Southwest Airlines Co (LUV) Reports Q1 2024 Earnings: Misses Analyst Forecasts Amidst ...

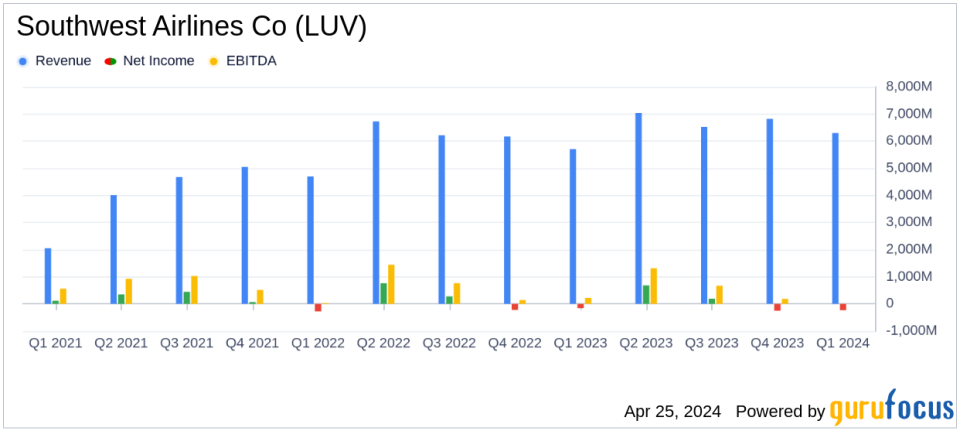

Net Loss: Reported a net loss of $231 million, or $0.39 loss per diluted share, falling short of estimates expecting a net loss of $190.88 million and -$0.34 per share.

Operating Revenues: Achieved record first quarter operating revenues of $6.3 billion, surpassing the estimated $6420.45 million.

Liquidity: Maintained strong liquidity with $11.5 billion, significantly exceeding the debt outstanding of $8.0 billion.

Cost Management: Experiencing cost pressures but realizing benefits from ongoing cost reduction actions, with a focus on enhancing productivity and controlling discretionary spending.

Network Optimization: Announced closures at four airport operations to address underperforming markets and optimize network efficiency.

Revenue and Capacity Guidance: Expects an all-time quarterly record for operating revenue in Q2 2024, despite anticipating a decrease in RASM by 1.5% to 3.5% year-over-year.

Fleet Adjustments: Plans for approximately 20 Boeing 737-8 aircraft deliveries in 2024, a reduction from previous expectations, due to delivery delays.

On April 25, 2024, Southwest Airlines Co (NYSE:LUV) disclosed its financial results for the first quarter of 2024 through an 8-K filing. The airline reported a net loss of $231 million, or $0.39 loss per diluted share, falling short of analyst expectations which projected a smaller loss of $0.34 per share and a net loss of $190.88 million. Despite these figures, the company achieved a record first quarter operating revenue of $6.3 billion, although this too was slightly below the anticipated $6.420 billion.

Southwest Airlines, recognized as the largest domestic air carrier in the U.S. by passengers boarded, operates over 700 aircraft primarily consisting of Boeing 737 models. The airline focuses on short-haul, leisure flights with a point-to-point network, maintaining a low-cost carrier business model.

Operational Highlights and Challenges

The first quarter of 2024 posed several challenges for Southwest Airlines, including increased operational costs and revised aircraft delivery expectations which impacted its growth strategy. The airline's President and CEO, Bob Jordan, highlighted efforts to control costs and enhance productivity amidst these challenges. Notably, the company decided to close operations at four airports and is revising its network to optimize performance.

Significant issues were also noted with aircraft deliveries from Boeing, prompting a swift strategic realignment to mitigate impacts on operations. The airline now anticipates a reduction in aircraft deliveries, which has led to adjustments in capacity growth forecasts for 2024 and 2025.

Financial Health and Future Outlook

Southwest reported liquidity of $11.5 billion, which is robust compared to its outstanding debt of $8.0 billion. Looking ahead, the company provided guidance anticipating a decrease in second quarter 2024 RASM (revenue per available seat mile) by 1.5% to 3.5%, with capacity expected to rise by 8% to 9%. The airline also expects economic fuel costs per gallon to range from $2.70 to $2.80.

For the full year of 2024, Southwest now projects a high-single digit increase in operating revenue growth, adjusted for current trends and planned post-summer schedule reductions. This adjustment comes as a direct consequence of the revised aircraft delivery schedules and ongoing operational challenges.

Strategic Initiatives and Capital Management

Amidst financial headwinds, Southwest Airlines is pushing forward with strategic initiatives aimed at enhancing customer experience and operational efficiency. These include network optimization and cost control measures such as limiting hiring and offering voluntary time off programs. The company's capital expenditures for Q1 2024 stood at $583 million, primarily driven by aircraft-related spending.

In terms of shareholder returns, the company continued its commitment by returning $215 million through dividends in the first quarter of 2024. Additionally, the airline highlighted its ongoing efforts in sustainability, notably through the launch of Southwest Airlines Renewable Ventures and investments in sustainable aviation fuel technologies.

Conclusion

Despite the challenges faced in the first quarter, Southwest Airlines is actively implementing strategies to navigate current headwinds and lay a foundation for future profitability and growth. Investors and stakeholders will likely keep a close watch on how these strategies unfold in upcoming quarters, particularly in light of the external pressures affecting the airline industry.

Explore the complete 8-K earnings release (here) from Southwest Airlines Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance