Technical Update For Important GBP Pairs: 04.07.2018

GBP/USD

Even after bouncing off the 1.3050 support-mark, GBPUSD’s recent recovery still struggles with the 1.3225-30 horizontal-region in order to justify its strength. In case the U.S. holiday & upbeat UK Services PMI manage to propel the pair beyond 1.3230 barrier, the 1.3270 and the 1.3300 are likely following numbers to appear on the chart ahead of highlighting nearly two-month old descending TL, at 1.3335 now. On the contrary, pair’s failure to surpass the 1.3230 hurdle can drag it back to 1.3170 and then to the ascending TL support of 1.3130. If at all the quote drops beneath the 1.3130, the 1.3100 and the 1.3050 can attract market attention as break of which opens the door for the pair’s plunge towards 61.8% FE level of 1.3000.

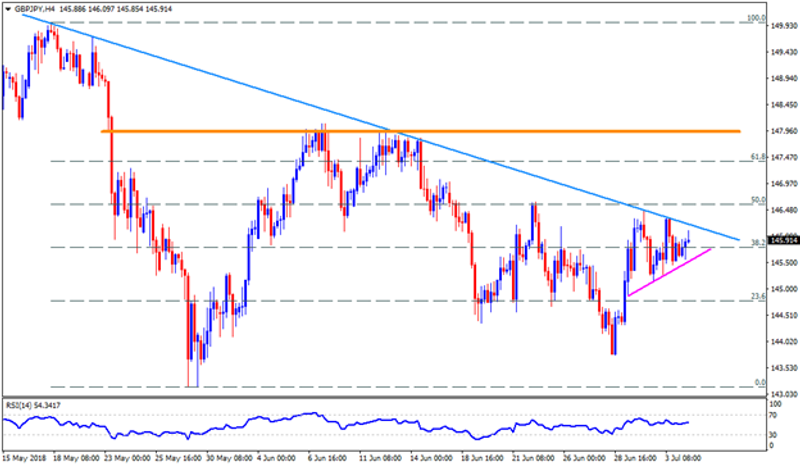

GBP/JPY

GBPJPY’s latest advances, as portrayed by an immediate upward slanting trend-line, seems helping the pair to again confront seven-week long descending trend-line resistance of 146.25. Should prices clear the 146.25 mark, their surge to 146.65 and to the 147.10 become imminent whereas 147.90-148.00 could challenge the Bulls afterwards. Moreover, pair’s sustained trading above 148.00 can take a halt at 148.15 before targeting the 148.75 and the 149.00 levels. Meanwhile, aforementioned TL, at 145.50, can serve as adjacent rest during the pair’s U-turn, breaking which 144.70 & 144.35 can entertain the sellers. It should also be noted that the pair break of 144.35 can make it vulnerable enough to revisit the 143.70-60 and the 143.15 numbers.

GBP/CAD

With the 200-day SMA aptly playing its role in activating the GBPCAD’s reversal, the pair is likely rising in direction to the 1.7430, the 1.7475-80 and the 1.7570 consecutive resistances; though, 100-day SMA level of 1.7665, near to downward slanting trend-line figure of 1.7685, may confine the quote’s further upside. Let’s say the pair conquers the 1.7685 resistance on a daily closing basis, in that case it can rally to the 1.7800 mark. Given the Canadian Dollar’s strength, mainly due to Crude’s surge, fetch the pair beneath 200-day SMA level of 1.7325 on a D1 basis, the 1.7215 and medium-term ascending trend-line, at 1.7120, are expected rests that it can avail. Also, Bears refrain to respect the 1.7120 TL support can push them to the 1.7040 buffer prior to aiming the 1.7000 round-figure.

GBP/CHF

Following its successful break of near-term descending trend-line, the GBPCHF buyers can target the 1.3180 resistance ahead of looking at the 1.3230 and the 1.3270-75 horizontal-region. If the pair surpasses the 1.3275 hurdle, the 1.3305 and the 1.3365 may mark their presence. Alternatively, pair’s trading beneath the 1.3080 resistance-turned-support can recall the 1.3050 and the 1.3020 before claiming the 1.3000 psychological-magnet. In case the pair extend its south-run below 1.3000, the 61.8% FE level of 1.2945 and the 1.2900 might please the pessimists.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance