Southwest Shares Take Flight as Elliott Management Discloses Stake

Activist hedge fund Elliott Management revealed its latest target on Monday morning: Southwest Airlines Co. (NYSE:LUV).

Filings show the New York-based firm, which was founded by renowned investor Paul Singer (Trades, Portfolio) in 1977, entered a $1.90 billion stake in the low-cost airline, which has underperformed its bigger rivals in recent years.

While the stock shot up more than 7% following the announcement and has gained nearly 5% year to date, its longer-term performance shows it has struggled. Shares have fallen around 5% on a one-year basis, declined nearly 50% over the past three years and retreated 40% over the last five years.

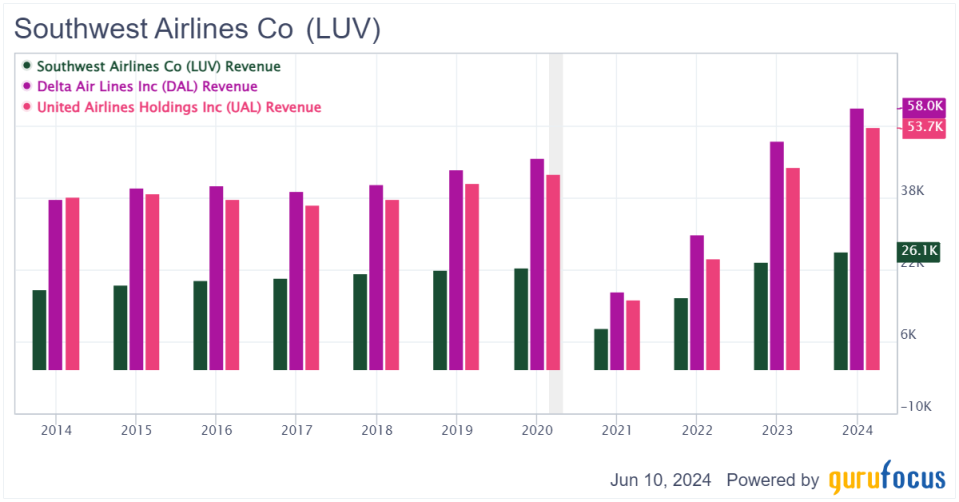

In comparison, Delta Air Lines Inc. (NYSE:DAL) has risen 8.92% while United Airlines Holdings Co. (NASDAQ:UAL) has tumbled around 6% over the past three years.

LUV Data by GuruFocus

As a result, a closer look at the company is warranted.

Weaknesses and challenges

Elliott noted in a letter and presentation it is seeking to replace CEO Bob Jordan and Chairman Gary Kelly, citing it believes the Dallas-based company has fallen from being a best-in-class airline to one of the biggest laggards under their leadership.

While Southwest, which was founded in 1966, has grown from a small regional carrier into a massive domestic airline that transports more travelers within the country than any other, it has stuck to the same conservative business model of using one kind of plane, offering only one class of service and not charging for checked bags. In comparison, its competitors have been able to generate additional revenue streams by offering seat upgrades, charging for luggage and hiking prices on other amenities.

Although many loyal customers choose to continue to fly with the airline for these reasons, it definitely is at a disadvantage when it comes to raking in profits. For instance, while Southwest recorded total revenue of $26.10 billion from its single business segment in 2023, Delta's three divisions generated $58.05 billion and United's three businesses posted sales of $53.72 billion.

This has been the norm for at least the past decade.

LUV Data by GuruFocus

As such, it is hard to argue that a change is not needed.

To his credit, Jordan, who succeeded Kelly as CEO in February 2022, revealed in an April CNBC interview that the airline is looking into new revenue streams to more effectively compete. For instance, it is contemplating abandoning its single class of airplane seating and longtime boarding method. However, this, along with its other past improvements of larger overhead bins, better WiFi and in-seat power sources, may not be enough to save the airline's leaders from further scrutiny.

One of the other major issues plaguing the airline has been deliveries of new Boeing (BA) 737 Max aircraft. As the newest model of the jet has struggled with manufacturing and certification delays due to continued investigations into the aircraft maker's operations, it has significantly hurt airlines that are depending on its planes. To make matters worse, Southwest flies these planes exclusively, leaving no room for other aircraft manufacturers to pick up the slack. This is a serious weakness that the leadership team needs to address quickly if it wants to continue to operate smoothly.

The company has also had to deal with shifting travel demand following the pandemic as well as technology issues like one that resulted in a meltdown during the 2022 holiday season. The ordeal cost Southwest more than $1 billion in appeasing upset customers and forced it to make quick fixes to its internal scheduling software.

It appears Southwest has its work cut out for it. The next challenge will be getting leadership to take the leap.

A glance at valuation and fundamentals

Despite its struggles in recent years, Southwest is not unappealing as an investment.

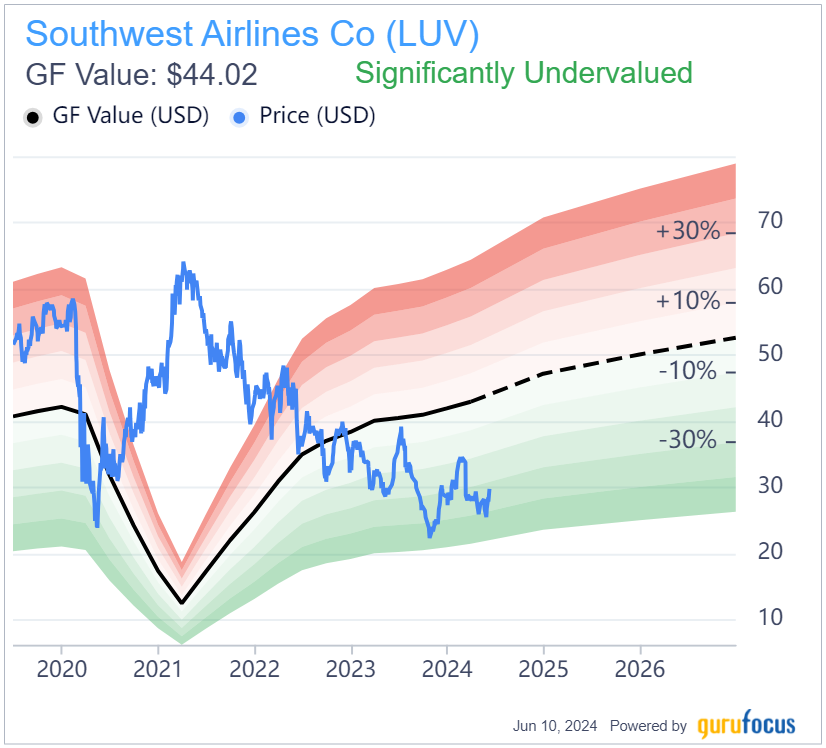

The GF Value Line, which is based on historical metrics, past financial performance and analysts' future earnings projections, shows the stock is significantly undervalued currently.

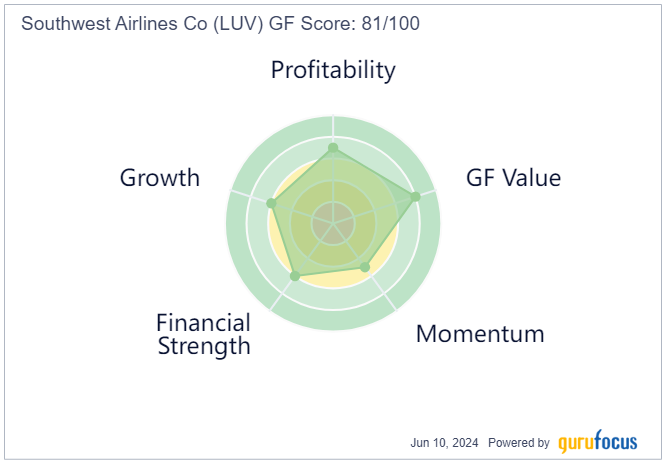

Further, the GF Score of 81 out of 100 indicates the company has good outperformance potential. While it received high ratings for profitability and value, the growth, financial strength and momentum ranks are more moderate.

The airline operator's Altman Z-Score of 1.85 indicates it is under some pressure, while the Piotroski F-Score of 5 out of 9 suggests conditions are typical for a stable company. However, the weighted average cost of capital of 8.36% eclipses the return on invested capital of 0.27%, meaning it struggles to effectively generate profits from its investment initiatives.

Guru ownership

Elliott is now one of the airline's largest shareholders, according to FactSet.

GuruFocus 13F portfolio data as of the end of the first quarter shows other gurus who are invested in the stock include PRIMECAP Management (Trades, Portfolio), the T Rowe Price Equity Income Fund (Trades, Portfolio), Jim Simons' Renaissance Technologies (Trades, Portfolio), Robert Olstein (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Azvalor Managers FI (Trades, Portfolio) and Ken Fisher (Trades, Portfolio).

Final thoughts

While Southwest has undeniably become one of the most popular low-cost airlines in the U.S., changes are needed in order for it to grow and effectively compete. Whether that calls for a complete leadership change or simply a shift in its strategy remains to be seen.

Regardless, something must be done in order for its stock to take off. As such, Elliott Management may be just the thing the company needs to get started.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance