Stellantis (STLA) Q2 Deliveries Down Y/Y, Chip Crisis Hurts Output

Stellantis NV STLA recently reported sales performance for the second quarter of 2022.

Sales fell 16% year over year, from 485,312 to 408,521 vehicles, marking the fourth consecutive quarter of decline. Supply chain challenges and tight inventory continue to throttle the auto sector.

The company noted that retail sales, which are more profitable than fleet sales, decreased 24% in the quarter. However, commercial shipments rose 13% year over year.

Across its brands, only Chrysler witnessed a rise in sales of 95%, driven by a jump in fleet sales because of a backlog of orders.

For the other brands, the sales numbers were down across the bulk of their lineups, except for a handful of models. Jeep was down 11%, Ram by 27%, Dodge by 30% and Alfa Romeo by 39%. Fiat sold a meager 249 vehicles in the quarter, declining from 891 in the year-ago period.

The results were, however, not without a positive tone. Jeep Grand Cherokee sales were up 12%, and the highly profitable Jeep Wagoneer and Grand Wagoneer, which were not yet in the market during the same period last year, added more than 14,000 vehicles to the sales mix. The prospects of Jeep's future electrified offerings look rosy as the plug-in hybrid electric Wrangler 4xe accounted for 20% of Wrangler sales, although total Wrangler sales were down 22%.

The automaker’s performance reflects the impact of low inventories, which is battering the auto sector in general. The bright spots, despite the challenges, indicate that the company is not completely in bad shape and has performed slightly better than the average auto sector.

In a dampening incident, warnings of an intensifying semiconductor supply shortage that weighs on Stellantis’ annual production in Italy sharply brought down the automaker’s shares to a 52-week low yesterday.

The Italian Federation of Metalworkers (“FIOM") opined that production was already down by 13.7% in the first half of 2022, with the company producing 351,890 vehicles. The output of commercial vehicles, especially, slumped by more than a third.

Stellantis' plant in Melfi, accounting for about 38% of all cars produced by the group in Italy, saw significant fall in the first-half production. Volumes at the site have fallen 17% from the previous year.

The Sevel unit is also likely to record a first-half production decline of more than 37%.

The union report by the FIOM stated that it expects Stellantis' output during the year to shrink by as much as 220,000 vehicles. Per the union, the projected decrease, led by a tight supply of raw materials and chips fueled by the Ukraine war and its impacts on European gas supplies, has led to such dire constraints.

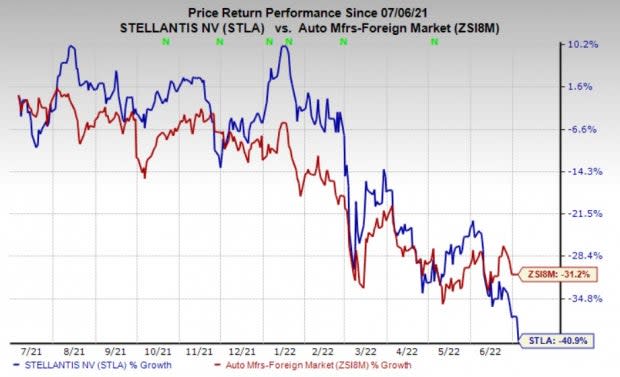

Shares of STLA have lost 40.9% over the past year compared with its industry’s 31.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

STLA carries a Zacks Rank #2 (Buy), currently.

Other top-ranked players in the auto space include Allison Transmission Holdings ALSN, LKQ Corporation LKQ and Standard Motor Products SMP, each carrying a Zacks Rank #2, currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Allison Transmission has an expected earnings growth rate of 24.5% for the current year. The Zacks Consensus Estimate for current-year earnings has been constant in the past 30 days.

Allison Transmission’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. ALSN pulled off a trailing four-quarter earnings surprise of 11.71%, on average. The stock has declined 5.1% over the past year.

LKQ has an expected earnings growth rate of 6.3% for 2023. The Zacks Consensus Estimate for current-year earnings has been revised 0.3% upward in the past 30 days.

LKQ’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. LKQ pulled off a trailing four-quarter earnings surprise of 23.55%, on average. The stock has risen 0.1% in the past year.

Standard Motor has an expected earnings growth rate of 5.2% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Standard Motor’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. SMP pulled off a trailing four-quarter earnings surprise of 40.34%, on average. The stock has increased 3.6% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Standard Motor Products, Inc. (SMP) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

LKQ Corporation (LKQ) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance