SoftBank’s Quiet Finance Chief to Take Son’s Place in Spotlight

(Bloomberg) -- Masayoshi Son has become synonymous with SoftBank Group Corp. and its risky bets in his four decades running the company. Now Yoshimitsu Goto is taking over Son’s role briefing investors once a quarter about the firm’s performance.

Most Read from Bloomberg

Biden, Xi Chart Path to Warmer Ties With Blinken China Visit

FTX Latest: Binance CEO Plans Recovery Fund, Laments Bad Actors

Fall of the World’s Hottest Stock Cost Sea Founders $32 Billion

US Stocks Climb as Fed’s Brainard Buoys Sentiment: Markets Wrap

Who? Goto is SoftBank’s little-known finance chief, who has earned Son’s trust by helping him steer the world’s biggest tech investor through the tumult of the Covid-19 pandemic and a ferocious downturn in the technology market.

For decades, Son used his platform during the quarterly results to pitch his investment concepts to the public. Staffers worked for days to capture just the right images and messaging for the billionaire’s ideas, including golden eggs dancing under a goose, tofu on conveyor belts and flying unicorns. He proselytized a bright, technology-driven future, winning die-hard fans who held onto SoftBank’s stock through some of the sector’s biggest downturns.

That show is over. This Friday, the 65-year-old Son will take the stage for a few minutes, before handing over the July-September earnings conference call to his chief financial officer. Goto will likely lead earnings briefings in the future to give Son more time to focus on chip design unit Arm Ltd.’s planned initial public offering and other priorities, company officials said. Son has regularly handled the company’s earnings calls since at least 1995.

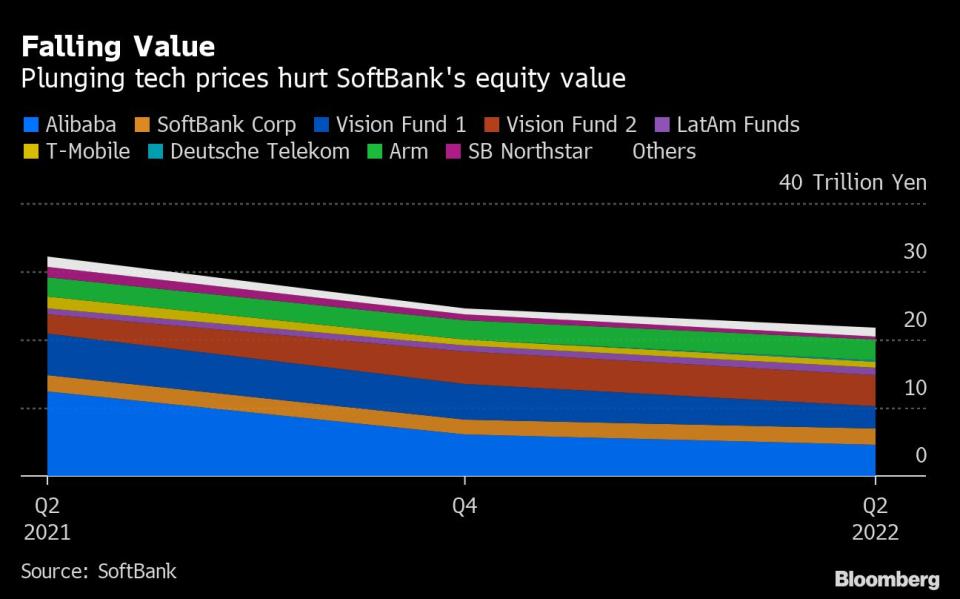

Son’s move roused concern on social media about his health, underscoring how succession and financial stability have risen to the forefront of stakeholders’ concerns. SoftBank reported a record loss of $23 billion in the last quarter and subsequently unveiled a flurry of job cuts.

The 59-year-old Goto’s style is far different from that of his boss. While Son is a consummate salesman who won from Steve Jobs exclusive rights to sell Apple Inc.’s iPhone in Japan, Goto represents the financial foundations of the company and its ties to Japanese banks. Its interest-bearing debts, excluding telecom arm SoftBank Corp., exceeded 17 trillion yen ($117 billion) at the end of June.

Since the start of the year, the pace of investment at SoftBank’s billions-wielding funds has dropped to a crawl. The Hang Seng Tech Index, which tracks bellwether Chinese companies, slumped 29% during the three months ended September in its worst performance on record, with Softbank’s most valuable holding, Chinese internet company Alibaba Group Holding Ltd., flirting with fresh all-time lows in Hong Kong this month. The Nasdaq 100 index remains slumped, weighing on SoftBank’s portfolio.

It is now up to Goto, a former banker, to reassure creditors and shareholders that their money is safe, and that the company’s debt levels are manageable.

“There’s not going to be this message that AI is the future of investing,” said Kirk Boodry, an analyst at Redex Research. “The balance sheet is what’s important.”

SoftBank’s core Vision Fund unit is expected to log billions of dollars in losses due to the rout in tech stocks. Overall, however, the group is expected to return to profitability in the quarter ended September, thanks to the disposal of a chunk of its Alibaba holding, according to Macquarie Capital analyst Paul Golding. Another key focus will be Arm’s revenue, which could help gage its prospects when going public.

“The exposure to public, liquid, identifiable value is misunderstood by the market. It’s actually higher than what the market understands it to be,” Golding said.

Goto joined SoftBank more than twenty years ago from Mizuho Financial Group Inc. at the urging of his mentor, Kazuhiko Kasai. Kasai had worked with Son on early deals, including SoftBank’s bet-the-company acquisition of Vodafone Group Plc’s Japan operations in 2006. Goto strengthened SoftBank’s relationship with Mizuho, now the conglomerate’s biggest lender and Japan’s third-largest bank, translating Son’s big dreams into financially feasible transactions. Goto was promoted to CFO in 2018.

“Sound financial management is the utmost priority,” Goto said in August. “Although many say this is an opportunity to invest, we believe we need to slow down new investment activities under the current market situation.”

Goto has stuck with Son, outlasting the departure of several high-profile lieutenants. Chief Operating Officer Marcelo Claure left earlier this year, while Chief Strategy Officer Katsunori Sago resigned in 2021. Rajeev Misra, the long-time head of the Vision Fund, gave up most of his titles and responsibilities to start his own investment fund.

One option Goto has said all managers should constantly weigh is whether a company should be public or private, adding to speculation Son may lead a management buyout of SoftBank. Over the last month, SoftBank has accelerated its pace of stock buybacks, boosting its shares more than 40% this quarter. Son has talked internally about taking SoftBank private, Bloomberg News has reported.

Goto’s communication skills will be put to the test on Friday when he takes the stage.

“We believe that SoftBank’s results to end-September will show further down rounds across the private portfolio of its holdings,” Victor Galliano, an independent analyst who publishes on Smartkarma, wrote in a note.

Even Son, who in bullish years showcased the startups in SoftBank’s portfolio he was most excited about, this year showed an image of a seedling planted in the middle of a barren winter landscape.

“I don’t think anyone can conclusively say that markets have bottomed,” Redex’s Boodry said.

--With assistance from Haruka Kuroo and Jeanny Yu.

Most Read from Bloomberg Businessweek

Americans Have $5 Trillion in Cash, Thanks to Federal Stimulus

How Apple Stores Went From Geek Paradise to Union Front Line

One of Gaming’s Most Hated Execs Is Jumping Into the Metaverse

Meta Investors Are in No Mood for Zuckerberg’s Metaverse Moonshot

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance