Swedish Growth Companies With At Least 21% Insider Ownership On The Rise

As Sweden's central bank takes a proactive stance in adjusting interest rates amidst global economic shifts, investors are closely monitoring growth companies with substantial insider ownership. These firms often demonstrate a strong alignment between management’s interests and shareholder expectations, which can be particularly appealing in the current economic environment.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

BioArctic (OM:BIOA B) | 35.1% | 48.2% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.4% |

SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

Yubico (OM:YUBICO) | 37.5% | 43% |

Let's dive into some prime choices out of from the screener.

BioArctic

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (OM:BIOA B) focuses on developing biological drugs for central nervous system disorders in Sweden, with a market capitalization of approximately SEK 20.49 billion.

Operations: The company generates its revenue primarily from the biotechnology segment, totaling SEK 616 million.

Insider Ownership: 35.1%

BioArctic, a Swedish biopharma company, stands out for its high insider ownership and strong growth metrics. Recently profitable, the company is trading significantly below estimated fair value. With revenue expected to grow at 37.6% annually—outpacing the Swedish market substantially—its earnings are also set to increase by 48.2% per year. Recent strategic alliances, like the one with Eisai on Alzheimer's treatment BAN2802, underscore BioArctic's commitment to innovative research and potential market expansion.

Click to explore a detailed breakdown of our findings in BioArctic's earnings growth report.

The valuation report we've compiled suggests that BioArctic's current price could be quite moderate.

Fortnox

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers financial and administrative software solutions tailored for small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 41.28 billion.

Operations: The company generates its revenue primarily through five segments: Core Products (SEK 698 million), Entrepreneurship (SEK 356 million), The Agency (SEK 327 million), Money (SEK 232 million), and Marketplaces (SEK 150 million).

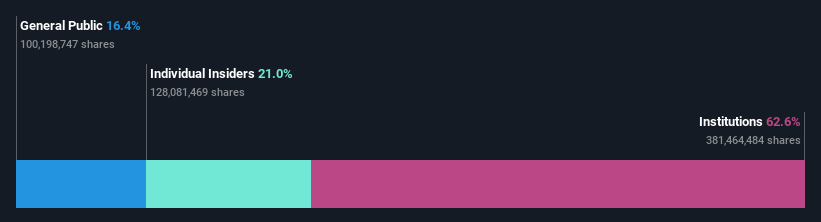

Insider Ownership: 21%

Fortnox, a Swedish software company, exhibits robust growth with significant insider engagement. Recently, Fortnox reported a substantial year-over-year earnings increase to SEK 149 million from SEK 106 million. Forecasted annual earnings and revenue growth rates of 21.2% and 19.6%, respectively, exceed the broader Swedish market's projections. This performance is supported by recent insider buying activities, although not in large volumes, indicating continued confidence among stakeholders in the company's trajectory without massive insider sales over the past three months.

Take a closer look at Fortnox's potential here in our earnings growth report.

Our expertly prepared valuation report Fortnox implies its share price may be too high.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (ticker: OM:SAGA A) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market capitalization of approximately SEK 105.50 billion.

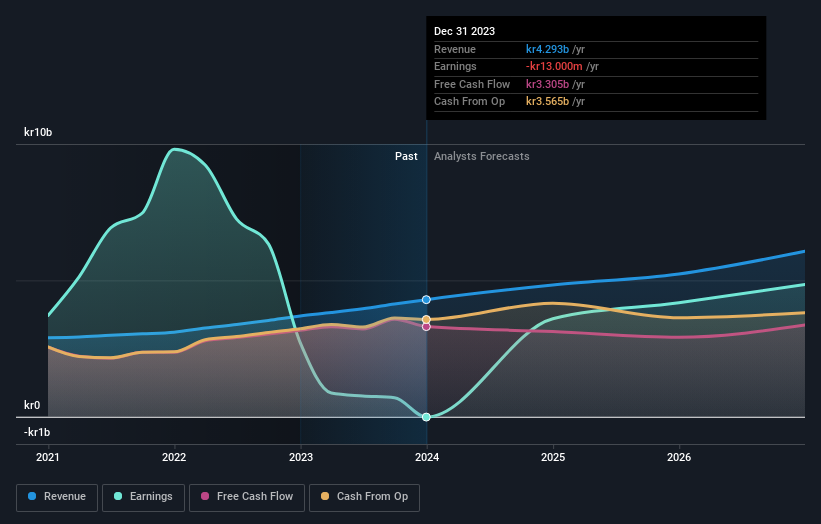

Operations: The company generates revenue primarily through its real estate rental segment, which amounted to SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish real estate company, has demonstrated strong financial recovery with first-quarter sales rising to SEK 1.19 billion from SEK 1.01 billion year-over-year and a significant turnaround to a net income of SEK 1.08 billion from a previous loss. Despite recent fluctuations, including a notable fourth-quarter loss in the previous year, the company maintains appealing dividends with an increase to SEK 3.10 per share and consistent quarterly payouts for series D shares. The firm's earnings are expected to grow significantly over the next three years, outpacing general market forecasts, although its debt is not well covered by operating cash flow.

Get an in-depth perspective on AB Sagax's performance by reading our analyst estimates report here.

Our valuation report here indicates AB Sagax may be overvalued.

Taking Advantage

Access the full spectrum of 81 Fast Growing Swedish Companies With High Insider Ownership by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BIOA B OM:FNOX and OM:SAGA A.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance