There Is Smoke From the M&A Rumor Mill, but Is There Fire?

Where there is smoke, there might be fire. As such, it behooves this analyst to investigate to see if there is some money to be made. The rumor mill has been quite active this past couple of weeks on mergers and acquisitions with the following three I find interesting and plausible. They appear to be good value, too.First, there have been whispers about a potential takeover of Vodafone Group PLC (NASDAQ:VOD). According to a Betaville alert, there is speculation that American telecom companies are eyeing the European telecom as a potential takeover target. Additionally, rumors suggest one of Vodafone's existing shareholders might be increasing their stake.

Furthermore, there are indications that Vodafone has received a new offer for its Italian unit. Although details remain undisclosed, sources following the matter have reported this development. In the past month, Iliad SA (XPAR:ILD) revealed that Vodafone rejected a revised proposal to merge their Italian businesses. Notably, Vodafone had previously turned down an offer exceeding 11 billion euros ($11.94 billion) for its Italian unit from an Iliad-backed consortium in 2022.Second, recent market murmurs suggest packaging company Sealed Air Corp. (NYSE:SEE) could be a potential takeover target. Berry Global (NYSE:BERY) is said to be interested. The stock has experienced a 28% decline over the past year, and the absence of a permanent CEO adds to the intrigue. As of now, Chief Operating Officer Emile Chammas and Chief Financial Officer Dustin Semach are stepping in as interim co-presidents and co-CEOs, continuing their existing responsibilities. The situation remains fluid, and market watchers are closely monitoring developments in this dynamic landscape.Finally, shares of Altice USA Inc. (NYSE:ATUS), a broadband provider, surged after rumors circulated that Charter Communications (CHTR) may be sniffing around. Altice has high short interest, so it is possible the rumors may have been circulated to flush the shorts out, but maybe not. This seems to happen quite frequently.Let us take a look at these stocks from a fundamental point of view, regardless of whether or not the rumors are true, to see if they are worth buying.

Vodafone

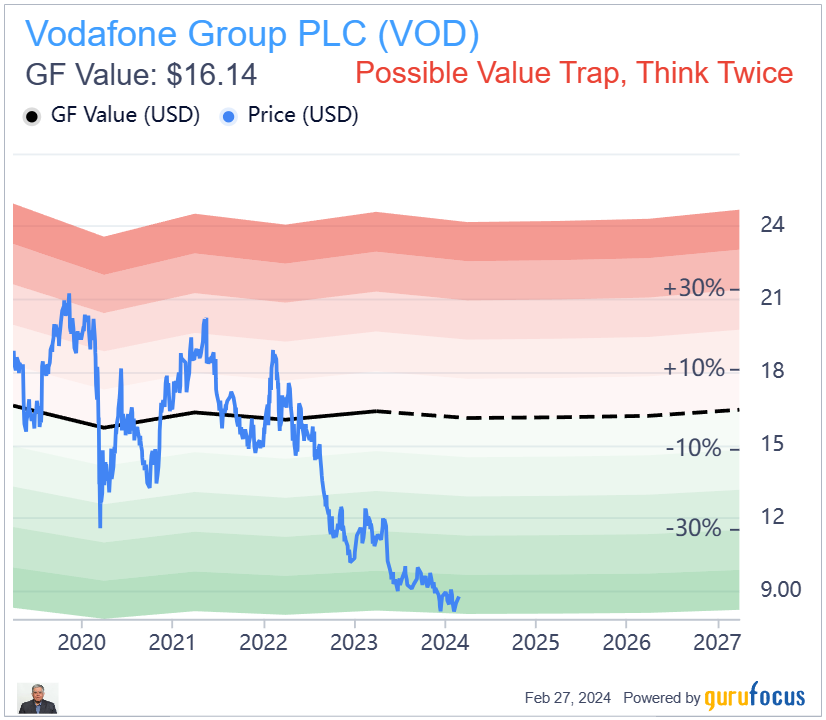

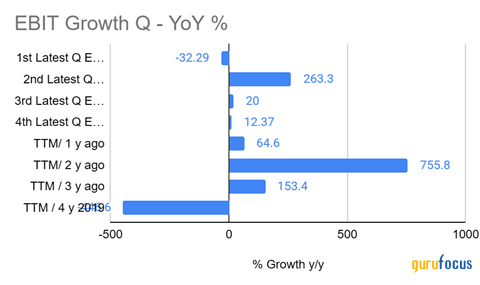

Vodafone (NASDAQ:VOD) has been a melting icecube for a long time, but lately it has been turning in good numbers, so the takeover rumors may have some legs. Further, Ebit per share has been on a positive trajectory over the last five years. Investors use Ebit to gauge a company's operational efficiency, providing insight into the core business performance, irrespective of external factors like taxes and interest.

VOD Data by GuruFocusOn a percentage change basis, year-over-year changes have been positive in three of the last four quarters, though the data is a bit volatile. Also, the changes have been positive for the current year over the last three years, but still down from 2019.

GuruFocus rates Vodafone as deeply undervalued, so much so that its flagging it as a possible value trap. This value trap flag is certainly well deserved when seen in the context of long underperformance of its shares.

However, Vodafone does pay a dividend of 11.45%, though the dividend itself is variable and depends on the company's results, but the company has been paying dividends for a long time.

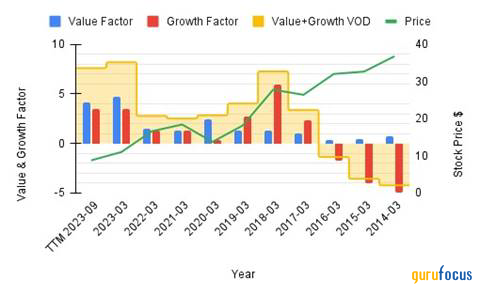

Vodafone's stock is dirt cheap with a price-earnings ratio of 2.08 (forward price-earnings ratio is 13.04). Morningstar also rates the stock as five-star, though it does not give it an economic moat.Based on the simple value and growth factors methodology I detailed in "The Zen of Price," Vodafone shows up very well on both value and growth factors. In short, the factors are derived as follows:

Value factor = Operating profits/ (enterprise value 10-year U.S. Treasury bond rate)Growth factor = Five-year Ebitda growth rate per share divided by 5.

Sealed Air

Sealed Air (NYSE:SEE) looks significantly undervalued on the GF Value chart. Also Morningstar gives it a five-star rating on value, while also conferring on it a narrow economic moat due to high switching costs its customers will incur if they were to go to a competitor. The company makes packaging and packaging equipment, especially for food manufacturers.

Sealed Air does face some short-term challenges with both operating income and revenue tracking below the five-year trendline. However, the trendline is sloping upward, which is a good sign. The company experienced a boom in business in 2021-22 when customers stocked up on packaging material, pulling forward sales. As a result, the company has been experiencing an inventory whiplash effect. However, I think this is temporary and should abate over the next year or so.

SEE Data by GuruFocusSealed Air's combined simple and value factor was a solid 4.85 as of September. Top-line results for the fourth quarter of 2023, announced on Feb. 27, were decent.

All in all, Sealed Air looks like a good bet, regardless of merger and acquisition rumors.

Altice USA

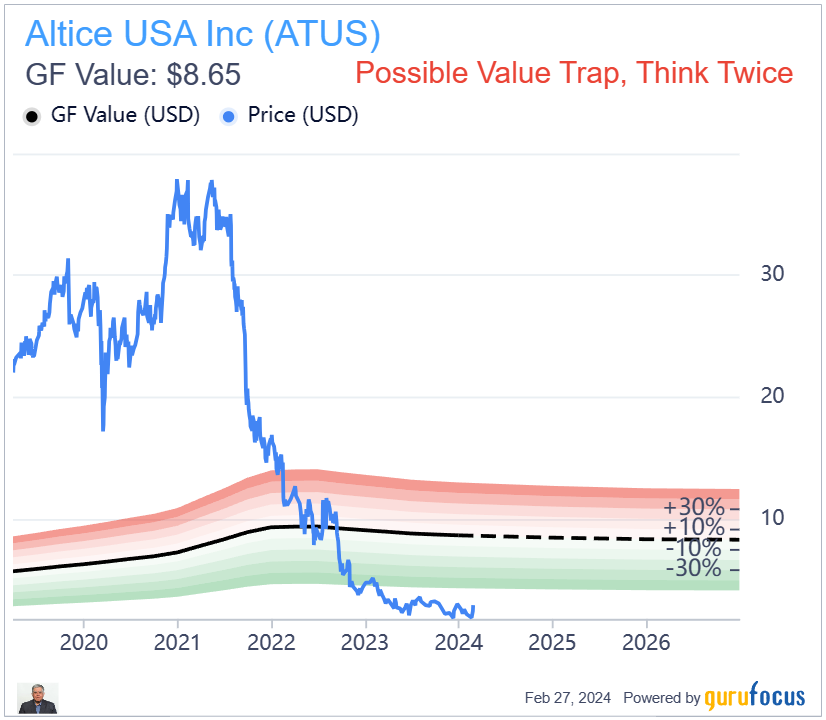

Altice (NYSE:ATUS) stock has been a disaster, to put it mildly. In 2015, Altice Europe acquired the privately held U.S. cable company Suddenlink, followed by the acquisition of Cablevision in 2016. Suddenlink serves approximately 3.50 million U.S. homes and businesses, primarily in smaller markets, with significant clusters in Texas, West Virginia, Idaho, Arizona and Louisiana. Meanwhile, Cablevision provides similar services to around 5.50 million homes and businesses in the New York City metro area. Both regions operate under the Optimum brand name. Subsequently, Altice Europe spun off Altice USA, which encompasses both Suddenlink and Cablevision, to shareholders in 2018.

Altice is controlled by the French-Israeli businessman Patrick Drahi. Drahi controls Altice through Class B shares, which are not publicly traded (unlike publicly traded Class A shares, which have one vote per share). Class B shares of Altice USA are entitled to 25 votes per share. The much higher voting power of Class B shares allows insiders to maintain control over corporate decisions without dilution from public shareholders. Thus, public shareholders are at the mercy of Drahi & Co., which is both good and bad.

While Drahi will most likely make decisions on a long-term basis, which should in theory benefit common class A shareholders, there is potential for conflict of interest. There is a possibility of a "take under," whereas Drahi could engineer a privatization of the company while the stock is deeply undervalued and short-change the common shareholders. There is also a possibility of a bankruptcy because of the high debt which Altice USA carries. The short interest is quite high with about 15% of the shares sold short.In terms of simple value and growth factors, Altice shows up decently with a combined score of 3.52 as of December. Thus, Altice is another dirt cheap stock, as long as punters like us are mindful of the high debt load and low financial strength score of only 3. The stock could well go to zero. The Altman Z-score is a cringe-worthy 0.41.

Conclusion

While the financier and investor Bernard Baruch once wryly observed that the main purpose of the stock market is to make fools of as many men as possible, the Roman stoic philosopher Seneca reminded the world long ago that luck is what happens when preparation meets opportunity. The above listed opportunities may well be only smoke and mirrors based on rumors, but fundamentally do look like decent bets. I would be surprised if no one is sniffing around. As I have often observed, good things do happen to cheap stocks if they can avoid going bust. One way of avoiding going bust is to sell out at the right time.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance