Simon Property (SPG) Misses on Q1 FFO & Revenues, Suspends View

Simon Property Group, Inc.’s SPG first-quarter 2020 funds from operations (FFO) per share of $2.78 missed the Zacks Consensus Estimate of $2.90. The reported figure also comes in 8.6% lower than the year-ago quarter’s FFO of $3.04 per share.

Further, the company generated revenues of $1.35 billion in the quarter, lagging the Zacks Consensus Estimate of $1.39 billion. The revenue figure also comes in 6.8% lower than the prior-year quarter reported tally.

Notably, "Business was off to a good start in January and February” according to the company’s management. However, things got jittery in March, with the coronavirus pandemic and the resultant store closures in the month to contain its spread.

Nevertheless, as of May 11, the company has reopened 77 of its U.S. retail properties in markets where local and state orders have been lifted and retail restrictions have been eased. Moreover, as of this date, 12 of Simon's Designer and international Premium Outlets properties have reopened.

However, in light of the coronavirus pandemic and related setbacks, Simon Property has withdrawn its guidance for the full year issued on Feb 4. Regarding dividends, the company said its board of directors will announce a common stock dividend for the second quarter before the end of June. The company intends to maintain a common stock dividend paid in cash and expects to distribute at least 100% of its REIT taxable income.

Inside the Headline Numbers

For the U.S. Malls and Premium Outlets portfolio, occupancy was 94% as of Mar 31, 2020, shrinking 110 basis points year on year. Retailer sales per square foot of $703 for the trailing 12-month period ended Feb 29, 2020, reflects an increase of 6.5%. However, the company’s temporary closure of its U.S. retail properties effective Mar 18, 2020 affected its performance and therefore, retailer sales per square foot came in at $673 for the trailing 12-month period, marking just 2.1% growth.

Base minimum rent per square feet was $55.76 as of Mar 31, 2020, up 2.6% year on year. Furthermore, leasing spread per square foot for the trailing 12-month period ended Mar 31, 2020 increased 4.6% to $2.80.

While comparable property net operating income (NOI) for the reported quarter was flat, portfolio NOI declined 0.2%.

Business Update

In response to the pandemic and its impact on business, Simon Property has substantially reduced all non-essential corporate spending as well as property operating expenses. In addition, the company has suspended or eliminated more than $1 billion of redevelopment and new development projects.

Nonetheless, for some redevelopment and new development projects in the United States and internationally that are nearing completion, construction continues. The company’s share of remaining required cash funding is roughly $160 million for these projects that are presently slated to be finished in 2020 or 2021. The company also drew $3.75 billion under its revolving credit facilities.

Furthermore, the company has implemented a temporary reduction to the base salary of some of its salaried employees as well as a temporary furlough of certain corporate and field employees due to U.S. retail properties’ closure.

Balance Sheet Position

During the first quarter, the company made efforts to bolster its financial flexibility. The company amended and extended its $4-billion senior unsecured multi-currency revolving credit facility with a $6-billion senior unsecured credit facility. The new facility consisted of a $4-billion multi-currency revolving credit facility and a $2-billion delayed draw term loan facility. The revolving credit facilities can further be increased by $1 billion, subject to additional commitments. The maturity dates for the revolving facility initially is on Jun 30, 2024, and the term facility initially is on Jun 30, 2022.

Notably, Simon Property had $8.7 billion of liquidity as of Mar 31, 2020. This comprised $4.1 billion of cash on hand, including its share of joint-venture cash, as well as $4.6 billion of available capacity under its revolving credit facilities and term loan, net of outstanding U.S. and Euro commercial paper.

Currently, Simon Property carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

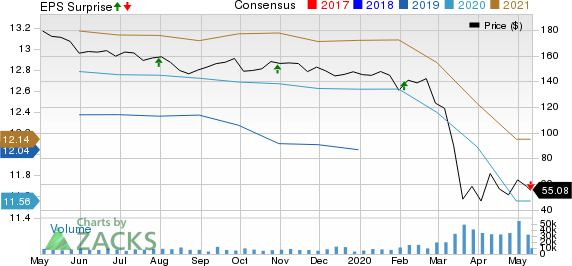

Simon Property Group Inc Price, Consensus and EPS Surprise

Simon Property Group Inc price-consensus-eps-surprise-chart | Simon Property Group Inc Quote

We now look forward to the earnings releases of other REITs like Cedar Realty Trust CDR, CBL Properties CBL, and Vereit, Inc. VER, slated to release first-quarter numbers on May 14, May 18 and May 20, respectively.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group Inc (SPG) : Free Stock Analysis Report

CBL Associates Properties Inc (CBL) : Free Stock Analysis Report

Cedar Realty Trust Inc (CDR) : Free Stock Analysis Report

VEREIT Inc (VER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance