Southern States Bancshares Inc (SSBK) Q1 2024 Earnings: Exceeds EPS Estimates, Showcases Robust ...

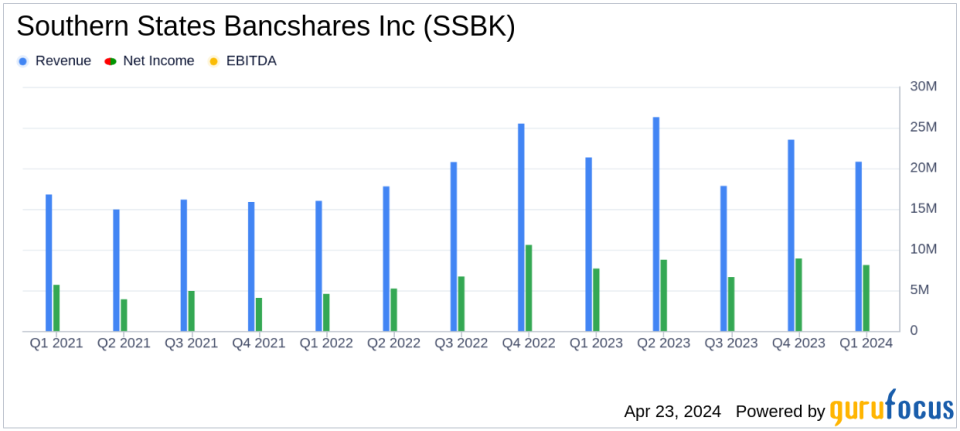

Net Income: Reported at $8.1 million, surpassing the estimated $7.50 million.

Earnings Per Share (EPS): Achieved $0.90 per diluted share, exceeding the estimate of $0.83.

Revenue: Net interest income reached $20.8 million, falling short of the estimated revenue of $21.60 million.

Net Interest Margin (NIM): Decreased to 3.59%, down from 3.69% in the previous quarter and from 4.07% year-over-year.

Loan Growth: Experienced a significant linked-quarter loan growth of 17.2% annualized.

Deposit Growth: Total deposits grew by 18.3% on an annualized basis from the previous quarter.

Efficiency Ratio: Maintained at 46.90%, indicating operational efficiency.

On April 22, 2024, Southern States Bancshares Inc (NASDAQ:SSBK) released its 8-K filing, unveiling the financial results for the first quarter of 2024. The company reported a net income of $8.1 million, translating to earnings of $0.90 per diluted share, which surpasses the analyst's estimate of $0.83 per share. This performance indicates a significant improvement from the previous quarter's earnings of $0.85 per share and highlights the company's ongoing financial strength and operational efficiency.

Company Overview

Southern States Bancshares Inc operates as a full-service community banking institution, providing a wide range of banking products and services. The bank serves businesses and individuals across its communities, with a portfolio segmented into real estate, commercial and industrial, and consumer and other loans. It operates 13 branches in Alabama and Georgia, along with two loan production offices in Atlanta.

Financial Performance Highlights

The company's net interest income for the quarter stood at $20.8 million, marking a 2.1% increase from the previous quarter and a 6.6% increase year-over-year. Despite the challenging interest rate environment, Southern States managed to expand its net interest margin (NIM) slightly to 3.59%, although this represents a decrease from 4.07% in the same quarter the previous year. This was primarily due to higher costs of interest-bearing deposits which outpaced the yield on interest-earning assets.

Significantly, the bank achieved a 17.2% annualized growth in loans and an 18.3% growth in total deposits from the previous quarter, demonstrating robust business acquisition and customer retention strategies. Noninterest income, however, saw a decline to $1.3 million, a 59.3% decrease from the previous quarter, mainly due to a lack of large one-time fees that had boosted previous figures.

Operational and Strategic Developments

According to CEO Mark Chambers, the bank has continued to leverage its strong momentum from 2023, focusing on selective lending and risk management to maintain solid credit quality. The strategic acquisition of CBB Bancorp is set to further strengthen Southern States' deposit base and enhance its loan growth capabilities in new markets.

"We built on our momentum in 2023 and continued strong lending activity in the first quarter, selectively identifying compelling opportunities while carefully managing risk and maintaining solid credit quality," stated Mark Chambers, CEO of Southern States.

Challenges and Forward-Looking Statements

Despite the positive outcomes, the company faces ongoing challenges from the high interest rate environment, which continues to pressure the net interest margin. Additionally, the shift from noninterest-bearing to interest-bearing deposits has unfavorably impacted the NIM. The bank's forward-looking statements suggest cautious optimism, with plans to navigate current market dynamics while pursuing strategic growth opportunities.

Conclusion

Southern States Bancshares Inc's first quarter of 2024 results reflect a resilient business model capable of navigating a complex banking environment. With strategic expansions and a focus on maintaining a high-quality loan portfolio, the company is well-positioned for continued growth. Investors and stakeholders may find reassurance in the bank's ability to exceed earnings expectations and its strategic initiatives aimed at long-term value creation.

Explore the complete 8-K earnings release (here) from Southern States Bancshares Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance