Technical Update For USD/CHF, GBP/CHF, NZD/CHF & CAD/CHF: 15.11.2017

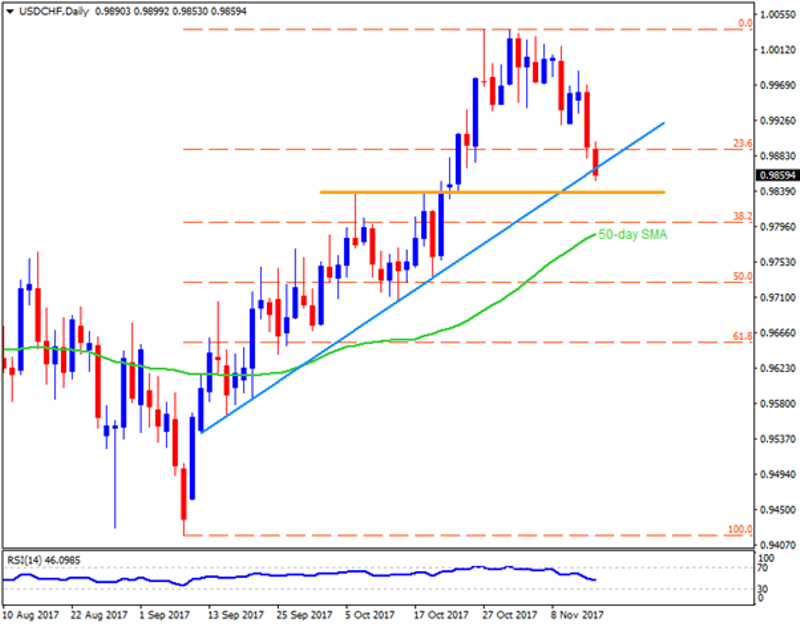

USD/CHF

Even after portraying a slump on Tuesday, the USDCHF didn’t refrain to extend its downturn on early-Wednesday that recently broke two-month-old ascending trend-line. As a result, the pair is likely declining towards 0.9835-40 horizontal-line but its following south-run seems questionable. If at all the quote closes beneath the 0.9835 mark on D1 chart, its subsequent drop to 0.9815 and then to the 50-day SMA level of 0.9785 become imminent while the 0.9765 and the 0.9730 support-levels could entertain sellers then after. Alternatively, pair’s inability to offer a daily close below the 0.9865 trend-line may trigger its pullback in the direction to 0.9920 and then the 0.9940 resistances, breaking which 0.9970 could be targeted by buyers. Should the pair manage to stretch its advances beyond 0.9970, the 1.0000 psychological magnets and the 1.0040 gain importance?

GBP/CHF

Although upbeat UK Jobs report currently trying to negate the GBPCHF’s dip below 1.2975-85 horizontal-line, the pair’s sustained trading above 1.3000 round-figure becomes pre-requisite to justify its latest recovery and challenge the 1.3030 resistance-mark. Given the pair surpasses the 1.3030 level, it can aim for 1.3070-75 and then to the 1.3130 ahead of confronting the 1.3160-70 resistance-region. In case if the pair fails to surpass the 1.3000 mark, chances its gradual decline to 1.2930, 1.2900 and 1.2880 can’t be denied. During the pair’s additional southward trajectory after 1.2880 breaks, the 1.2830-25 and the 1.2780 may act as intermediate halts that could direct prices to 1.2740 support.

NZD/CHF

NZDCHF’s uptick from 0.6775 may have to clear the 0.6845-50 resistance-area to be able to meet the 0.6880 and the 0.6940 resistances; however, the pair’s up-moves past 0.6940 might be confined by the 0.6985-90 confluence-region that comprises 100-day & 200-day SMAs together with descending TL which connects highs marked in July and September. Should the pair surpasses the 0.6990 mark, it confirms the “Falling-Wedge” Bullish pattern and could easily rise to 0.7040 and then to the 0.7085 resistances. On the downside, pair’s trading below 0.6775 could be restricted by the 0.6755-60 support-zone which includes the horizontal-line and a broader support-line. Given the pair’s sustained downturn beneath 0.6755, the 0.6740, the 0.6720 and the 0.6680 may well please the sellers.

CAD/CHF

Following its U-turn from 0.7870-75 horizontal-region, the CADCHF is now re-testing the four-month-old ascending trend-line that activated the pair’s pullback multiple times in recent months. If the pair respects the TL and bounces again, it can visit the 0.7790 and then the 0.7820 before trying to conquer the 0.7870-75 region for one more time. Further, Bulls’ ability to propel the quote above 0.7875 at a day’s close can flash 0.7910 and the 0.7960 resistances on the chart, which if broken could open the door for the pair’s rally towards 61.8% FE level of 0.8060. Meanwhile, break of 0.7750 trend-line support can easily drag the pair to 100-day SMA level of 0.7710 and then to the 0.7645. During the pair’s additional declines below 0.7645, the 0.7620, the 0.7600 and the 0.7580 are likely rests that it could avail.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance