Things to Consider as Goodyear (GT) Gears Up for Q1 Earnings

Goodyear Tire GT is slated to release first-quarter 2022 results on May 6, before the opening bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at 18 cents per share and $4.89 billion, respectively.

The Zacks Consensus Estimate for Goodyear’ first-quarter earnings per share has been revised downward by 13 cents in the past 30 days. The bottom-line projection implies a year-over-year decline of 58.2%. The top-line projection implies a year-over-year surge of 39.4%.

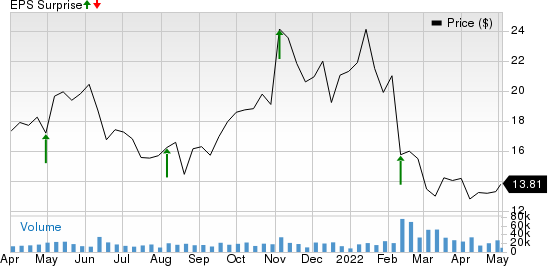

Goodyear posted higher-than-expected earnings in the last reported quarter amid high sales volume across all segments, thanks to Cooper Tire buyout synergies. Over the trailing four quarters, Goodyear beat earnings estimates on all occasions, with the average surprise being 212.5%.

The Goodyear Tire & Rubber Company Price and EPS Surprise

The Goodyear Tire & Rubber Company price-eps-surprise | The Goodyear Tire & Rubber Company Quote

Investors are keeping their fingers crossed for Goodyear Tire to maintain its beat run but our model does not predict the same. Let’s see how things have shaped up prior to its first-quarter 2022 results.

Factors at Play

Goodyear’s upcoming results will reflect synergies from the Cooper Tire buyout, which closed last June. The frequent rollout of new products is also likely to have led to top-line growth. During the last reported quarter, the company launched Goodyear ElectricDrive GT, a best-in-class fit-for-purpose tire, especially for electric vehicles. Collaborations with various companies for the same are expected to have benefited GT.

However, low global vehicle production amid the chip crisis is anticipated to have induced lost sales. Supply chain snafus worsened by the Russia-Ukraine war and resurgence of COVID-19 cases in China are anticipated to have played spoilsports. High commodity, labor and logistics costs are likely to have clipped margins. GT expects 1H’22 commodity costs to increase $700-$800 million from the comparable year-ago period. This doesn’t bode well for the first-quarter 2022 results. Discouragingly, the firm expects Q1 transportation costs alone to be $20-$30 million higher than Q4 levels. Also, high capex and R&D expenses incurred by Goodyear in an effort to ramp up its capabilities to develop technologically advanced products are anticipated to have acted as a killjoy.

All in all, chip famine, supply chain woes and high commodity and operational costs are likely to have offset commercial and operational synergies from Cooper Tire buyout and mar Goodyear’s first-quarter margins.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Goodyear this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here as elaborated below.

Earnings ESP: Goodyear has an Earnings ESP of -42.86%. This is because the Most Accurate Estimate is pegged 8 cents lower than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Goodyear currently holds a Zacks Rank of 4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

S&P 500 Stocks With Favorable Combination

While an earnings beat looks uncertain for Goodyear Tire, we have highlighted a few S&P 500 stocks that have the right combination of elements to come up with an earnings beat this time around.

Analog Devices, Inc. ADI: Headquartered in Massachusetts, Analog is one of the leading chipmakers in the world. It has an Earnings ESP of +2.17% and a Zacks Rank #2. The company is scheduled to release second-quarter fiscal 2022 results on May 18.

The Zacks Consensus Estimate for Analog’s to-be-reported quarter’s revenues and earnings is pegged at $2.86 billion and $2.12 per share, respectively. ADI surpassed earnings estimates in the trailing four quarters, with an average surprise of 6%.

Cisco Systems CSCO: California-based, Cisco is the world's largest networking-hardware company. It has an Earnings ESP of +0.84% and a Zacks Rank #2. The company is scheduled to release third-quarter fiscal 2022 results on May 18.

The Zacks Consensus Estimate for Cisco’s to-be-reported quarter’s revenues and earnings is pegged at $13.33 billion and 86 cents per share, respectively. CSCO surpassed earnings estimates in the trailing four quarters, with an average surprise of 1.2%.

Best Buy Co., Inc. BBY: Headquartered in Richfield, MN, Best Buy is a consumer electronics leader. It has an Earnings ESP of +9.85% and a Zacks Rank #3. The company is scheduled to release first-quarter fiscal 2023 results on May 24.

The Zacks Consensus Estimate for Best Buy’s to-be-reported quarter’s revenues and earnings is pegged at $10.34 billion and $1.56 per share, respectively. BBY surpassed earnings estimates in the trailing four quarters, with an average surprise of 29.2%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance