Those who invested in DGR Global (ASX:DGR) five years ago are up 70%

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the DGR Global share price has climbed 49% in five years, easily topping the market return of 35% (ignoring dividends).

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for DGR Global

We don't think DGR Global's revenue of AU$1,596,000 is enough to establish significant demand. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, investors may be hoping that DGR Global finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

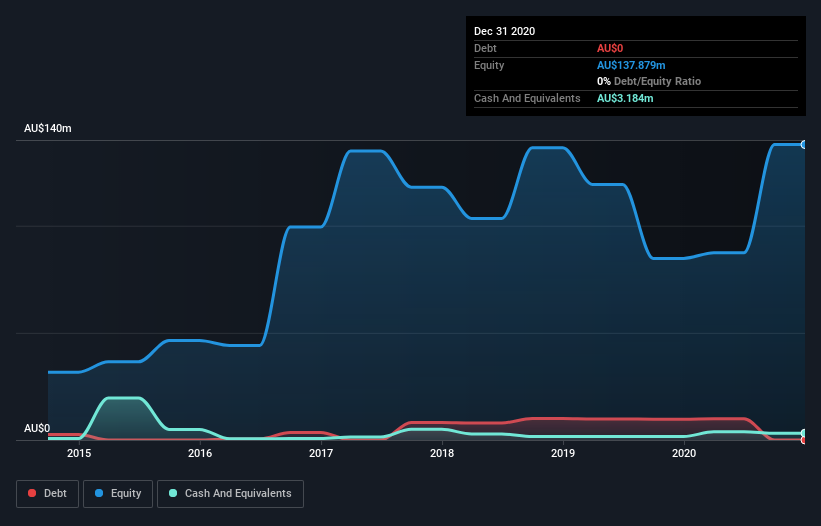

DGR Global had liabilities exceeding cash by AU$30m when it last reported in December 2020, according to our data. That puts it in the highest risk category, according to our analysis. So the fact that the stock is up 126% per year, over 5 years shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. The image below shows how DGR Global's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between DGR Global's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. DGR Global hasn't been paying dividends, but its TSR of 70% exceeds its share price return of 49%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in DGR Global had a tough year, with a total loss of 12%, against a market gain of about 31%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for DGR Global (of which 2 shouldn't be ignored!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance