TE Connectivity (TEL) Q2 Earnings Beat, Sales Rise Y/Y

TE Connectivity Ltd. TEL reported second-quarter fiscal 2023 adjusted earnings of $1.65 per share, which surpassed the Zacks Consensus Estimate by 5.1%.

However, the figure decreased 8.8% from the year-ago quarter’s reading.

Net sales in the reported quarter were $4.16 billion, beating the consensus mark of $3.9 billion. The figure rose 4% on a reported basis and 8% organically from the year-ago quarter’s readings.

Well-performing transportation and industrial solutions drove top-line growth in the reported quarter.

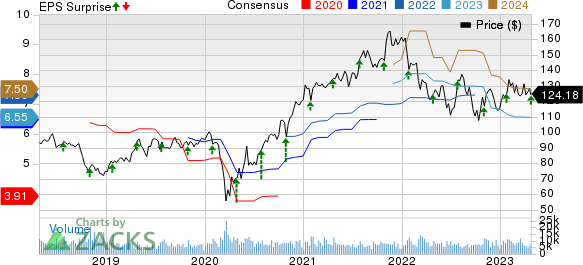

TE Connectivity Ltd. Price, Consensus and EPS Surprise

TE Connectivity Ltd. price-consensus-eps-surprise-chart | TE Connectivity Ltd. Quote

Top-Line Details

Transportation Solutions: The segment generated $2.5 billion, which accounted for 59.7% of net sales. The figure grew 7% year over year. The company witnessed 9% growth in automotive sales, driven by the growing proliferation of electric vehicles and strong content trends in electronification. Sensor sales were up 6% from the year-ago quarter, owing to solid momentum across automotive applications. Commercial transportation sales grew 3% year over year, which was a positive.

Industrial Solutions: The segment generated $1.2 billion, which accounted for 28.6% of net sales. The figure rose 12% year over year on improvements in commercial aerospace, which led to 14% growth in aerospace, defense and marine sales. Solid momentum across renewable applications was also positive for the company’s energy business, which grew 27% year over year. Increasing momentum across interventional procedures led to a 26% rise in medical sales.

However, industrial equipment sales, which declined 1%, were concerning.

Communications Solutions: The segment generated $486 million, which accounted for 11.7% of net sales. The figure declined 22% year over year. This was attributed to broad market weakness. Data and device sales decreased 27% and appliance sales fell 15% year over year.

Operating Details

Per management, the gross profit was $1.3 billion, which was down 3.9% year over year. As a percentage of revenues, the figure contracted 250 basis points (bps) from the year-ago quarter to 30.9%.

We note that selling, general and administrative expenses were $435 million, up 4.6% year over year. Research and development expenses were $185 million, flat year over year.

The company’s adjusted operating margin was 16% in the reported quarter, down 240 bps year over year.

Balance Sheet & Cash Flow

As of Mar 31, 2023, cash and cash equivalents were $905 million, up from $793 million as of Dec 30, 2022.

Long-term debt was $3.9 billion in the fiscal first quarter, up from $3.4 billion in the prior quarter.

TE Connectivity generated $634 million in cash from operations in the reported quarter, up from $581 million in the previous quarter. It generated a free cash flow of $445 million.

TEL returned $375 million to its shareholders.

Guidance

For third-quarter fiscal 2023, TE Connectivity expects net sales of $4 billion. The Zacks Consensus Estimate for the same is pegged at $3.97 billion.

Adjusted earnings are projected at $1.65 per share. The consensus mark is pegged at $1.67 per share.

Zacks Rank & Stocks to Consider

Currently, TE Connectivity carries a Zacks Rank #4 (Sell).

Investors interested in the broader Zacks Computer & Technology sector may consider some better-ranked stocks like Salesforce CRM, Arista Networks ANET and Analog Devices ADI. Salesforce sports a Zacks Rank #1 (Strong Buy), and Arista Networks and Analog Devices carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Salesforce’s shares have risen 43.8% in the year-to-date period. CRM’s long-term earnings growth rate is anticipated to be 16.75%.

Arista Networks’ shares have risen 26.5% in the year-to-date period. ANET’s long-term earnings growth rate is projected to be 14.17%.

Analog Devices’ shares have gained 10.5% in the year-to-date period. ADI’s long-term earnings growth rate is expected to be 10.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

TE Connectivity Ltd. (TEL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance