Those who invested in Alliance Aviation Services (ASX:AQZ) five years ago are up 562%

Long term investing can be life changing when you buy and hold the truly great businesses. And highest quality companies can see their share prices grow by huge amounts. For example, the Alliance Aviation Services Limited (ASX:AQZ) share price is up a whopping 482% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen 10% in thirty days. But this could be related to good market conditions -- stocks in its market are up 4.3% in the last month.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Alliance Aviation Services

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Alliance Aviation Services actually saw its EPS drop 21% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

On the other hand, Alliance Aviation Services' revenue is growing nicely, at a compound rate of 10% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

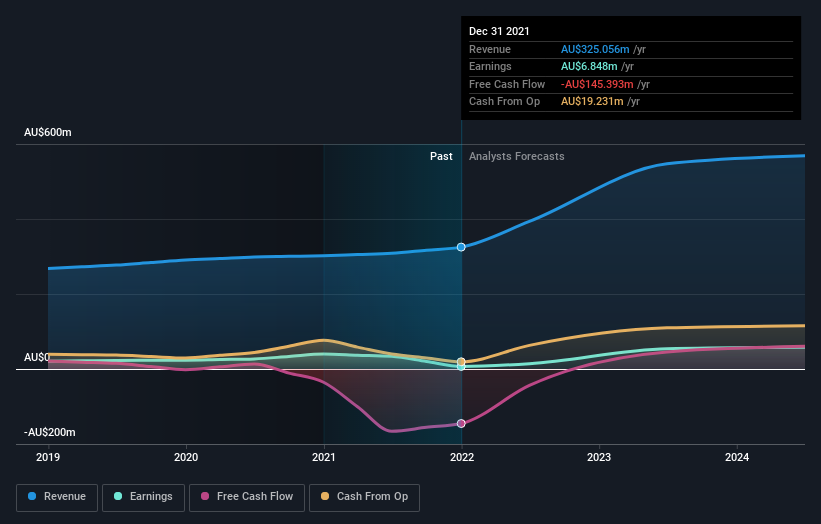

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Alliance Aviation Services

What about the Total Shareholder Return (TSR)?

We've already covered Alliance Aviation Services' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Alliance Aviation Services shareholders, and that cash payout contributed to why its TSR of 562%, over the last 5 years, is better than the share price return.

A Different Perspective

Investors in Alliance Aviation Services had a tough year, with a total loss of 8.3%, against a market gain of about 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 46% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Alliance Aviation Services better, we need to consider many other factors. For example, we've discovered 3 warning signs for Alliance Aviation Services (2 don't sit too well with us!) that you should be aware of before investing here.

Alliance Aviation Services is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance