Textron Inc (TXT) Reports Q1 2024 Earnings: Mixed Results Against Analyst Expectations

Earnings Per Share (EPS): Reported at $1.03, falling short of the estimated $1.23.

Adjusted EPS: Achieved $1.20, up from $1.05 in the previous year, but still below the quarterly estimate of $1.23.

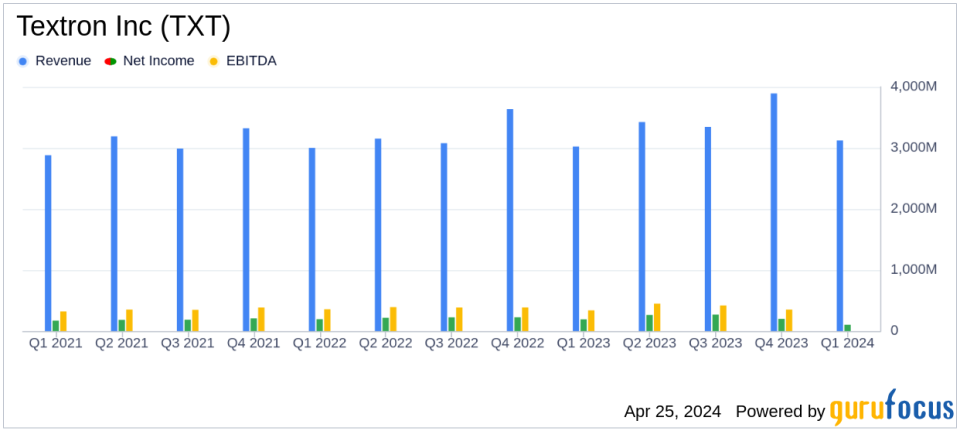

Revenue: Reached $3,135 million, surpassing the estimate of $3,294.80 million and showing an increase from $3,024 million year-over-year.

Net Income: Reported at $201 million, below the estimated $246.13 million.

Segment Profit: Increased to $290 million from $259 million in the prior year, indicating improved operational efficiency.

Backlog Growth: Notable in Aviation with $177 million increase, totaling $7.3 billion, and Bell segment at $4.5 billion, driven by military contracts.

Cash Flow: Net cash used by operating activities was $30 million, a significant shift from $153 million provided in the previous year.

On April 25, 2024, Textron Inc (NYSE:TXT) released its first quarter financial results through its 8-K filing. The company reported earnings per share (EPS) of $1.03, with an adjusted EPS of $1.20, which slightly missed the analyst estimate of $1.23 per share. Despite this, the adjusted EPS shows an improvement from the previous year's $1.05, indicating a positive trajectory in profitability. The total revenue for the quarter stood at $3,135 million, narrowly surpassing the estimated $3,294.80 million.

About Textron Inc

Textron Inc is a renowned conglomerate known for its extensive portfolio in aircraft, defense, industrial, and finance sectors. The company's major brands include Bell, Cessna, and Beechcraft, among others, which cater to both commercial and military needs globally. With a focus on innovation and strategic market positioning, Textron continues to enhance its product offerings and expand its market footprint.

Performance Highlights and Challenges

The quarter witnessed growth in segment profits, rising to $290 million, a $31 million increase from the previous year. This improvement was primarily driven by higher revenues and profit margins in the Aviation and Bell segments. Textron Aviation, in particular, saw a revenue increase due to higher pricing, despite a mixed volume, and ended the quarter with a substantial $7.3 billion backlog, highlighting strong market demand.

However, the Industrial segment faced a downturn, with revenues declining by $40 million due to lower volume and mix, particularly in the Specialized Vehicles product line. This dip reflects ongoing challenges in market demand and operational efficiency within this segment.

Financial Position and Cash Flow

Textron's balance sheet remains robust with total assets of $16,414 million. However, the company experienced a significant use of cash in operating activities, reporting a net cash usage of $30 million, a stark contrast to the $153 million provided last year. This shift was largely due to changes in working capital and increased capital expenditures, which may raise concerns about short-term liquidity and cash management efficiency.

Strategic Initiatives and Outlook

During the quarter, Textron continued to execute its strategic initiatives, including the restructuring plan which expanded to accommodate additional severance costs anticipated in Q2 2024. This restructuring aims to optimize cost structures across various segments, particularly in response to program cancellations in the Textron Systems and Bell segments.

The company's leadership remains optimistic about leveraging Textron's diversified business model to navigate market uncertainties and drive long-term growth. With ongoing investments in key military programs and innovations in aviation technology, Textron is well-positioned to capitalize on emerging opportunities in its sectors.

Investor and Analyst Perspectives

While Textron's Q1 performance presents a mixed financial landscape, the company's strategic adjustments and backlog growth in critical segments underscore its resilience and potential for recovery. Investors and analysts will likely watch closely how Textron balances its operational challenges with strategic investments to enhance shareholder value in the upcoming quarters.

For detailed financial figures and future projections, stakeholders are encouraged to view the full earnings report and tune into the company's earnings call, which provides further insights into its strategic plans and financial health.

Explore the complete 8-K earnings release (here) from Textron Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance