Strategic Education Inc. (STRA) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

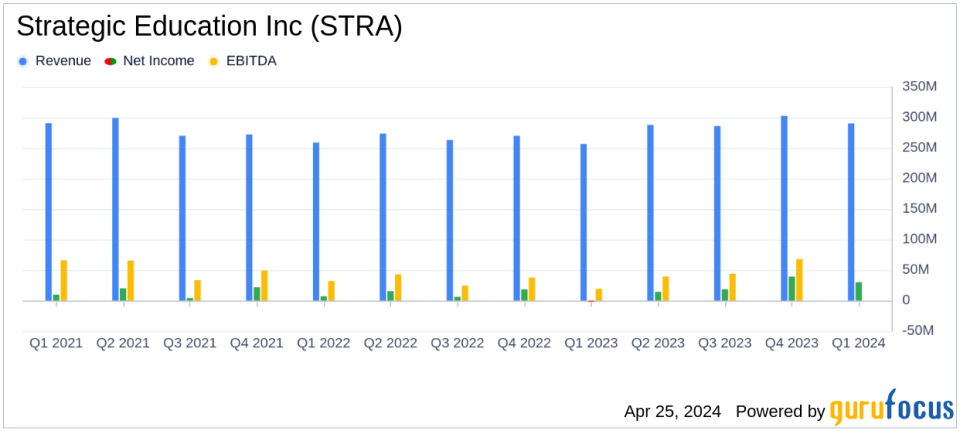

Revenue: Reported at $290.25 million for Q1 2024, surpassing the estimate of $273.63 million.

Net Income: Reached $29.70 million, significantly exceeding the estimated $14.31 million.

Earnings Per Share (EPS): Achieved $1.23 diluted EPS, greatly surpassing the estimated $0.59.

Cash Flow: Cash provided by operations rose to $77.6 million from $35.2 million in the previous year.

Dividends: Announced a regular quarterly cash dividend of $0.60 per share, payable on June 3, 2024.

Bad Debt Expense: Increased to 4.2% of revenue, up from 3.8% in the same period last year.

Capital Expenditures: Grew to $9.2 million, compared to $8.3 million in the prior year.

On April 25, 2024, Strategic Education Inc (NASDAQ:STRA) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a significant increase in revenue, reaching $290.25 million, surpassing the analyst's expectation of $273.63 million. Net income also exceeded forecasts, with the company achieving $29.7 million against an estimated $14.31 million.

Company Overview

Strategic Education Inc. is a pioneer in education services, providing comprehensive campus-based and online post-secondary education through Strayer and Capella Universities in the U.S., and Torrens University in Australia. The company focuses on high-demand, job-ready skills, catering primarily to working adult students through its U.S. Higher Education, Australia/New Zealand, and Education Technology Services segments.

Financial and Operational Highlights

The company's U.S. Higher Education segment showed robust growth, driven by increased employer-affiliated enrollments. The Education Technology Services, including Sophia subscriptions, continued to perform strongly. Additionally, the Australia/New Zealand segment saw a return to enrollment growth, contributing positively to the consolidated results.

Strategic Education's balance sheet remains healthy with $253.6 million in cash and marketable securities. The company's operational efficiency is evident from the cash flow from operations, which more than doubled to $77.6 million from $35.2 million in the same period last year. Despite a slight increase in bad debt expense to 4.2% of revenue, up from 3.8% last year, the overall financial health of the company improved markedly.

Dividend and Shareholder Returns

In a move affirming its financial stability and commitment to shareholder returns, Strategic Education announced a quarterly cash dividend of $0.60 per share, payable on June 3, 2024, to shareholders of record as of May 24, 2024.

Management's Perspective

CEO Karl McDonnell expressed satisfaction with the company's performance, highlighting the strength across business segments and the organization's commitment to student success. "The U.S. Higher Education segment delivered another quarter of strong growth driven by employer affiliated enrollment; the Education Technology Services segment continued to see strength, including from Sophia subscriptions; and the Australia/New Zealand segment returned to total enrollment growth," McDonnell stated.

Forward Outlook and Strategic Moves

Strategic Education is well-positioned to leverage its diversified educational services to meet the increasing demand for adult learning and professional development. The company's focus on integrating technology and education to enhance learning experiences and outcomes is likely to continue driving its growth in the competitive education sector.

Conclusion

Strategic Education Inc.'s performance in the first quarter of 2024 sets a positive tone for the year. With a strong financial position, strategic growth in key segments, and a commitment to enhancing shareholder value, the company is poised for continued success. Investors and stakeholders can look forward to the sustainability of this growth trajectory supported by Strategic Education's robust business model and strategic initiatives.

Explore the complete 8-K earnings release (here) from Strategic Education Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance