Surgeons claiming $21k back on tax

The Australian Taxation Office has already refunded $1.2 billion to Australian taxpayers, but some jobs are getting a lot more back than others.

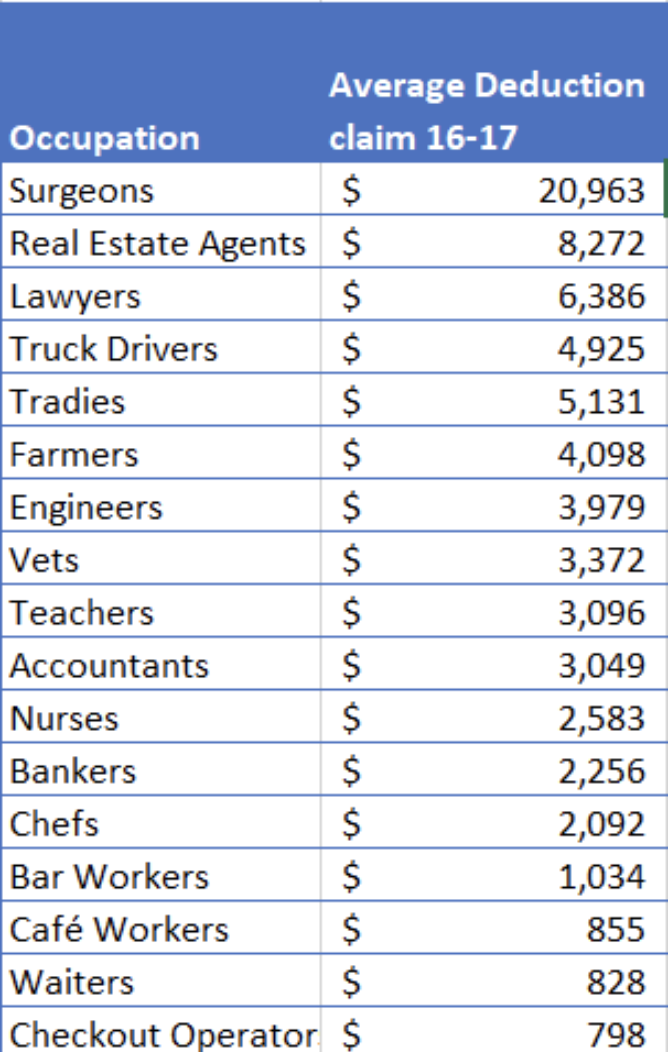

Surgeons, real estate agents and lawyers are claiming literally thousands back in tax, analysis by Etax.com.au has revealed, while waiters and checkout operators are claiming the least.

Based on data from 13.5 million taxpayers, Etax.com.au found the average surgeon was claiming back $20,963, followed by real estate agents’ $8,272 and lawyers’ $6,386.

They’re some big numbers, but according to Liz Russell, senior tax agent at Etax.com.au, the figures aren’t surprising.

“One reason for this is that surgeons generally aren’t reimbursed for any of their many, many expenses by their employer. This means all those expenses can generally be claimed on their return instead.”

She said this explanation accounted for all the top claiming jobs - their work means they have a lot of work-related expenses which aren’t reimbursed. Real estate agents will incur car maintenance costs, licencing fees and incidental out of pocket costs.

“Unlike many other professionals, surgeons are generally required to take a certain number of special training courses to keep up with the latest medical practices,” Russell added.

“Additionally, surgeons can claim costs for textbooks, other learning materials, home office computers, furniture for study, and travel costs associated with attending courses. Plus they often need their own insurance which can run into the thousands, or in some cases tens of thousands of dollars per year."

What can I claim on my tax return?

Even if you’re not a surgeon or lawyer, there are still thousands of deductions available to Australians, Russell said.

“[However] each occupation has a niche set of rules that govern the relevant tax entitlements, and there are no guarantees when it comes to the minimum refund a taxpayer can expect in each industry.

“Even workers within one specific occupation can have hugely different deductions, meaning yours could be completely different to your co-worker's and can even change from year to year.”

This also means that knowing what you can claim, and keeping clear records is critical.

A good rule of thumb is that if you can answer “yes” to the following questions, you can claim the expense back on tax:

1. Is it directly related to your work?

2. Do you have a proper receipt?

3. Did you pay for it yourself, with your own money, and it wasn’t reimbursed?

“Smart workers are the ones who have a good system for recording expenses and they use a tax agent to get all that added the right way to their tax return.

“Any expenses that are truly work-related and necessary can be claimed as a tax deduction. It’s important to seek guidance on what is relevant to your specific industry, role, and income,” Russell added.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance