Simmons First National Corp (SFNC) Q1 2024 Earnings: Aligns with Analyst EPS Projections

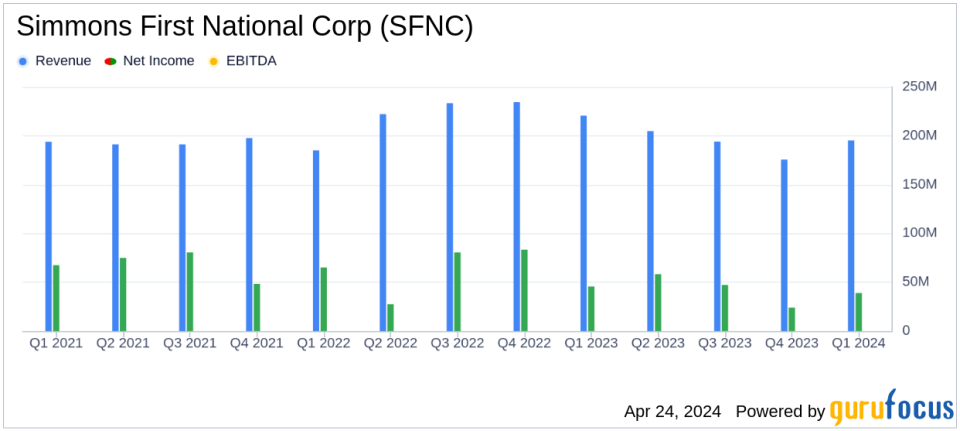

Net Income: Reported at $38.9 million for Q1 2024, below the estimated $40.43 million.

Earnings Per Share (EPS): Achieved $0.31, falling short of the estimated $0.32.

Revenue: Totalled $195.1 million, below the forecast of $202.35 million.

Net Interest Margin: Remained relatively stable at 2.66%, demonstrating effective cost management despite economic pressures.

Loan Growth: Increased by 4% on a linked quarter annualized basis, indicating robust organic growth.

Deposit Growth: Rose by 2% on a linked quarter annualized basis, with notable increases in money market and savings accounts.

Provision for Credit Losses: Exceeded net charge-offs by $2.1 million, reflecting a cautious approach to potential credit risks.

On April 24, 2024, Simmons First National Corp (NASDAQ:SFNC) disclosed its first-quarter earnings for the year, revealing a performance that aligns closely with analyst expectations for earnings per share but falls slightly short in revenue projections. The detailed earnings insights were released in their recent 8-K filing.

Simmons First National Corp, a prominent financial holding company, operates through its subsidiaries offering a wide range of banking services. These services include consumer and commercial loans, and savings products, alongside trust services, investment lending, and more, primarily across the United States.

Performance Overview

For Q1 2024, Simmons reported a net income of $38.9 million and diluted earnings per share (EPS) of $0.31, closely aligning with the analyst's EPS estimate of $0.32. The reported revenue stood at $195.1 million, slightly below the estimated $202.35 million. The company's CEO, Bob Fehlman, highlighted the quarter's solid results reflective of Simmons' strong risk management culture and profitability focus, despite a challenging economic backdrop.

Financial Highlights and Challenges

Simmons experienced a modest growth in total loans and deposits, with a noted increase in money market and savings accounts. The net interest margin remained stable at 2.66%, reflecting effective management of funding costs and deposit mix. However, the company faced heightened credit costs, with provision expenses exceeding net charge-offs by $2.1 million, indicating a cautious approach to potential credit risks.

The balance sheet showed resilience with total assets amounting to $27.37 billion. The capital and liquidity positions remained robust, supporting ongoing growth initiatives and shareholder returns, evidenced by a consistent dividend payout and a strong capital adequacy ratio.

Detailed Financial Metrics

Simmons' asset quality metrics showed some stress with an increase in nonperforming loans, primarily due to specific legacy loans impacted by the economic downturn. The allowance for credit losses stood at 1.34% of total loans, consistent with the previous quarter, underscoring a prudent stance on potential vulnerabilities.

Noninterest income saw an uptick due to higher debit and credit card fees and mortgage banking income, totaling $43.2 million. Conversely, noninterest expenses were managed effectively at $139.9 million, down from $148.1 million in the previous quarter, reflecting cost control measures and lower FDIC special assessment charges.

Strategic Movements and Future Outlook

Simmons continues to focus on strategic growth and operational efficiency. The bank's loan portfolio diversification and disciplined cost management are expected to support profitability in the upcoming quarters. However, the ongoing adjustments in credit and interest rate environments require continuous monitoring.

The company's commitment to shareholder returns remains strong, with a declared quarterly dividend increase and a prudent approach to capital management, as seen in the strategic non-utilization of the stock repurchase program in Q1.

As Simmons First National Corp navigates through fluctuating market conditions, its foundational strategies of risk management and sustainable growth will be pivotal in maintaining its trajectory towards long-term value creation for shareholders.

For more detailed information on Simmons First National Corp's financial performance and strategic directions, stakeholders and interested investors are encouraged to review the full earnings report and supplementary materials provided by the company.

Explore the complete 8-K earnings release (here) from Simmons First National Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance