Southwestern Energy Co (SWN) Q1 2024 Earnings: A Detailed Financial Review

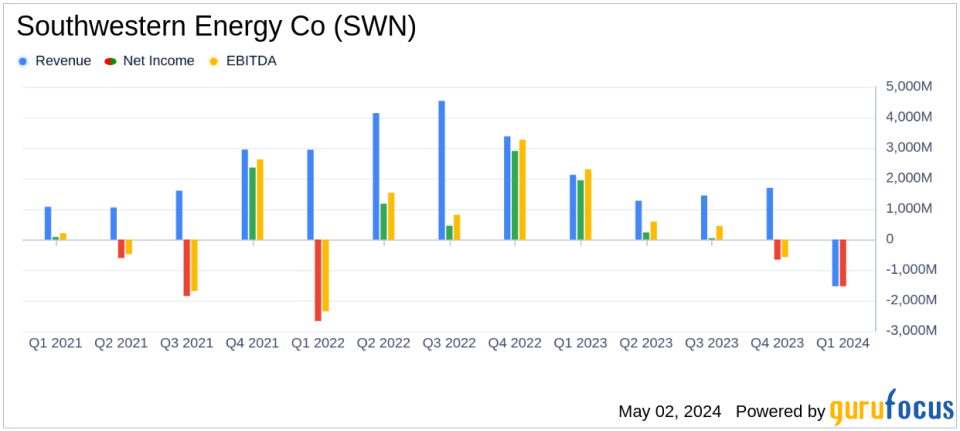

Net Loss: Reported a significant net loss of $1.535 billion for Q1 2024, a stark contrast to the net income of $1.939 billion in Q1 2023.

Adjusted Net Income: Achieved $131 million, falling short of the estimated $158.88 million.

Revenue: Generated $1.417 billion in operating revenues, exceeding the estimated $1.267 billion.

Earnings Per Share: Reported a diluted loss per share of $1.39, significantly below the estimated earnings per share of $0.14.

Operating Cash Flow: Net cash provided by operating activities amounted to $496 million, demonstrating robust operational cash generation despite overall losses.

Capital Investments: Maintained a high level of capital expenditure at $538 million, aligning with the company's strategic focus on front-end loaded development.

Production Levels: Total net production reached 376 Bcfe, with a daily production rate of 4.1 Bcfe, indicating strong operational output.

On May 2, 2024, Southwestern Energy Co (NYSE:SWN) released its 8-K filing, revealing a complex financial landscape for the first quarter ended March 31, 2024. The company, a prominent player in the exploration, development, and production of natural gas and liquids, reported a significant net loss of $1.5 billion, contrasting sharply with a net income of $1.939 billion in the same period last year. This financial downturn was primarily due to a substantial $2.093 billion impairment charge. Adjusted for non-recurring items, the adjusted net income stood at $131 million, significantly lower than the previous year's $346 million.

Financial and Operational Highlights

SWN's operational activities yielded a net production of 376 billion cubic feet equivalent (Bcfe), with natural gas accounting for the majority. The company's capital investments amounted to $538 million, aligning with its front-end loaded development strategy. Despite the financial challenges, SWN generated $496 million from operating activities and maintained a net cash flow of $439 million. However, the company faced a free cash flow deficit of $99 million, indicating potential liquidity constraints.

The earnings per share (EPS) on a diluted basis was a loss of $1.39, reflecting the impact of the impairment. When adjusted for specific non-GAAP items, the EPS was $0.12, which is below the analyst estimate of $0.14 per share for the quarter. This discrepancy highlights the financial pressures faced by SWN, including the volatile commodity price environment which saw a 35% decrease in NYMEX Henry Hub prices.

Strategic and Market Considerations

SWN's strategic operations in the Appalachian and Haynesville regions showed varied production metrics, with a notable decrease in production efficiency in Appalachia compared to the previous year. The company's average realized prices for natural gas and liquids also declined, influenced by broader market trends and operational adjustments.

Amidst these challenges, SWN is navigating a pending merger with Chesapeake Energy Corporation, which has led to the discontinuation of future financial guidance and the suspension of quarterly earnings calls. This strategic move could reshape the company's future operational and financial trajectory, emphasizing the importance of strategic agility in the volatile energy market.

Investor Considerations and Forward-Looking Statements

Investors and stakeholders should consider the various financial and operational risks disclosed by SWN, including commodity price volatility and regulatory changes. The company's forward-looking statements, particularly concerning the merger with Chesapeake, provide insights into management's expectations and strategic priorities. However, these statements are inherently uncertain and should be interpreted with caution.

As Southwestern Energy Co (NYSE:SWN) continues to adjust its operations and strategy in response to internal and external pressures, the financial outcomes of these adjustments will be crucial in determining the company's ability to sustain and grow in the competitive energy market.

Explore the complete 8-K earnings release (here) from Southwestern Energy Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance