Sprouts Farmers (SFM) Stock Up on Q4 Earnings & Sales Beat

Sprouts Farmers Market, Inc. SFM reported fourth-quarter 2019 results wherein both the top and the bottom line not only improved year over year but also surpassed respective the Zacks Consensus Estimate for the second straight quarter. Further, the company sustained its positive comparable store sales trend. Following the quarterly results, shares of this Phoenix, AZ-based company gained more than 7% during the after-market trading session on Feb 20.

Let’s Delve Deeper

Sprouts Farmers reported quarterly earnings of 27 cents a share that surpassed the Zacks Consensus Estimate of 14 cents, and improved considerably from 19 cents in the year-ago period. Higher sales, reduced net interest expense and lower shares outstanding aided bottom-line performance.

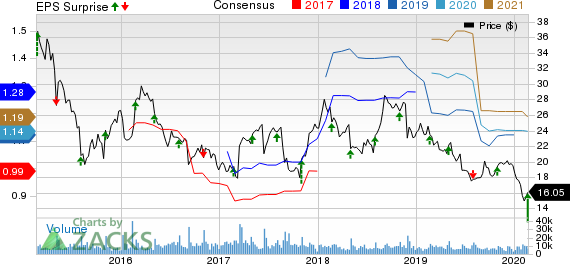

Sprouts Farmers Market, Inc. Price, Consensus and EPS Surprise

Sprouts Farmers Market, Inc. price-consensus-eps-surprise-chart | Sprouts Farmers Market, Inc. Quote

Net sales came in at $1,365 million, up 7.5% from the prior-year quarter on account of comparable store sales growth of 1.5%. Further, net sales outpaced the Zacks Consensus Estimate of $1,359 million.

Margins

Gross profit jumped 11.4% to $469 million during the quarter. Moreover, gross margin expanded 120 basis points to 34.4%. Management expects gross margin to be marginally positive for 2020 with more benefit expected during the first three quarters.

Operating income came at $46.9 million, up from $28.8 million reported in the year-ago period. Further, operating margin increased 110 basis points to 3.4%. We also note that adjusted EBITDA rose 13.5% to $78.2 million, adjusted EBITDA margin grew 30 basis points to 5.7%.

SG&A expenses jumped 9.9% to $387.5 million, while as a percentage of net sales the same increased 60 basis points to 28.4%. The deleverage in SG&A expenses was due to the adoption of the new lease accounting standard, expansion of home delivery program, increased healthcare expenses and cycling the California payroll tax benefit in 2018.

Store Update

During 2019, Sprouts Farmers opened 28 new outlets and closed one, taking the total count to 340 stores in 22 states. The company plans to open about 20 stores in 2020.

Other Financial Aspects

Sprouts Farmers, which carries a Zacks Rank #3 (Hold), ended the quarter with cash and cash equivalents of $85.3 million, long-term debt and finance lease liabilities of $549.4 million and shareholders’ equity of $582 million.

The company generated cash flow from operations of $355.2 million and incurred capital expenditures (net of landlord reimbursements) of $157 million for 52 weeks ended on Dec 29, 2019. Management plans to invest $120-$130 million in capital expenditures (net of landlord reimbursements) during 2020. During 2019, the company bought back 7.95 million shares of worth $176 million.

Guidance

Management envisions 2020 earnings in the band of $1.17-$1.23 per share. The projected range is ahead of the current Zacks Consensus Estimate of $1.14 but down from $1.25 reported in 2019. Sprouts Farmers expects net sales to increase between 5.5% and 6.5% for the full year. Comparable store sales are anticipated to be flat to up 1%.

For the first quarter, management estimates net sales growth of 5.5-6.5% with comparable store sales expected to be flat to up 1%. Earnings are anticipated in the range of 45-47 cents, the mid-point of which — 46 cents — is in line with the year-ago period but above the Zacks Consensus Estimate of 41 cents.

Sprouts Farmers informed that the year 2020 will be a 53-week year, with the extra week coinciding with the fourth quarter. The company estimates the impact for the 53rd week to be $120 million in total sales and 6 cents in earnings per share.

Stocks to Consider

Performance Food Group Company PFGC has a long-term earnings growth rate of 12%. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

US Foods Holding Corp. USFD has a long-term earnings growth rate of 7.5% and a Zacks Rank #1.

Beyond Meat BYND, with a Zacks Rank #2 (Buy), has delivered positive earnings surprises in the last two reported quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

">Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Performance Food Group Company (PFGC) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

Beyond Meat, Inc. (BYND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance