Stellar Bancorp Inc. (STEL) Q1 2024 Earnings: Aligns with EPS Projections, Slight Miss on ...

Net Income: Reported $26.1 million for Q1 2024, slightly below the estimate of $25.64 million.

Earnings Per Share (EPS): Achieved $0.49, surpassing the estimated $0.48.

Revenue: Generated $102.1 million in net interest income, falling short of the estimated $107.14 million.

Net Interest Margin: Recorded at 4.26% for Q1 2024, showing a decrease from 4.40% in the previous quarter.

Regulatory Capital: Total risk-based capital ratio improved to 14.62% from 14.02% at the end of the previous quarter.

Cost of Funds: Increased slightly to 2.06% in Q1 2024 from 2.03% in Q4 2023.

Asset Quality: Nonperforming assets were 0.53% of total assets, up from 0.37% at the end of the previous quarter.

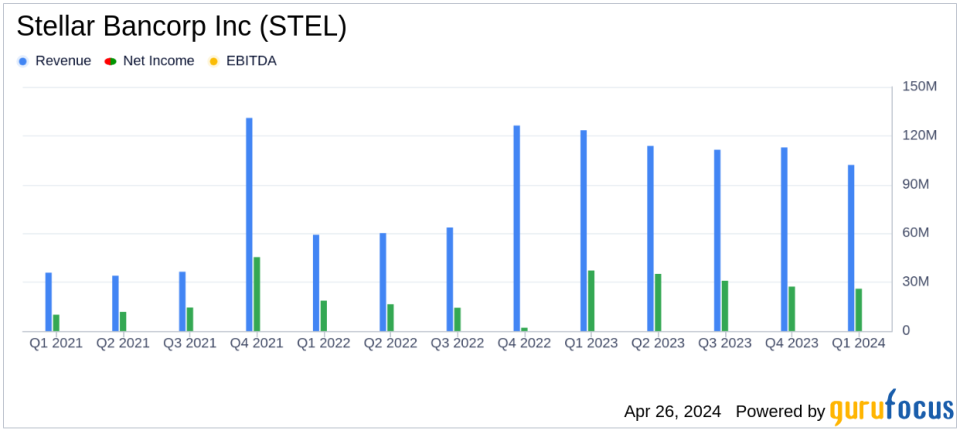

On April 26, 2024, Stellar Bancorp Inc. (NYSE:STEL) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a net income of $26.1 million, with diluted earnings per share (EPS) of $0.49. These figures closely align with analyst expectations, which projected an EPS of $0.48 and a net income of $25.64 million. However, the reported revenue of $102.1 million for the quarter fell short of the estimated $107.14 million.

Stellar Bancorp Inc., a prominent bank holding company based in the U.S., primarily serves small to mid-sized businesses and professionals through over 50 full-service banking centers. It offers a comprehensive range of services including business and personal deposit accounts, lending, and online banking solutions.

Quarterly Financial Highlights

The first quarter saw a slight decrease in net interest income, dropping by 3.6% to $102.1 million from the previous quarter's $105.9 million. This decline was mainly due to a reduced yield on interest-earning assets, despite benefiting from $8.6 million in income from purchase accounting adjustments. The company's net interest margin also experienced a decrease, settling at 4.26% compared to 4.40% in the preceding quarter.

Noninterest income saw a decrease of 8.6%, totaling $6.3 million, influenced by lower Small Business Investment Company income, which was slightly offset by increased gains on sales of assets. Noninterest expenses were reduced by 8.4% to $71.4 million, thanks to lower nonrecurring items related to acquisition and merger-related expenses and other operational costs.

Strategic Initiatives and Market Positioning

CEO Robert R. Franklin, Jr. highlighted the company's strategic focus on building capital, maintaining liquidity, and monitoring credit amidst ongoing interest rate uncertainties. He expressed confidence in the company's market positioning and its ability to navigate the challenging economic landscape, thanks to Stellar's robust service model and strategic market presence.

Operational and Asset Quality

Stellar Bancorp reported a total loan portfolio of $7.91 billion, slightly down from $7.93 billion at the end of the previous quarter. The quality of assets showed some signs of stress, with nonperforming assets increasing to 0.53% of total assets from 0.37%. However, the company has maintained a solid capital position, with a total risk-based capital ratio of 14.62%.

Outlook and Forward-Looking Statements

While the company faces challenges from the interest rate environment and competitive pressures, its strategic initiatives and strong market fundamentals position it well for future stability and growth. The management remains focused on leveraging its strong market presence and operational efficiency to navigate the current economic uncertainties effectively.

For detailed financial metrics and further information, investors and stakeholders are encouraged to refer to the full earnings release and supplementary financial data provided by Stellar Bancorp Inc.

Explore the complete 8-K earnings release (here) from Stellar Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance