The suburbs where property values halved since 2008

Australia’s worst-performing suburbs have one thing in common, and it’s bad news for those living in mining regions.

According to new research by investor group, Property Investment Professionals of Australia (PIPA), there’s a “clear front-runner” for poorly performing suburbs; mining locations.

In fact, home-owners and investors in these regions have likely seen their property values decrease over the last 10 years, PIPA chairman, Peter Koulizos said.

Also read: Where would you be today if you’d bought property 20 years ago?

“Western Australia – which benefited the most from the mining boom – has also suffered the most from the mining bust,” he explained.

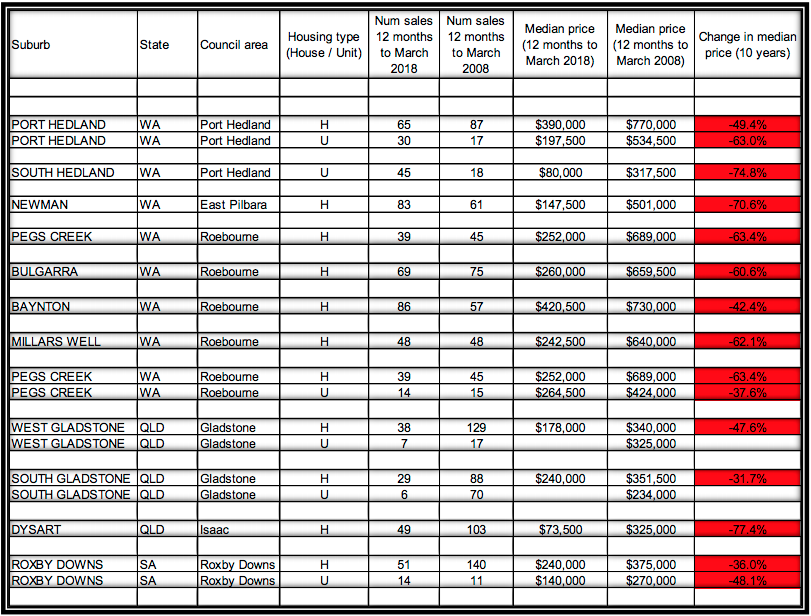

“There is a very long list of underperforming mining towns in WA, but the worst is South Hedland, a suburb in Port Hedland, where house prices fell a whopping 74.8 per cent.

Also read: NAB opts against mortgage rate hikes

“Newman came in a close second to South Hedland, where the median house price was $501,000 in 2008 and now it is only $147,000.”

It’s not just Western Australian properties that are feeling the burn. Queensland and South Australian mining towns have also experienced price slumps.

Mr Koulizos said it’s critical prospective buyers aren’t taken in by property spruikers, pointing to Queensland suburb Gladstone.

Also read: Housing shouldn’t hit bank stability: RBA

Gladstone was promoted by spruikers, but South Gladstone and West Gladstone house prices have fallen by 31.7 per cent and 47.6 per cent respectively over the last 10 years.

“However, these two suburbs are not the worst performers. Property prices in the mining town of Dysart fell a whopping 77.4 per cent, while at the same time Brisbane house prices increased by 24 per cent,” he added.

How Aussie mining regions performed

The lesson for investors isn’t to avoid regional properties, but to focus on long-term fundamentals, rather than short-term gains, Mr Koulizos argued.

“That usually means investing in locations with diverse, multi-faceted economies, not areas that financially ebb and flow depending on the strength – or weakness – of a single industry.”

Yahoo Finance

Yahoo Finance