Smithfield Foods, Up 16% YTD, Has a Plan to End Malaise

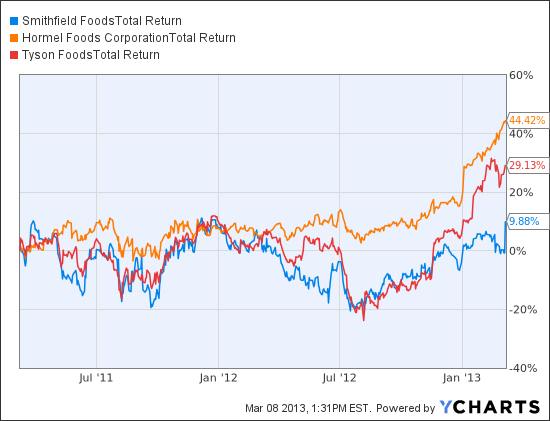

It’s no wonder that investors in pork producer Smithfield Foods (SFD) were frustrated. Before Thursday’s excitement, Smithfield shareholders had made exactly zero return in two years while investors at competitors, like Spam-maker Hormel Foods (HRL) and chicken producer Tyson Foods (TSN), pocketed decent cash, as seen in a stock chart.

That last spike in Smithfield’s share price follows a better-than-expected earnings report, which was quickly followed with revelations that a major shareholder wanted serious changes. Continental Grain Co., which controls about 6% of Smithfield, declared its dismay with the lack of shareholder value in a letter and suggested breaking up Smithfield into three separate companies to get more.

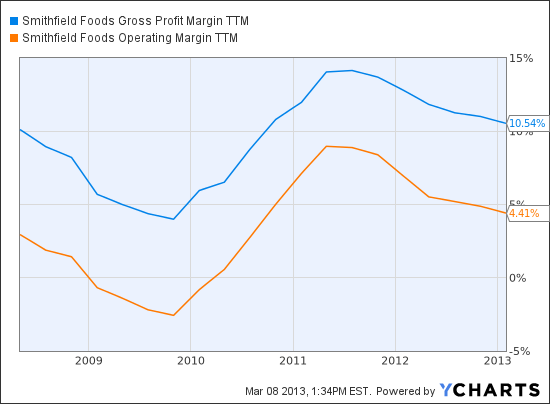

A breakup is not at all what the Smithfield board has had in mind. Smithfield has been promising for a couple of years now to unlock shareholder value by moving the product mix toward packaged foods – bacon and sausage, for example, as opposed to raw pork and hogs – to raise profit margins and make it less vulnerable to commodity prices. The latest two earnings reports showed that the packaged goods were gaining sales and market share as planned but hadn’t yet bolstered overall profit margins.

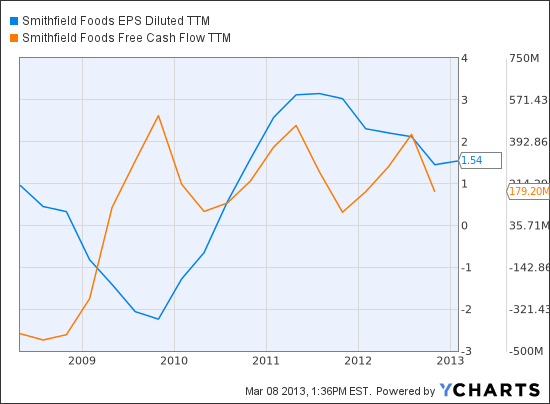

Continental also harped on executive pay ($37 million over the past two years for the CEO, according to the letter), and the lack of a dividend at Smithfield. Hormel has a dividend yield of about 1.8% now, and Tyson has a 1% dividend yield. Smithfield’s board may find initiating a dividend the most palatable way to make Continental back off. The company has earnings and cash flow, although the board says it wants to use that for acquisitions.

As for breaking up the company into thirds? Well, Smithfield has a market cap of $3.86 billion. Splitting could result in three small caps: one for hog production, one for fresh pork, and one for packaged meats. See anything particularly enticing there?

Dee Gill, a senior contributing editor at YCharts, is a former foreign correspondent for AP-Dow Jones News in London, where she covered the U.K. equities market and economic indicators. She has written for The New York Times, The Wall Street Journal, The Economist and Time magazine. She can be reached at editor@ycharts.com.

Yahoo Finance

Yahoo Finance