‘Steep decline’: Warning over gas shortfall

Winter next year could bring shortfalls in gas supply, as the Australian Energy Market Operator forecasts major gaps in the coming years.

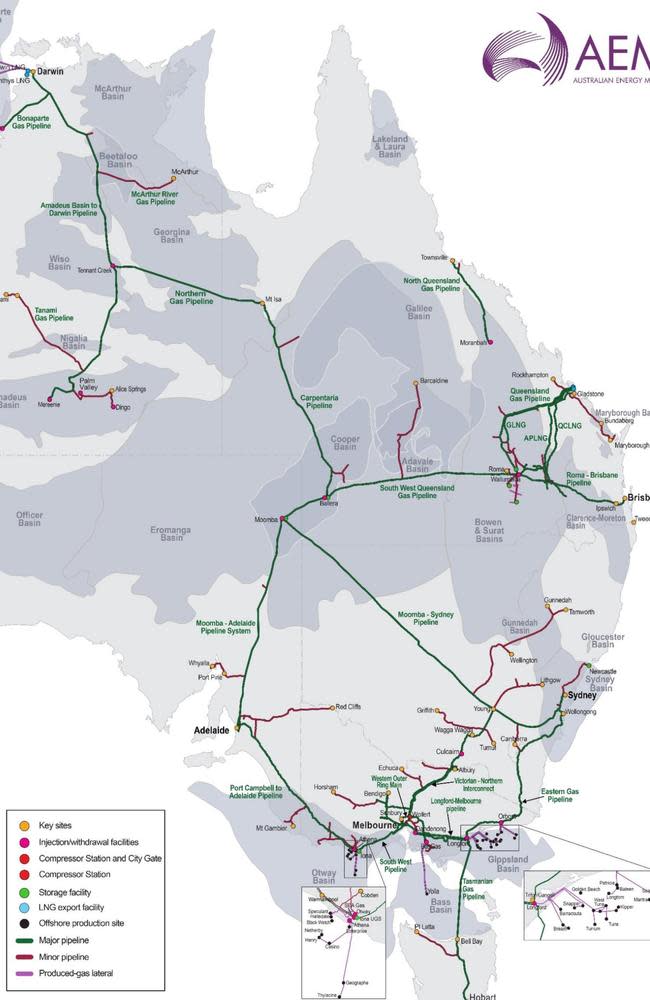

Gas supply into the southern network is trending downwards as fields in the Gippsland Basin age, potentially putting out 40 per cent less gas in 2028 than this year.

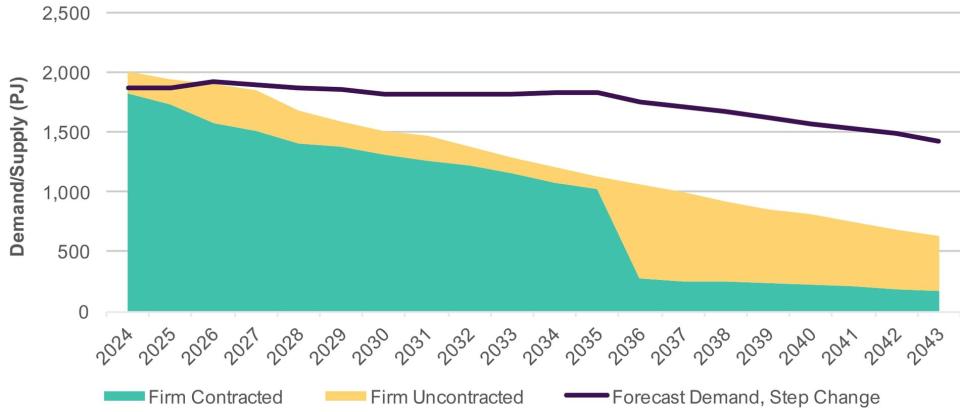

However, gas consumption has decreased since the agency’s previous forecast, as more of the country electrifies.

“The long-term production outlook represented by existing, committed and anticipated volumes for southern gas fields is in steep decline,” the AEMO says in the report.

“Peak-day shortfalls’are forecast for 2025 during extreme weather in winter when gas for heating and electricity spikes.”

The agency and industry can manage the peak day gaps in 2026 and 2027, but “from 2028 a solution which brings in more supply is needed”, it says in the report.

That leaves the industry facing pressure to develop new projects and storage.

“While the scale of gas consumption remains uncertain through the energy transition, particularly in relation to gas usage for electricity generation, all scenarios identify the urgent need for new investments to maintain supply adequacy,” the AEMO says in the report.

In 2025, the AEMO projects domestic production and northern importation “will likely meet forecast southern demand for most days of the year”.

But during winter there remains a risk of shortfall if extreme peaks in demand occur.

Despite those Gippsland Basin sites’ declining output, gas plants at Longford set to close and coal power stations in NSW shutting their doors, the energy agency can point to positives.

Most states and the Northern Territory are expected to require less gas because of smaller demands for large industrial loads and electrification.

However, analysis commissioned by Solutions for Climate Australia argues that the volume of gas in existing fields combined with shrinking gas demand for domestic electricity generation means that existing reserves are enough.

Solutions for Climate Australian deputy director Sophia Walter said “this is hard data showing Australia has used and will use less and less gas for electricity”.

“It’s clearer than ever that we need to accelerate the replacement of climate polluting fossil fuel gas and coal with renewable energy,” Ms Walter said.

Yahoo Finance

Yahoo Finance