compared to the previous year.

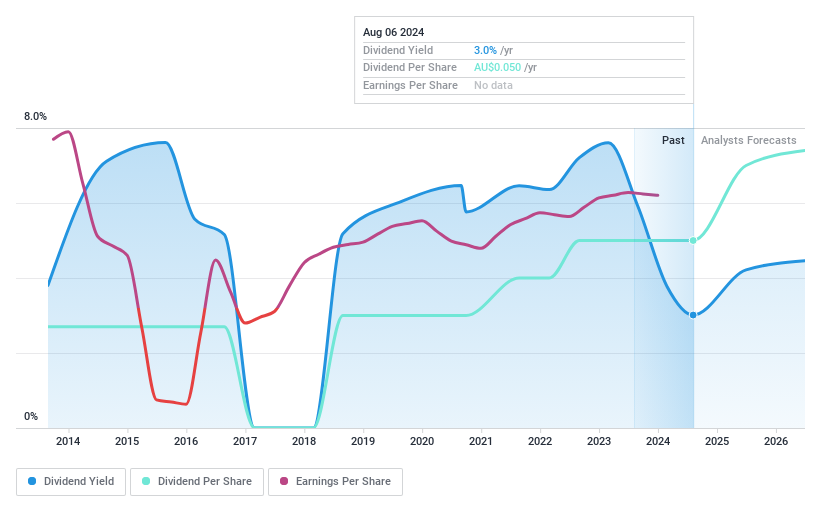

Fiducian Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd is an Australian company that offers financial services through its subsidiaries, and it has a market capitalisation of approximately A$258.12 million.

Operations: Fiducian Group Ltd generates its revenue through four key segments in Australia, including Funds Management which brings in A$20.49 million, Corporate Services earning A$12.06 million, Financial Planning contributing A$28.95 million and Platform Administration accounting for A$15.38 million.

Dividend Yield: 3.7%

Fiducian Group's dividends have shown growth and stability over the past decade, supported by a sustainable payout ratio of 83.7% from earnings and 60.5% from cash flows. Recent half-year results reported an increase in sales to A$39 million and net income to A$6.84 million, reflecting a year-on-year earnings growth of 12%. Despite these positives, FID's dividend yield of 3.7% is lower than the top quartile of Australian dividend payers (6.25%), indicating room for improvement.

Dive into the specifics of Fiducian Group here with our thorough dividend report.

Our valuation report here indicates Fiducian Group may be undervalued.

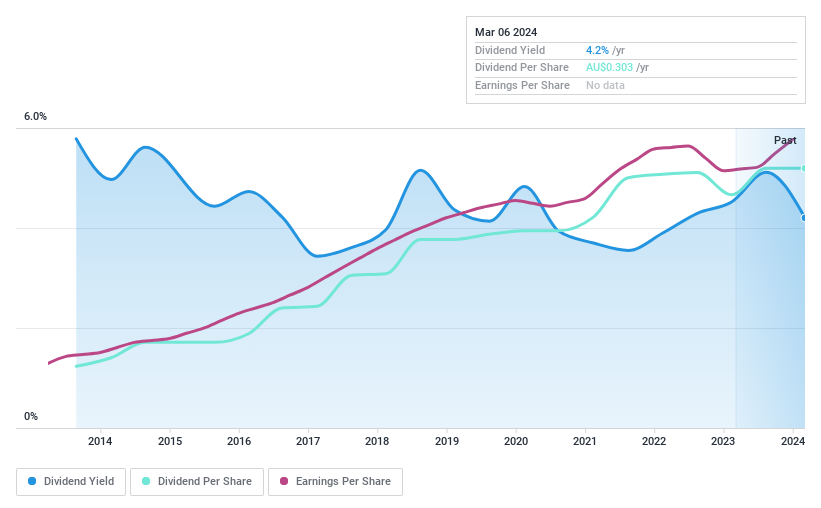

Southern Cross Electrical Engineering

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, with a market capitalisation of A$313.23 million, is an Australian company that offers a range of services including electrical, instrumentation, communication and maintenance.

Operations: Southern Cross Electrical Engineering Limited, valued at A$313.23 million, generates its revenue primarily through the provision of electrical services, accounting for A$464.88 million of its earnings.

Dividend Yield: 4.2%

Southern Cross Electrical Engineering's dividends are supported by a sustainable payout ratio of 66.5% from earnings and 78.2% from cash flows. The firm's recent half-year results reported stable sales of A$255.55 million and a net income of A$9.64 million, indicating steady performance despite slight volatility in dividend payments over the past decade. However, with a dividend yield of 4.2%, it falls short when compared to the top quartile of Australian dividend payers (6.25%).

Next Steps

Unlock our comprehensive list of 45 Top Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CNI ASX:FID and ASX:SXE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance