Surmodics (SRDX) Inks Group Purchasing Agreement With Premier

Surmodics, Inc. SRDX recently announced that it has been awarded a group purchasing agreement for the company’s thrombectomy products with Premier, Inc., a company that operates as a healthcare alliance in the United States.

With effect from Jun 1, 2024, the new agreement offers Premier members an opportunity to choose from exclusive pricing and conditions pre-negotiated by Premier for Surmodics Pounce and Pounce Venous Thrombectomy Systems.

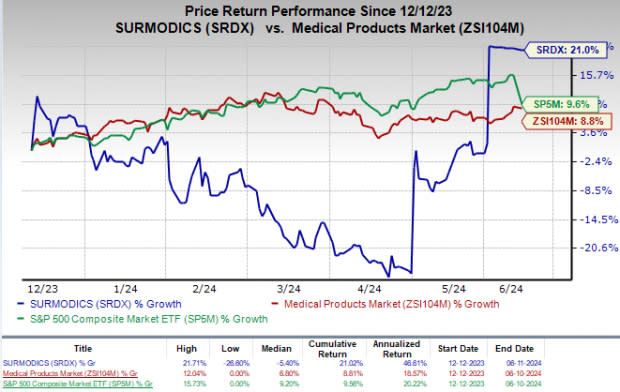

Price Performance

In the past six months, SRDX shares have rallied 21% compared with the industry’s rise of 8.8%. The S&P 500 has increased 9.6% in the same time frame.

Image Source: Zacks Investment Research

More on the News

Premier is a leading healthcare improvement company, uniting more than 4,350 U.S. hospitals and 300,000 other providers to transform healthcare.

The Pounce Thrombectomy and Pounce Low-Profile (LP) Thrombectomy Systems, as well as the Pounce Venous Thrombectomy System, are fully mechanical, non-aspiration endovascular systems that are intended to promptly remove soft or hardened blood clots from peripheral veins or peripheral arteries.

Surmodics thrombectomy systems are designed to minimize physicians’ need to remove clots using thrombolytic medications, a treatment that requires an overnight stay in an intensive care unit. These systems do not require capital equipment.

Surmodics’ portfolio of thrombectomy systems is likely to contribute meaningfully to high-quality, cost-effective care throughout the Premier hospital alliance. Pounce thrombectomy device platform is one of the key growth factors for SRDX’s topline, which is likely to continue with this new agreement.

Surmodics’ Thrombectomy Portfolio

At the time of the release of its second-quarter fiscal 2024 results in May, Surmodics announced the completion of limited market evaluation and commercial launch of two new mechanical thrombectomy systems for the peripheral venous and arterial vasculatures — the Pounce Venous Thrombectomy System and the Pounce LP Thrombectomy System in March and April, respectively.

The Pounce Thrombectomy platform devices from Surmodics are designed to remove emboli and thrombi from the peripheral artery vasculature without the need for surgery. The Pounce LP Thrombectomy System is recommended for vessels with diameters between 2 mm and 4 mm, which are common sizes for vessels located below the knee.

The Pounce Venous Thrombectomy System is indicated for mechanical de-clotting and controlled and selective infusion of physician-specified fluids, including thrombolytics, in the peripheral vasculature. The system is indicated for use in vessels of diameters between 6 mm and 16 mm.

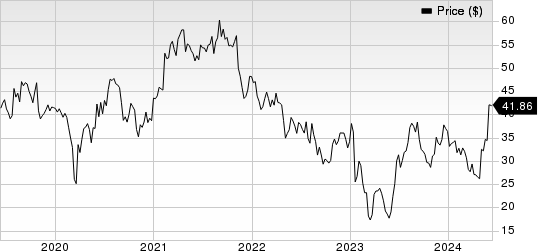

Surmodics, Inc. Price

Surmodics, Inc. price | Surmodics, Inc. Quote

Zacks Rank & Other Stocks to Consider

SRDX sports a Zacks Rank #1 (Strong Buy) at present.

Some other top-ranked stocks in the broader medical space that have announced quarterly results are DaVita DVA, Ecolab ECL and Boston Scientific Corporation BSX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 44% compared with the industry’s 20.4% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in the trailing four quarters, the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted earnings per share of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Surmodics, Inc. (SRDX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance