Technical Update For USD/CHF, GBP/CHF, AUD/CHF & NZD/CHF: 07.12.2017

USD/CHF

Although USDCHF’s bounce from 0.9735-30 horizontal-region propelled it towards a fortnight high, the pair has multiple nearby strong resistances to clear in order to justify its strength. Amongst them, an upward slanting TL figure of 0.9925 becomes the first to observe, break of which could open the gate for the pair’s extended rise to 0.9940-45 resistance-confluence that seems a tough challenge for buyers. Should the pair manage to surpass 0.9945, the 0.9980 and the 1.0000 may please the Bulls before giving them another task to conquer the 1.0035-40 area. On the contrary, 0.9875 and the 0.9830 are likely immediate supports for the quote to avail during its U-turn, break of which can further drag it to 0.9785 and then to the 0.9765. Given the pair’s sustained downturn beneath 0.9765, the 0.9735-30 again comes into play ahead of pushing Bears to target 0.9670 support-mark.

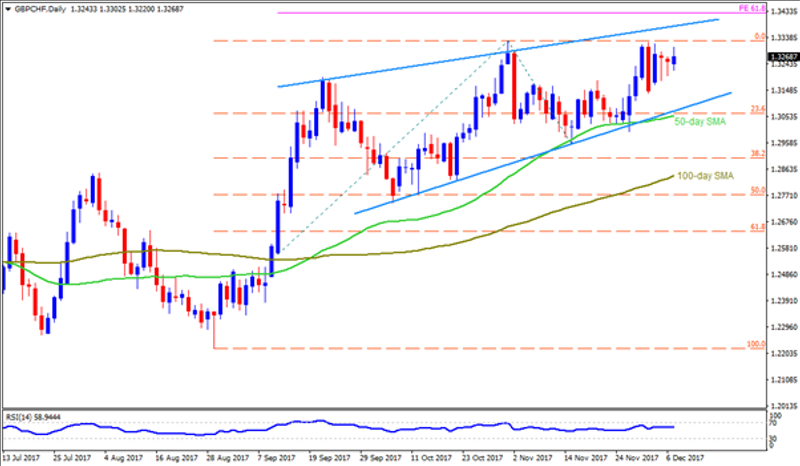

GBP/CHF

Having failed to sustain its latest pullback, the GBPCHF seems again heading to confront the 1.3320-30 region, comprising highs marked in November and early-December. If the pair successfully breaches the 1.3330, an ascending resistance-line, at 1.3375, may try to hurt the present optimism, inability to do so can further fuel the prices to 61.8% FE level of 1.3430. Meanwhile, the 1.3200 and the 1.3165 can be considered as adjacent supports for the pair before the 1.3100 and an upward slanting TL, at 1.3070, followed by 50-day SMA level of 1.3055 gain traders’ attention. Moreover, pair’s daily close below 1.3055 confirms a short-term “Rising-Wedge” bearish pattern and may make it vulnerable to plunge towards 100-day SMA level of 1.2840 with 1.2960 & 1.2900 being intermediate halts.

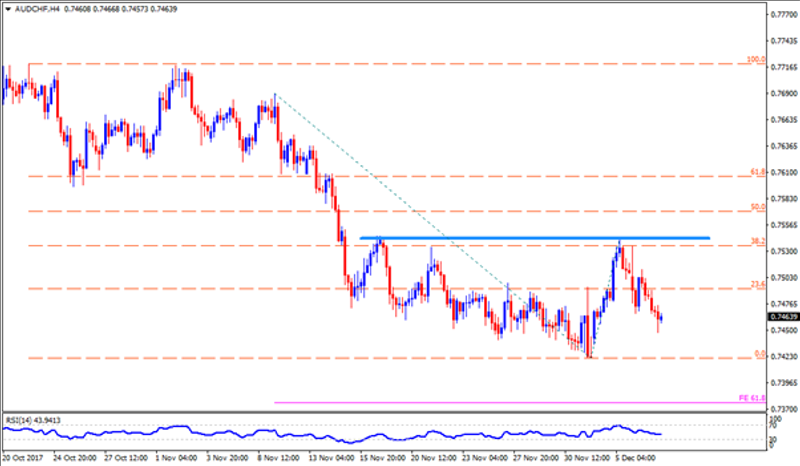

AUD/CHF

AUDCHF seems all set to revisit early-month lows around 0.7420 but 0.7450 may act as buffer. Though, break of 0.7420 could make the quote weaker enough to test the 0.7400 round-figure and then slide to 61.8% FE level of 0.7375. In case if the pair reverses from present levels, 0.7490 & 0.7520 are likely immediate resistances for the pair to clear prior to progressing in direction to 0.7540-45 horizontal-line, which if surpassed can help buyers to aim for 0.7600 round-figure.

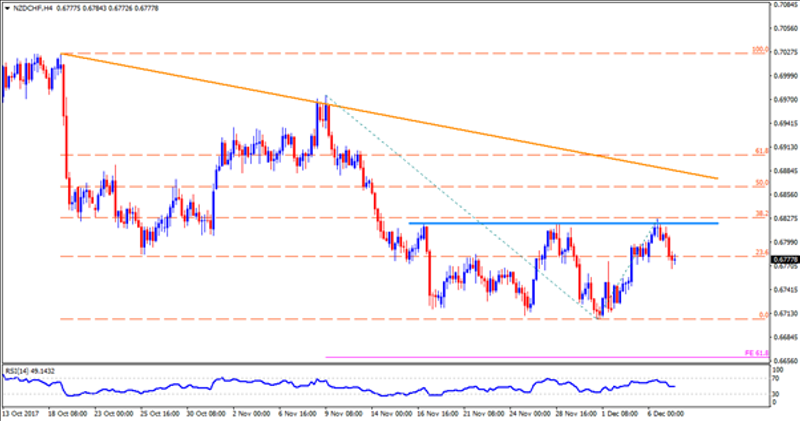

NZD/CHF

The 0.6820-25 horizontal-line has been restricting the NZDCHF’s upside off-late. As a result, the pair’s recent U-turn from the same pose it’s drop to 0.6750 as imminent. However, the pair’s following downside may only has 0.6720 to enjoy before the 0.6700 give another opportunity of its reversal, if not than chances of witnessing 61.8% FE level of 0.6660 can’t be denied. Alternatively, 0.6800 and the 0.6820-25 could limit the pair’s short-term advances, breaking which its rally to 0.6880 and then to the 0.6885 TL resistance seem accepted. Given the pair’s refrain to respect the 0.6885, it can meet the 0.6935 and the 0.6980 resistances.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance