Sotera Health Co (SHC) Q1 2024 Earnings: Aligns with Analyst EPS Projections Amid Revenue Growth

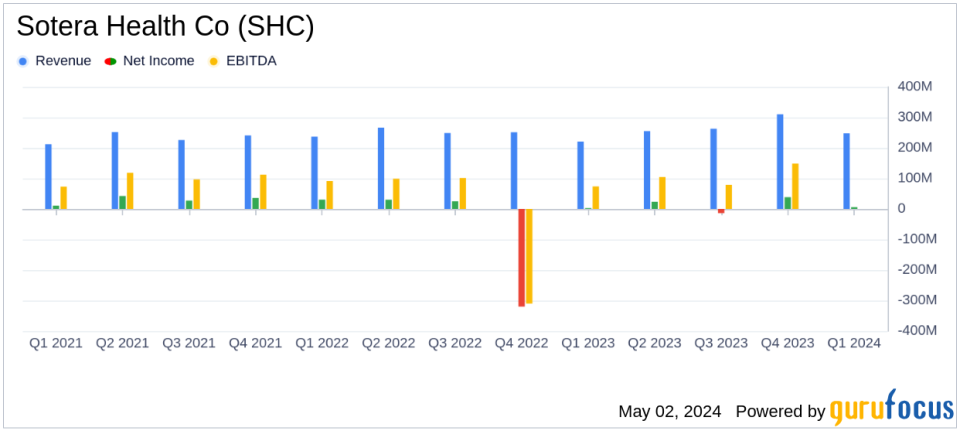

Revenue: Reached $248 million in Q1 2024, up 12.5% year-over-year, surpassing estimates of $244.35 million.

Net Income: Reported at $6 million, significantly below the estimated $36.46 million.

Earnings Per Share (EPS): Achieved $0.02 per diluted share, falling short of the estimated $0.13 per share.

Adjusted EBITDA: Increased by 13.7% to $112 million, indicating improved operational efficiency.

Segment Performance: Sterigenics segment revenue grew by 4.1% to $166 million; Nelson Labs saw a 10.8% increase to $58 million.

Financial Position: Held $2.3 billion in total debt with $261 million in cash and cash equivalents as of March 31, 2024.

2024 Outlook: Company reaffirms its growth projection of 4.0% to 6.0% in net revenues and Adjusted EBITDA.

Sotera Health Co (NASDAQ:SHC) released its 8-K filing on May 2, 2024, revealing a notable increase in net revenues and a steady EPS in line with analyst expectations for the first quarter of 2024. The company, a global provider of sterilization, analytical lab testing, and advisory services, reported a 12.5% increase in net revenues, reaching $248 million compared to $221 million in Q1 2023. Adjusted EPS remained consistent at $0.13, aligning with current quarterly estimates.

Company Overview

Sotera Health operates through three segments: Sterigenics, Nordion, and Nelson Labs. Sterigenics offers terminal sterilization and irradiation services, Nordion supplies Co-60 and gamma irradiators, and Nelson Labs provides microbiological and analytical chemistry testing services. The company's services are crucial in ensuring the safety of medical, pharmaceutical, and food products across the United States, Canada, Europe, and other regions.

Financial and Operational Highlights

The first quarter saw a robust performance across all business segments. Sterigenics reported a revenue of $166 million, up 4.1% year-over-year, driven by favorable pricing and changes in foreign currency exchange rates. Nordion experienced a significant revenue increase to $24 million, a 180.8% rise, primarily due to favorable volume and mix related to reactor harvest schedules. Nelson Labs also showed strong performance with a 10.8% increase in revenues, reaching $58 million.

Adjusted EBITDA for the quarter increased by 13.7% to $112 million. The company's net income saw a rise, reaching $6 million, or $0.02 per diluted share, up from $3 million, or $0.01 per diluted share in the previous year. This improvement reflects the company's operational efficiency and ability to manage costs effectively despite market challenges.

Strategic Developments and Future Outlook

CEO Michael B. Petras Jr. highlighted the company's strategic focus and adaptation to regulatory changes, notably the EPA's update on National Emission Standards, which poses challenges but finds SHC well-prepared due to prior investments in emission controls. The company reaffirmed its 2024 outlook, projecting net revenues and Adjusted EBITDA growth of 4.0% to 6.0%, with capital expenditures expected between $205 million and $225 million.

Financial Position and Liquidity

As of March 31, 2024, Sotera Health reported $2.3 billion in total debt with $261 million in cash and cash equivalents. The company's Net Leverage Ratio stood at 3.8x, consistent with the end of 2023. These figures reflect a stable financial position capable of supporting ongoing operations and future growth initiatives.

Conclusion

Sotera Health's Q1 2024 results demonstrate a solid start to the year, marked by revenue growth and stable earnings per share. The company's strategic investments and operational focus are poised to navigate regulatory challenges effectively, supporting its reaffirmed outlook for the year. Investors and stakeholders may look forward to continued growth and operational enhancements that align with long-term strategic goals.

For further details, investors are encouraged to review the full earnings report and stay tuned for upcoming investor events, including the RBC 2024 Global Healthcare Conference and the Sotera Health 2024 Annual Meeting of Shareholders.

Explore the complete 8-K earnings release (here) from Sotera Health Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance