Strengthening America’s Electric Power Grid: How the Government and Industry Are Improving T&D Systems

The U.S. transmission and distribution (T&D) network is reliable and well-maintained, but as renewable energy continues being added to the grid, and demand increases due to growing data center needs and the electrification of transportation and manufacturing processes, work is necessary to keep up with the changing times.

The U.S. government understands the need for power grid upgrades and has put its money where its mouth is. President Biden claims his “Investing in America” agenda is delivering the largest investment in grid infrastructure in history—more than $30 billion from the Inflation Reduction Act and the Bipartisan Infrastructure Law. The administration says these investments “will help deliver reliable, affordable electricity to families and businesses, prepare for worsening natural disasters that strain the grid, and unlock the economic and environmental benefits of clean energy.” In a fact sheet issued on April 25, 2024, the White House touted several actions it said will streamline permitting for transmission system projects and help overcome financial hurdles facing some of the work. Specifically, it noted applications had closed for up to $2.7 billion in Department of Energy (DOE) grant funding under the second round of the Grid Resilience and Innovation Partnerships (GRIP) program for projects to upgrade and modernize the transmission and distribution (T&D) system in an effort to increase reliability and resilience. This was in addition to $3.46 billion in projects selected for grid upgrades in October 2023. Among recently completed projects featured in the fact sheet was the Ten West Link transmission line from Arizona to California, which the White House said would unlock more than 3,200 MW of capacity from solar projects. Construction of the project was approved by the Department of the Interior in 2022 and it began transmitting electricity on April 25, 2024. Meanwhile, the DOE announced up to $331 million for a new transmission line to be built from Idaho to Nevada. The Southwest Intertie Project-North, as the project is called, will be a 285-mile transmission line, bringing more than 2,000 MW of needed transmission capacity to the region, according to the fact sheet.

Cutting Red Tape

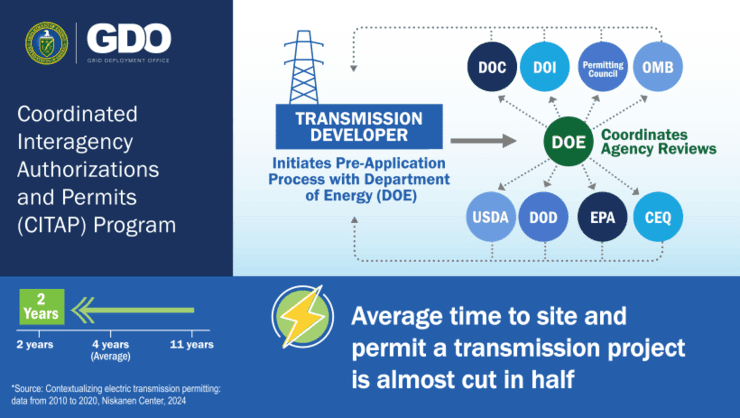

Yet, one of the biggest hurdles for many projects is the approval process, which can take several years. With that in mind, the admistration has taken steps in an effort to speed things up. Among the actions is a final rule issued by the DOE to create a faster track for completing environmental reviews of upgrades to existing transmission lines. The rule creates a categorical exclusion, the simplest form of review under the National Environmental Policy Act, for projects that use existing transmission rights of way, such as reconductoring projects, as well as for solar and energy storage projects on already disturbed lands. The DOE also released a final rule designed to make federal permitting of new transmission lines more efficient. The rule establishes the Coordinated Interagency Transmission Authorization and Permits (CITAP) program, which aims to improve coordination across agencies, create efficiencies, and establish a standard two-year timeline for federal transmission authorizations and permits (Figure 1). The White House said, “The CITAP program gives transmission developers a new option for a more efficient review process, a major step to provide increased confidence for the sector to invest in new transmission lines.” [caption id="attachment_220327" align="aligncenter" width="740"]

1. The CITAP program aims to improve coordination across agencies including the Department of Agriculture (USDA), Department of Commerce (DOC), Department of Defense (DOD), Department of the Interior (DOI), Environmental Protection Agency (EPA), Federal Permitting Improvement Steering Council (Permitting Council), Council on Environmental Quality (CEQ), and the Office of Management and Budget (OMB). Source: U.S. Department of Energy[/caption] Additionally, the Biden administration launched an effort intended to mobilize public- and private-sector leaders to expand the capacity of the existing U.S. transmission network. The goal of the initiative is to upgrade 100,000 miles of transmission lines over the next five years. The funding is available through the GRIP program. The White House said the DOE’s categorical exclusion will speed up the process to upgrade existing lines. “The power sector can achieve this ambition primarily by deploying modern grid technologies like high-performance conductors and dynamic line ratings that enable existing transmission lines to carry more power. As a complement to building new lines, deploying solutions like these offer fast and cost-effective ways to unlock hundreds of gigawatts of additional clean energy, increase system reliability and resilience, reduce grid congestion, and cut energy costs,” the fact sheet says.

High-Performance Conductors

The operating temperature for which power lines are designed is one of the most important factors in determining their current-carrying capabilities. “Traditional conductors are rated to a specific temperature, and traditionally, they’ve been rated to 90 to 100 degrees C in the U.S.,” Andrew Phillips, vice president of T&D Infrastructure with EPRI, explained. The reason that’s important is because as transmission lines heat up, the metal in them, typically steel and aluminum, expands and the lines sag. System designers take this into account, of course, and follow National Electrical Safety Code requirements to assure that clearances at design conditions will be appropriate for all items concerned, but the current the lines are capable of carrying is affected. Beyond sag, Phillips noted a couple of other items that limit current flow through an electric power transmission system. “All of those connectors—those splices and joints and a whole bunch of things—they’re rated to 90 to 100 degrees C as well. And, then, the conductor itself can anneal and lose its strength at high temperatures,” Phillips further explained. “So, those are the three things that limit you with temperature: sag, connectors, and the conductor itself.” One way to increase the current-carrying capability of a transmission system is by designing it to operate at higher temperatures. Phillips pointed to aluminum conductor steel-supported (ACSS) conductors as a higher-temperature alternative to some more-common materials. Unlike aluminum conductor steel-reinforced (ACSR) conductors, for example, in which the strength is held by both the steel and aluminum, only the steel in the middle of ACSS conductors holds the strength. The aluminum on the outside holds no strength and is actually annealed. “There’s an ACSS conductor that’s got a steel core that will go to 250 degrees C,” said Phillips. “So, you’re able to withstand much higher temperatures—you can get more power down it—but it sags more easily. And, so, you can easily design a new line—you can make the towers a little taller or put the tension a bit higher—you can get over the obstacles. But to go and re-conductor an existing line, that’s not easy.” When reconductoring existing lines to expand capacity, a better option could be installing carbon-core conductors. “Carbon-core conductors basically use carbon fiber,” said Phillips. “The nice thing about carbon fiber is you can design it so that it doesn’t expand as much as steel when it heats up, and therefore, doesn’t sag as much. Also, it’s light.” Phillips suggested reconductoring existing lines with carbon-core conductors could allow going to higher temperatures without having to worry about sag constraints. Another option available through at least one manufacturer is an aluminum metal-matrix core conductor, which has properties similar to those of carbon-core conductors.

Dynamic Line Ratings

Traditionally, transmission system owners have used static or seasonal line ratings based on worst-case assumptions. For example, they might set limits using ambient temperatures from the peak time of the day on the hottest day of the year under relatively calm wind speeds. This results in very conservative ratings that do not accurately reflect the true thermal capacity of a line during less-extreme points in time. Dynamic line rating (DLR) systems, on the other hand, provide real-time visibility into line capacity and customized rating profiles on lines that might otherwise be identical. DLR can be particularly beneficial in high-wind areas because wind can cool conductors and enable them to carry more current. Similarly, lines can carry more current in lower ambient temperatures, so utilities with transmission constraints during winter peaks could benefit greatly from DLR. As a guest on The POWER Podcast, Alexina Jackson, vice president of Strategic Development with AES Corp., said DLR technology can be deployed relatively quickly and easily. “We were able to deploy in a series of months from the idea of wanting to deploy dynamic line rating to actually getting it on the grid,” Jackson said. “That’s a really quick turnaround—doing anything on the grid in less than a year is really significant when it comes to transmission.” AES partnered with LineVision on what was the largest single deployment of DLR technology in the U.S. at the time. The two companies published a 22-page case study in April 2024 titled “Lessons from first deployment of Dynamic Line Ratings,” detailing insight gleaned from the project. The paper says, “Installation of the 42 LineVision sensors on AES’s five lines in Indiana and Ohio occurred safely, efficiently, and quickly. Total installation time took less than two weeks with an average sensor installation time of approximately 30 minutes, excluding travel time.” The installation process was said to be very straightforward. The sensors were installed about 15 to 20 feet above grade on the structure, well outside the minimum approach distances for live conductors. No outages were required and there was no disruption to grid operations. With basic training, two 30-foot ladders, and standard hand tools, the AES crew safely deployed the DLR sensors (Figure 2). [caption id="attachment_220328" align="aligncenter" width="740"]

2. Workers install dynamic line rating sensors on an AES Indiana line. Courtesy: AES/LineVision[/caption] Immediately following installation, the sensors began collecting data. Light detection and ranging (LiDAR) readings from the sensors were securely transmitted to LineVision’s ratings platform. Meanwhile, LineVision collaborated with a local engineering firm to conduct LiDAR-enabled drone flights over each monitored span, establishing a baseline model, the case study explains. Once a localized model was built for each of the five AES lines, LineVision further trained the base model with three months of AES loading data. Notably, the case study only presents early results from winter months (October 2023 through March 2024). Nonetheless, the findings are worth reviewing. Three top-level learnings were noted in the report. They are:

There are common transmission lines for which DLR models are currently experienced and ready “out-of-the-box.” These are extra-high-voltage lines on steel structures with suspension-type insulators.

There are high-voltage and sub-transmission lines that may benefit from DLR that have not been modeled typically and may require additional model training to return verified ratings. These include lines that may be older in construction and supported by wood poles with post-type insulators. These characteristics can cause movement in poles resulting in greater variations in line sag, which arguably provides additional safety and reliability arguments for dynamic awareness of actual line carrying capacity measurements.

DLR has provided improved situational awareness and an opportunity for informed decision-making in all five deployments, which will inform next steps for each line.

Much greater detail was reported in the case study, especially for the first and second of the five demonstration lines (anonymized as “345kV-1” and “69kV-4,” respectively). The case study also memorializes a list of additional broad learnings, which could be beneficial to other utilities intending to deploy DLR technology. Furthermore, AES and LineVision said they look forward to their continued collaboration and additional publication of insights intended to pave the way for scale deployment of DLR solutions. “One key thing we need to do is education,” said Jackson. “That’s one of the reasons why we put our white papers out there, and we’re sharing our insights at a system level. We want to make sure that we’re breaking down barriers to people’s understanding of these technologies.”

An Alternative Line Rating Solution—and More

Still, LineVision’s DLR system isn’t the only option on the market. Prisma Photonics, an Israeli company that also has offices in Germany and the U.S., monitors transmission lines through the utilization of existing optical fiber, which is turned into a distributed sensor extending thousands of miles. Prisma Photonics told POWER it captures data points on assets in real-time, collecting highly detailed acoustic signatures that are fed into an artificial intelligence (AI) model, which the company said offers “unmatched awareness of conditions that affect conductor health.” “We operate in regions where transmission grids are equipped with optical fibers, specifically the OPGW [optical ground wire],” Eran Inbar, CEO of Prisma Photonics, explained. “Our approach involves connecting an optical interrogator unit to standard single-mode optical fibers to turn them into highly sensitive sensors for infrastructure monitoring. Leveraging our Hyper-Scan technology represents a significant advancement over traditional methods, providing exceptionally accurate data for rapid issue identification and minimizing false alarms. This capability allows us to effectively monitor power lines over extensive distances, ensuring smooth and safe operations.” Inbar said client needs often vary by region. For many customers in established power markets, the focus is often on grid resiliency, but could also include factors like line rating or cross-border energy market forecasting. In developing countries, meanwhile, addressing capacity shortages or combating vandalism might be more important. “What may be a significant issue in one region could be a lesser challenge elsewhere, and we address all such concerns comprehensively,” Inbar said. One location where Prisma Photonics began deploying its technology in 2020 was within the Israel Electric Corp.’s (IEC’s) power grid. Prisma Photonics achieved coverage of about 1,000 kilometers by 2023, spanning 20% of IEC’s coverage area across 45 distinct substations and 1,850 towers. During that period, Prisma Photonics identified various instances of short circuits, vandalism, and a wildfire event, accurately pinpointing tower locations. In terms of capacity optimization, Prisma Photonics flagged lines that could benefit from DLR, yielding a 21.6% gain over static ratings. In December 2021, Prisma Photonics won the New York-Israel Smart Energy Innovation Challenge, a competitive award with a value of $1 million sponsored by the New York Power Authority (NYPA), the largest state public utility in the U.S. The award enabled Prisma Photonics to partner with the NYPA to conduct real-time monitoring for 24 months on a transmission line running through the rugged terrain of the Catskill Mountains. The project provided NYPA with insight into the health and functionality of its grid, enabling early detection of potential issues such as line icing and other anomalies. Inbar said Prisma Photonics’ team of physicists and AI experts are continuing to expand optical fiber sensing capabilities. “For instance, we measure wind metrics on each power line span—the stretch between two towers—to identify the cooling effect of the wind on each span and calculate line rating with accuracy, while identifying the movement of critical spans—the ‘weakest link’—during the day as the wind patterns shift,” he said. Prima Photonics is doing that by increasing the sensitivity and the quality of the signal gleaned from the fiber, which stretches hundreds of miles. Additionally, the company is improving the AI models that identify the anomalies from the wind data. “We have over two petabytes of data, which is labeled and ready to be loaded as training and testing data for AI models. This spans thousands of miles and several years of data,” said Inbar.

Advanced Equipment Enhances Grid Reliability

New and improved devices are also helping the grid perform better. In February 2022, G&W Electric, a global supplier of electric power equipment, introduced what it claimed was “the world’s first sub-transmission recloser.” Called the Viper-HV, the 72.5-kV recloser is designed to provide overcurrent protection through fault isolation and automatic restoration for temporary faults on overhead sub-transmission lines. It incorporates reclosing technology, current transformers, and voltage sensors in a single space-saving design. The Viper-HV recloser provides utilities with improved performance on a pole to automatically clear any temporary faults and isolate only the section of the grid necessary to protect additional lines from going down, preventing an entire region from losing power. Nic DiFonzo, a lead power grid automation engineer with G&W Electric, explained during an exclusive interview with POWER at the DISTRIBUTECH event that many utilities don’t sectionalize sub-transmission lines, or if they do, they use a device such as a motor-operated air-brake (MOAB) switch, which requires on-ground real estate that is not available in some situations. Furthermore, DiFonzo said with a MOAB, an arc is drawn every time the switch is opened or closed under load, which is sometimes done but not recommended. “One of the advantages of the Viper-HV recloser is you can put this up on the line and it can interrupt a fault,” DiFonzo said. “So, you don’t have to worry about tripping back at a substation, taking out the whole line. You can now use this device to get more granularity and take out less of that line, which means less outages for the customers.” The Viper-HV recloser (Figure 3) is maintenance-free, with no oil or gas required. The vacuum interrupter and all other energized parts are sealed within field-proven solid-dielectric insulation, providing optimum operator safety and additional protection to discourage wildlife interference. The pole top design offers cost savings by eliminating the need for foundations in fenced substations. Mounting configurations are adaptable to pole construction, providing further flexibility. [caption id="attachment_220329" align="aligncenter" width="333"]

3. The Viper-HV recloser was on display at the DISTRIBUTECH event in Orlando, Florida, in February 2024. Source: POWER[/caption] Similarly, S&C Electric Company has developed devices that can restore power quickly following temporary faults. During an episode of The POWER Podcast, Mike Edmonds, Chief Commercial Officer of S&C, noted that S&C invented the fuse 115 years ago, but now the company is working to replace fuses on the grid with more-intelligent devices that can re-energize lines without sending a lineman to the site. Edmonds provided an example using theoretical palm fronds being blown by heavy winds during a storm in Florida. “Those storm gusts typically lasts 23 to 26 seconds, based on 10 years’ worth of data. So, if you wait 30 seconds, that palm frond has now come back off the line and you can re-energize,” he explained. “It’s taking those things into account to say, ‘Let’s try every way of regaining the grid back.’ That really for us is resiliency, as we aim towards a 100% outage-free grid.” For a number of years now, S&C has been supplying the VacuFuse II Self-Resetting Interrupter, which brings fault testing to the edge of the grid. It has the ability to test if a fault is temporary, and if so, it automatically restores power. The way it works is when the device detects fault current, the vacuum interrupter inside the unit opens and interrupts that fault current. About 45 seconds later, the interrupter will test the line to see if the fault remains. If the issue was temporary, then the vacuum interrupter remains closed and power is restored without the need for a time-consuming and costly truck roll. Because the majority of overhead faults are temporary, one of the most effective ways to manage them is by using fault-testing devices to keep temporary issues from becoming longer-lasting outages. Meanwhile, voltage regulation is another critical aspect of distribution grid operation. Eaton offers a well-proven voltage regulator integrated with a versatile controller. Daniel Daley, lead controls development engineer with Eaton, explained the functionality of the equipment during an interview with POWER at DISTRIBUTECH. He said maintaining a stable and consistent voltage on distribution feeders keeps lights at a steady brightness, and keeps equipment and devices running at a more efficient nominal voltage. “The voltage regulator allows you to do that,” said Daley. “You have a traditional load curve during the daytime, when everybody’s turning stuff on and utilities see demand go up.” Eaton’s CL-7 voltage regulator control and Quik-drive tap changer (Figure 4) has the ability to run right along with it. “So, as it needs to bump up the available load, it can do that, and it tracks along as a smart controller,” Daley explained. “It can do a lot of more sophisticated things than that, but that’s the real basic function of the voltage regulator.” [caption id="attachment_220330" align="aligncenter" width="333"]

4. The CL-7 voltage regulator control and Quik-Drive tap changer are a package that is unmatched in the industry, according to Eaton. The equipment was on display at the DISTRIBUTECH event in Orlando, Florida, in February 2024. Source: POWER[/caption] Eaton says the CL-7 voltage regulator meets the needs of system planners today and in the future with integrated supervisory control and data acquisition (SCADA) componentry and continuously evolving features such as a radio-ready control box, direct-current (DC) power supply, input-output (I/O) module, and alternating-current (AC) cabinet power. An analog input card is available for monitoring apparatus data such as insulating fluid temperatures, pressure/vacuum, and regulator health. “The speed of the industry’s only Quik-Drive tap-changer along with the unique voltage limiter capabilities of the control enable the fastest response available for extreme voltage swings,” the company says. ■ —Aaron Larson is POWER’s executive editor.

Yahoo Finance

Yahoo Finance