SPX 500 Technical Analysis: Recovery Stalls Above 2100

DailyFX.com -

Talking Points:

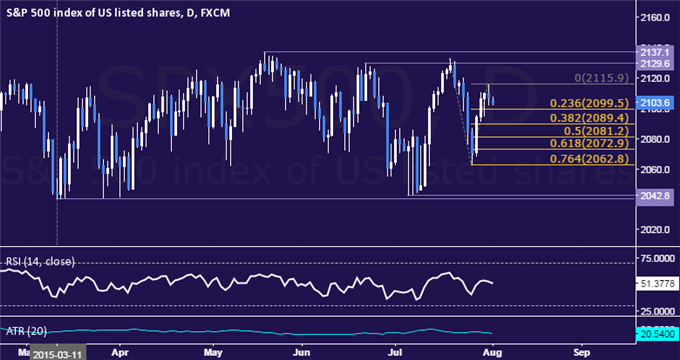

Support: 2099.50, 2089.40, 2081.20

Resistance: 2115.90, 2129.60, 2137.10

For more , visit our SPX 500 page

The SPX 500 stalled after erasing nearly all of last week’s down move and reclaiming a foothold above the 2100 figure. Near-term support is at 2099.50, the 23.6% Fibonacci expansion, with a break below that on a daily closing basis exposing the 38.2% level at 2089.40. Alternatively, a move above the July 31 high at 2115.90 opens the door for a test of the June 22 top at 2129.60.

KEY UPCOMING EVENT RISK:

03 AUG 2015, 12:30 GMT – US PCE Core (YoY) (JUN) – Expected: 1.2%, Prev: 1.2%

03 AUG 2015, 14:00 GMT – US Manufacturing ISM (JUL) – Expected: 53.5, Prev: 53.5

05 AUG 2015, 01:45 GMT – Caixin China PMI Composite (JUL) – Expected: n/a, Prev: 50.6

05 AUG 2015, 14:00 GMT – US Non-Mfg ISM Composite (JUL) – Expected: 56.2, Prev: 56.0

07 AUG 2015, 12:30 GMT – US Change in Nonfarm Payrolls (JUL) – Expected: 225K, Prev: 223K

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance