Teradyne Inc (TER) Q1 2024 Earnings: Surpasses Analyst Revenue and EPS Forecasts

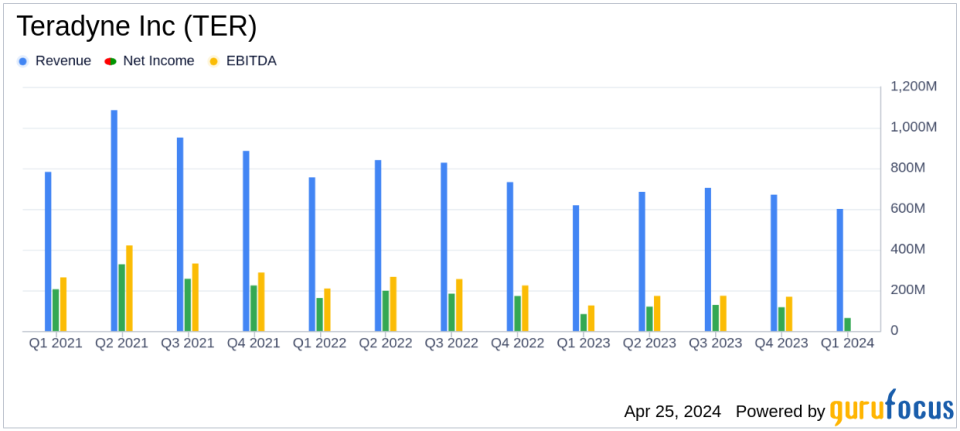

Revenue: Reported $600 million in Q1 2024, a decrease of 3% year-over-year from $618 million in Q1 2023, surpassing the estimate of $566.31 million.

GAAP Net Income: Achieved $64.2 million, exceeding the estimated $52.53 million.

GAAP EPS: Recorded at $0.40 per diluted share, surpassing the estimated $0.33.

Non-GAAP EPS: Reported at $0.51 per diluted share, indicating a strong financial performance excluding specific expenses.

Segment Performance: Notable revenue of $412 million from Semiconductor Test, with Robotics and other segments contributing to the balance.

Future Guidance: Q2 2024 revenue projected between $665 million and $725 million, with GAAP net income per diluted share expected to be between $0.90 and $1.10.

Strategic Developments: Anticipated sale of Design Interface Solutions business to Technoprobe S.p.A., expected to impact future financials.

On April 24, 2024, Teradyne Inc (NASDAQ:TER) released its 8-K filing, announcing a first-quarter revenue of $600 million, which not only surpasses the analyst's expectation of $566.31 million but also exceeds the high-end of the company's own Q1 guidance. This figure, however, represents a 3% decrease from the $618 million reported in Q123. The company's earnings per share (EPS) also outperformed estimates, with a GAAP EPS of $0.40 compared to the estimated $0.33, and a Non-GAAP EPS of $0.51.

Teradyne, a leading provider of automated test equipment, serves numerous end markets with significant exposure to semiconductor testing. The company's diverse product portfolio includes equipment for testing semiconductors, system testing for hard disk drives, circuit boards, electronics systems, and wireless devices, as well as robotics for industrial applications.

Financial and Operational Highlights

For Q1 2024, Teradyne reported a GAAP net income of $64.2 million. The Non-GAAP net income stood at $82.5 million after adjustments for various non-operational items. The detailed earnings report highlighted strong year-over-year growth in the memory test segment, which helped offset continued softness in the mobility sector. According to CEO Greg Smith, the demand driven by Artificial Intelligence (AI) applications in memory and networking sectors significantly contributed to the quarter's robust performance.

Despite the positive outcomes in these areas, Teradyne faces challenges with limited visibility beyond the second quarter of 2024, particularly in the robotics segment. However, the company is optimistic about growth driven by new products and global distribution channel improvements.

Looking Ahead

Teradyne provided guidance for Q2 2024, projecting revenues between $665 million and $725 million, and GAAP net income per diluted share ranging from $0.90 to $1.10. The Non-GAAP net income per diluted share is expected to be between $0.64 and $0.84, excluding certain adjustments like acquired intangible asset amortization and gains from anticipated business sales.

Strategic and Financial Analysis

The company's balance sheet remains strong with $707.4 million in cash and cash equivalents as of March 31, 2024. Total assets were reported at $3.41 billion, with shareholders' equity amounting to $2.56 billion. These figures reflect a solid financial position that supports ongoing and future business operations.

Teradyne's strategic focus on high-growth areas such as AI-driven applications and robotics, combined with its robust financial health, positions it well to navigate market uncertainties and capitalize on emerging opportunities. However, the company must continue to innovate and adjust to the fast-evolving tech landscape to maintain its competitive edge and drive long-term shareholder value.

For detailed financial figures and management commentary, interested parties can access the earnings call webcast and presentation materials on April 25, 2024, via Teradyne's investor relations website.

Explore the complete 8-K earnings release (here) from Teradyne Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance