Tax cuts kick in: How much extra pay you’ll get back

Australian workers will begin to see a tax reduction of as much as $47 a week as businesses finalise the new tax rates.

Employers have until 16 November to ensure their payroll processes account for the Government’s $17.8 billion tax cuts, meaning many businesses are already implementing the cuts this week.

Also read: 'Not possible': ATO confirms major tax cut detail

Also read: PM in spotlight after suggesting people earning $180k aren’t rich

Also read: ATO gives Aussies new tax cut deadline

Around 11 million Australians are expected to see some form of benefit under the cuts, which see the 19 per cent tax rate increase from $37,000 to $45,000, and the 32.5 per cent tax bracket jump from $90,000 to $120,000.

Additionally, the low income tax offset will increase from $445 to $700 and the $1,080 low- to middle-income tax offset will also be in place this financial year.

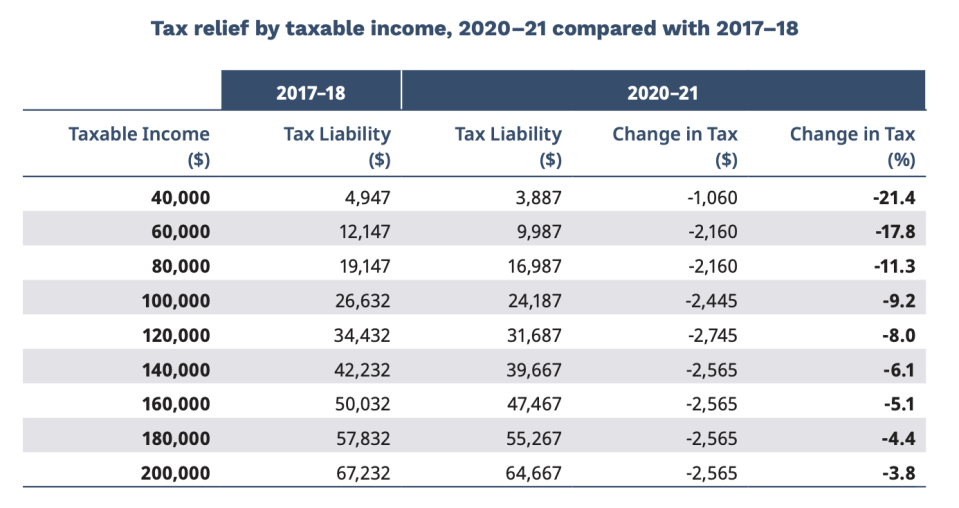

That means that the cuts will deliver a person earning $120,000 a year an extra $47 a week, and those earning $100,000 will see a $29 weekly boost.

Those on $60,000 will see a difference of roughly $20.77 per week.

Who gets the most from the tax cuts?

Over the course of the year, Australians earning $120,000 will receive the biggest benefit, paying $2,745 less in tax.

Those earning $40,000 will receive the smallest benefit, getting $1,060 back.

Aussies forced to wait for tax cuts

While most employers should have changed their tax rates by 16 November, that doesn’t mean all workers will see the benefit as quickly.

“Generally speaking the people who will see these cuts the most slowly are people who get paid monthly… they may be the last to see it,” H&R Block tax communications director Mark Chapman told Yahoo Finance.

“The other group that could potentially struggle is businesses where the payroll department has been not as responsive as it should have been [and] very small businesses that may not even have a payroll department.”

Other businesses may still be in the dark about the tax cuts, Chapman added.

“So there’s a bit of a risk there, but hopefully by the end of this month, everyone who is paid a wage or salary is beginning to see this on their pay slip.”

What if I don’t see the tax cuts?

Chapman said workers who don’t see any change on their next pay slip need to talk to their employer, or their employer’s payroll department.

“Don't leave it for weeks or months: if you don't see that tax cut in your next pay packet, then have that conversation.

“It's unlikely there are going to be any businesses that are deliberately doing the wrong thing, it may just be that they are not aware of the changes. So just have that conversation, maybe jog the memory and hopefully that will resolve the issue.”

Want to get better with money and investing in 2021? Sign up here to our free newsletter and get the latest tips and news straight to your inbox.

Yahoo Finance

Yahoo Finance