Stewart Information Services Corp (STC) Surpasses Analyst Revenue Forecasts in Q1 2024

Net Income: Reported at $3.1 million, a significant improvement from a net loss of $8.2 million in Q1 2023, surpassing the estimated net loss of $2.93 million.

Earnings Per Share (EPS): Achieved $0.11 per diluted share, a reversal from a loss of $0.30 per diluted share in the prior year, exceeding the estimated EPS of -$0.13.

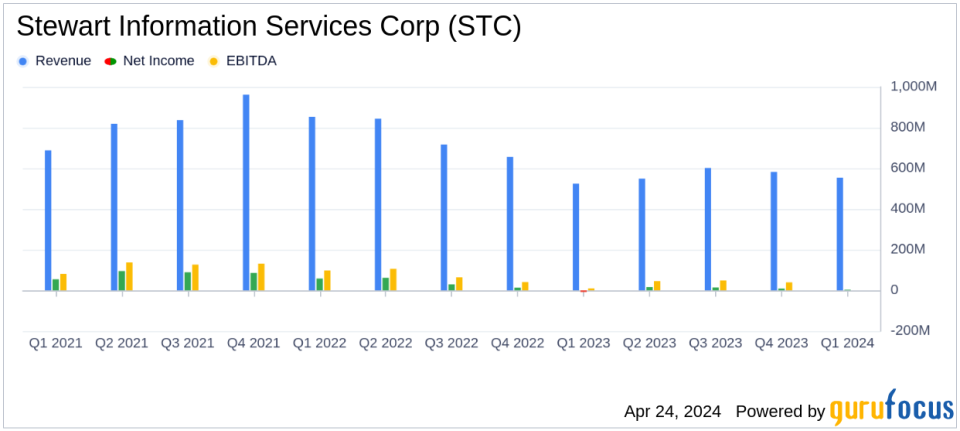

Total Revenue: Reached $554.3 million, up from $524.3 million year-over-year, and exceeded the estimated revenue of $536.17 million.

Pretax Income: Recorded at $7.1 million, compared to a pretax loss of $10.2 million in the same quarter last year.

Adjusted Net Income: Increased to $4.6 million from $0.2 million in Q1 2023, reflecting stronger operational performance.

Commercial Revenue Growth: Noted a significant increase, particularly in domestic commercial revenues which rose by 52%.

Real Estate Solutions Segment: Showed robust growth with operating revenues up 33% to $83.0 million, driven by higher demand for credit information and valuation services.

Stewart Information Services Corp (NYSE:STC) released its 8-K filing on April 24, 2024, revealing a notable improvement in its financial performance for the first quarter of 2024. The company reported a net income of $3.1 million, or $0.11 per diluted share, a significant recovery from a net loss of $8.2 million, or $0.30 loss per diluted share, in the same quarter of the previous year. Adjusted net income also rose to $4.6 million, or $0.17 per diluted share, compared to just $0.2 million, or $0.01 per diluted share, in Q1 2023.

Stewart Information Services Corp, a global real estate services company, focuses on title insurance and real estate services, providing products and services to various stakeholders in the real estate market. The company operates through three segments: Title insurance and related services, Real estate solutions, and Corporate and other. The Title segment is the primary revenue generator, engaging in activities ranging from title insurance to property and casualty insurance.

Financial Overview

The company's total revenues for Q1 2024 reached $554.3 million, up from $524.3 million in Q1 2023, exceeding the estimated revenue of $536.17 million. This increase was primarily driven by gains in the Real Estate Solutions segment, which saw a 33% increase in operating revenues, and a significant improvement in investment income, which nearly doubled from the previous year. The Title segment, however, experienced a slight decline in operating revenues due to decreased residential volume, which was partially offset by increased commercial revenues.

Operational Highlights and Challenges

Despite the overall revenue growth, the company faced challenges due to the higher interest rate environment impacting the real estate market. CEO Fred Eppinger noted the ongoing challenges to residential transaction volumes but expressed encouragement over the increase in commercial revenues. The company remains focused on strategic investments and maintaining cost discipline to bolster long-term growth and resilience.

Segment Performance

The Title segment's pretax income saw a dramatic turnaround, posting $10.2 million compared to a loss in the previous year, aided by a 492% increase in net realized and unrealized gains. The Real Estate Solutions segment also performed well, with pretax income increasing by 393% to $6.7 million, driven by higher revenues from credit information and valuation services.

Strategic and Financial Position

STC's strategic initiatives, including cost management and investment in technology and services, are set to enhance its competitive edge in the industry. The company's balance sheet remains solid, with a notable reduction in net cash used by operations, which decreased to $29.6 million from $51.1 million in the prior year's first quarter.

Looking Forward

As Stewart Information Services Corp navigates through the fluctuating real estate market, its focus on strategic investments and cost efficiency is expected to play a crucial role in sustaining its growth trajectory. The company's ability to exceed revenue expectations amidst market adversities highlights its resilience and adaptability in a challenging economic landscape.

For more detailed information on STC's financial performance and strategic outlook, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Stewart Information Services Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance