Teleflex (TFX) Witnesses Lower UroLift Sales, Cost Woes

Teleflex’s TFX escalating operating expenses are putting immense pressure on the bottom line. Tough competition and pricing pressure also weigh on the stock. The stock currently carries a Zacks Rank #4 (Sell).

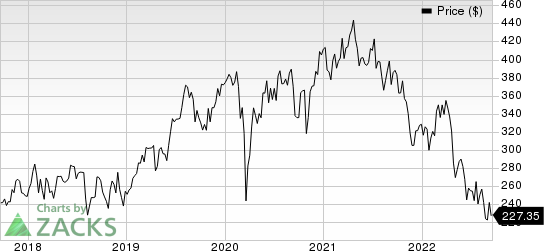

Over the past year, Teleflex has underperformed the industry. The stock has declined 40.3% in this period, compared with a 31.2% drop of the industry. Teleflex’s second-quarter revenues fell short of estimates. The company exhibited a year-over-year decline across the Americas.

For UroLift, the company saw year-over-year revenue declines in all service sites during the quarter, including hospital, ASC and physician's offices.

In the Americas, revenues declined 0.3% year over year. In the quarter, growth within the Surgical business was hugely offset by a decline in Interventional Urology sales. Teleflex’s lowered revenue and adjusted EPS outlook for 2022 indicates lackluster performance in the coming period, raising investors’ concern.

In the second quarter, Teleflex’s gross profit was down 2.2% year over year. The gross margin contracted 53 basis points (bps) to 55.2%. Overall, the adjusted operating profit was down 3.6% year over year. Adjusted operating margin saw a 47 bps contraction year over year to 19.2%.

Teleflex has implemented a number of restructuring, realignment and cost reduction initiatives, including facility consolidations, organizational realignments and reductions in workforce. While the company has historically realized some efficiencies from these initiatives, it may fail to realize the benefits of these or future initiatives to the expected extent. This may also put pressure on the bottom line.

Teleflex Incorporated Price

Teleflex Incorporated price | Teleflex Incorporated Quote

On a positive note, Teleflex exited the second quarter of 2022 with better-than-expected earnings. The International business witnessed constant currency growth in the second quarter of 2021. The company reported solid execution, with nearly 90% of the collective business driving constant-currency revenues ahead of plan. Volumes continue to recover in the United States, EMEA and Latin America as COVID hospital admissions have declined from the peak level of the earlier months of 2022.

Excluding UroLift, constant-currency growth in the quarter was 4% year over year as the remainder of the business collectively outperformed the company’s forecast for the quarter. Moreover, when adjusting for the impact of the Respiratory divestiture and UroLift, the rest of the business grew 5.2% at CER, reflecting the benefits of a diversified portfolio that targets critically ill patients.

Within the UroLift business, despite being impacted by the ongoing macro and COVID-19 headwinds, the preference for UroLift over other outpatient BPH treatments continued to be driven by strong clinical results. Several studies on Urolift have demonstrated rapid symptom relief and recovery, no new sustained sexual dysfunction and durable results.

With respect to Teleflex’s market development objective for UroLift, the company continued to gain positive feedback from surgeons regarding UroLift 2 as well as the UroLift Advanced Tissue Control for use in the obstructive median lobe. Teleflex believes that the launch of UroLift 2 and Advanced Tissue Control will enable the company to further engage with surgeons and drive utilization deeper into its labeled indication.

During the second quarter, the company reported procedure growth in accounts that have converted over to UroLift 2. Based on Teleflex’s progress in Q2, the company expects to convert most of its U.S. customers to UroLift 2 by the end of 2022. In turn, the company expects a 400- basis point margin expansion for Interventional Urology associated with the UroLift 2 conversion when the U.S. base is fully switched over.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.7%, on average. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has lost 4.7% against the industry’s 36.7% fall.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has outperformed its industry in the past year. SWAV has gained 26.1% against the industry’s 29.7% fall in the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13%, on average. It currently carries a Zacks Rank #2 (Buy).

McKesson has outperformed its industry in the past year. MCK has gained 64.3% against the industry’s 15.8% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance