Is a Surprise Coming for Kimberly-Clark (KMB) This Earnings Season?

Investors are always looking for stocks that are poised to beat at earnings season and Kimberly-Clark Corporation KMB may be one such company. The firm has earnings coming up pretty soon, and events are shaping up quite nicely for their report.

That is because Kimberly-Clark is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat. After all, analysts raising estimates right before earnings — with the most up-to-date information possible — is a pretty good indicator of some favorable trends underneath the surface for KMB in this report.

In fact, the Most Accurate Estimate for the current quarter is currently at $1.61 per share for KMB, compared to a broader Zacks Consensus Estimate of $1.60 per share. This suggests that analysts have very recently bumped up their estimates for KMB, giving the stock a Zacks Earnings ESP of +10.36% heading into earnings season.

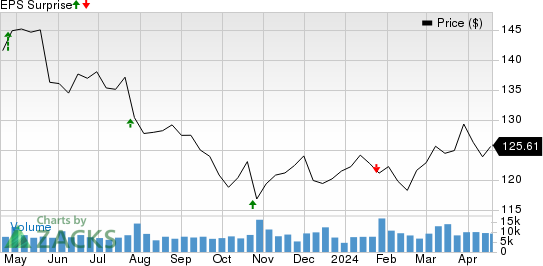

Kimberly-Clark Corporation Price and EPS Surprise

Kimberly-Clark Corporation price-eps-surprise | Kimberly-Clark Corporation Quote

Why is this Important?

A positive reading for the Zacks Earnings ESP has proven to be very powerful in producing both positive surprises, and outperforming the market. Our recent 10-year backtest shows that stocks that have a positive Earnings ESP and a Zacks Rank #3 (Hold) or better show a positive surprise nearly 70% of the time, and have returned over 28% on average in annual returns (see more Top Earnings ESP stocks here).

Given that KMB has a Zacks Rank #3 and an ESP in positive territory, investors might want to consider this stock ahead of earnings. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Clearly, recent earnings estimate revisions suggest that good things are ahead for Kimberly-Clark, and that a beat might be in the cards for the upcoming report.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance