It's A Story Of Risk Vs Reward With GIEAG Immobilien AG (ETR:2GI)

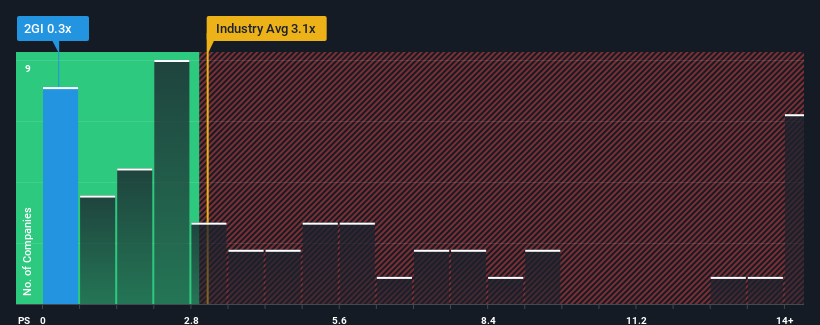

With a price-to-sales (or "P/S") ratio of 0.3x GIEAG Immobilien AG (ETR:2GI) may be sending very bullish signals at the moment, given that almost half of all the Real Estate companies in Germany have P/S ratios greater than 3.1x and even P/S higher than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for GIEAG Immobilien

How Has GIEAG Immobilien Performed Recently?

With revenue that's retreating more than the industry's average of late, GIEAG Immobilien has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GIEAG Immobilien.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as GIEAG Immobilien's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth will be highly resilient over the next three years growing by 9.2% per year. Meanwhile, the broader industry is forecast to contract by 17% per year, which would indicate the company is doing very well.

With this information, we find it very odd that GIEAG Immobilien is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of GIEAG Immobilien's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for GIEAG Immobilien (1 shouldn't be ignored) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance