Those Who Purchased Food Revolution Group (ASX:FOD) Shares A Year Ago Have A 27% Loss To Show For It

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in The Food Revolution Group Limited (ASX:FOD) have tasted that bitter downside in the last year, as the share price dropped 27%. That's disappointing when you consider the market returned -22%. On the bright side, the stock is actually up 11% in the last three years. More recently, the share price has dropped a further 16% in a month. But this could be related to poor market conditions -- stocks are down 35% in the same time.

See our latest analysis for Food Revolution Group

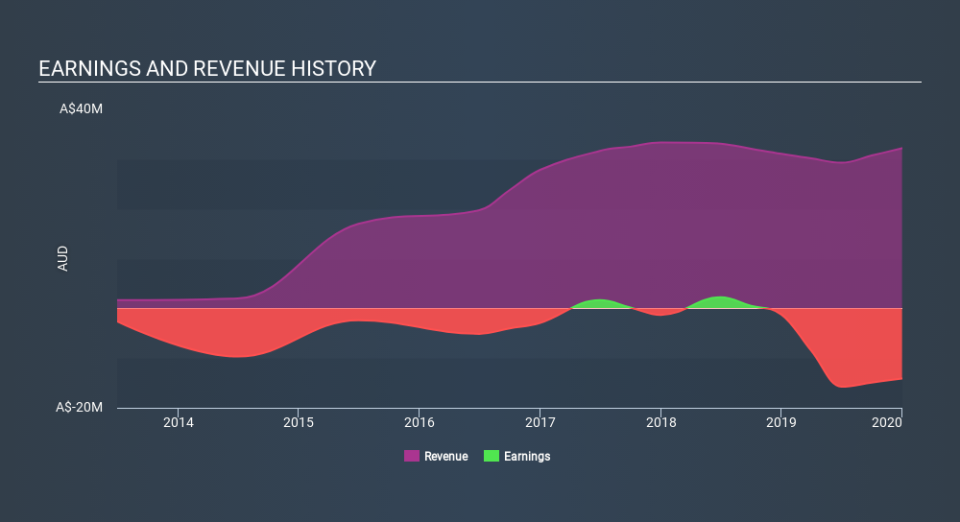

Because Food Revolution Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Food Revolution Group saw its revenue grow by 3.6%. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 27% in a year. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Food Revolution Group's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Food Revolution Group shares, which performed worse than the market, costing holders 27%. The market shed around 22%, no doubt weighing on the stock price. Investors are up over three years, booking 3.5% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Food Revolution Group better, we need to consider many other factors. Take risks, for example - Food Revolution Group has 6 warning signs (and 2 which are significant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance