Tax cuts: Here’s everything you need to know

Almost 12 million Australians will receive a tax break in the next financial year, with the Government bringing forward stage two of the income tax cuts under the 2020 Federal Budget.

The cuts were originally scheduled to come into effect from July 2022, but Treasurer Josh Frydenberg brought them forward to stimulate consumer spending and kickstart the economy.

But some of the cuts are temporary in nature, and largely benefit high income earners. Many people will also need to wait for their lump sum pay out.

Big businesses were clear winners, with the instant asset write-off extended. Many argue small businesses missed out in some key areas.

Here’s a breakdown of the tax policies outlined in the budget.

What are the income tax changes for me?

The income tax brackets have changed.

Now, the 19 per cent tax threshold has increased from $41,000 to $45,000, and the 32.5 per cent tax threshold has increased from $90,000 to $120,000.

That’s where the big breaks lie.

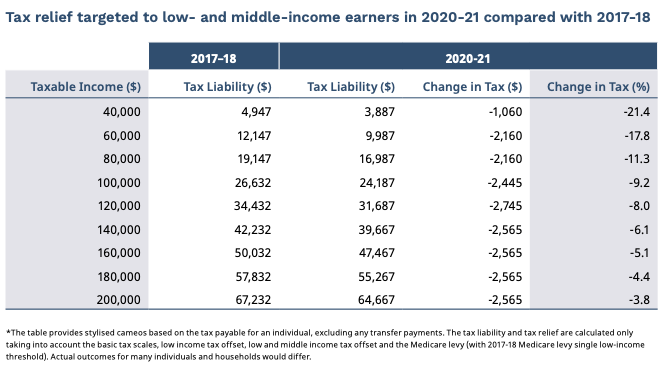

From 1 July 2020-21, those earning $120,000 or more will now get $2,745 back, while those earning between $80,001 and $100,000 get $2,160 back. Those earning $40,000 will get $1,060 back.

How do I get my tax back, and when will I get it back?

Once the Budget passes Parliament, the Australian Taxation Office can update their PAYG withholding schedules mid this month, Frydenberg confirmed.

That means the tax cuts can come straight into effect, and you’ll see your take-home pay increase shortly.

You don’t need to do anything.

Here’s a breakdown of how it will work for you:

If you earn up to $40,000, you’ll save up to $1,060

If you earn more than $40,000, up to $80,000, you’ll save up to $$2,160

If you earn more than $80,000, up to $100,000, you’ll save up to $2,445

If you earn more than $100,000, up to $120,000, you’ll save up to $2,745

If you earn more than $120,000, up to $200,000, you’ll save up to $2,565

The changes will be backdated to 1 July. But, if the above changes officially come into effect in, say, December, but you’ve been paying the previous tax rate for several months, you will have overpaid.

To combat that, the Government will refund you any amount you’ve overpaid when you do your tax return next year.

What are the tax changes for businesses?

The instant asset write-off policy has been extended until 30 June 2022, meaning businesses with up to $5 billion in turnover can deduct the full cost of any of assets installed that year.

“Full expensing significantly reduces the after-tax cost of eligible assets, providing a cash flow benefit,” the Government stated.

That’s estimated to deliver around $27 billion worth of tax relief to businesses.

These businesses can also offset losses against previous profits on which tax has been paid to generate a refund. That means losses incurred up to 2021-22 can be carried back against any profits made in or after 2018-2019.

Small businesses with a turnover of less than $50 million can now access the tax concessions that are currently available to businesses with turnover of under $10 million.

“The increase in the small business turnover threshold...is great for mid-sized businesses that were struggling to cope with the financial impact of Covid-19. A welcome measure,” director of tax policy and technical at the Tax Institute, Andrew Mills said.

Who will benefit most from the tax changes?

High income earners are big winners, with this cohort of Australians getting a permanent tax cut from the 2021-22 financial year onwards.

“This Budget gives a temporary boost to lower and middle-income earners and a permanent boost to the wealthiest people in the country,” Matt Grudnoff, senior economist at The Australia Institute said.

Big businesses get a massive break by virtue of the instant asset write-off extension.

The $200 billion temporary full expensing measures mean businesses with a turnover of up to $5 billion will be able to deduct the full cost of eligible depreciable assets of any value in the year that they are installed.

Who and what did the tax cuts miss?

Small businesses can benefit from the instant asset write-off, but the policy measure really only aids businesses that have the cash flow to take advantage of it.

Instead, COSBOA chief Peter Strong said the Government should have looked at providing rental assistance to small businesses.

Small Business Ombudsman Kate Carnell also said the Government missed a “critical first step”.

“My office, in coordination with the national peak accounting and bookkeeping bodies, has been calling for the establishment of a small business viability program, where small business owners facing financial stress can obtain professional support valued at up to $5,000 to access tailored advice on the state of their business.” she said.

“Small businesses need access to an accredited professional adviser to judge the viability of their business now, so they can make an informed decision about the future of their business and actually do something about it.

Low-and middle-income earners get a one-off offset of $1,080, but from 2021-22 onwards, the Government’s tax plan gives them nothing.

Someone earning $70,000 will save $1,080 in the 2020-21 financial year, nothing from 2021-22 and $625 from 2024-25.

Conversely, someone earning $170,000 will save $2,430 in the 2020-21 financial year, $2,430 from the 2021-22 financial year and $7,805 from 2024-25.

Will the tax changes boost the economy?

The consensus from tax experts is that the tax measures make sense for now, but it’s likely there will be more policy needed to stimulate the economy.

As it stands, women, older Australians and those Aussies receiving welfare have been largely left out by the Budget, meaning there’s a significant chunk of the population that isn’t receiving direct support, and therefore can’t give anything back into the economy.

“This is a Budget that is spending more on recycled rubbish than it is on women,” Danielle Wood, chief executive of the Grattan Institute said.

“I would have liked to have seen more money to support women’s participation in the workforce.”

The Budget also failed to address the arts sector, did not make any mention of increasing the $40-per-day base rate of the JobSeeker payment, and hiked university fees for prospective students.

“A good budget for the times, but there is more long-term work to be done," president of the Tax Institute Peter Godber said.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Are you a millennial or Gen Z-er interested in joining a community where you can learn how to take control of your money? Join us at The Broke Millennials Club on Facebook!

Yahoo Finance

Yahoo Finance