Shimmick Corp (SHIM) Announces Fiscal Year 2023 Results with Mixed Performance

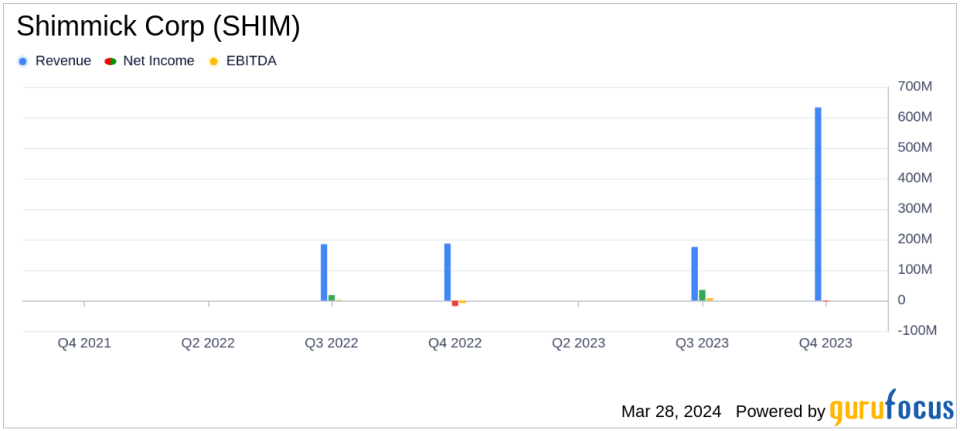

Revenue: Fiscal year revenue stood at $633 million, with Shimmick Projects contributing $434 million, marking a 24% increase year-over-year.

Net Loss: The company reported a net loss of $2.54 million for the fiscal year, a decline from the previous year's net income of $3.76 million.

Earnings Per Share (EPS): Shimmick Corp reported a diluted loss per share of $0.11, missing the estimated earnings per share of -$0.08.

Gross Margin: Gross margin for the fiscal year was 7%, consistent with the growth in Shimmick Projects revenue.

Backlog: The company's backlog reached approximately $1.1 billion as of December 29, 2023, with an 18% increase in Shimmick Projects backlog year-over-year.

Guidance: For fiscal year 2024, Shimmick Projects revenue is expected to grow 7 to 13 percent with gross margin between 7 to 13 percent.

On March 28, 2024, Shimmick Corp (NASDAQ:SHIM) released its 8-K filing, detailing the financial results for the fiscal year ended December 29, 2023. The company, a leading provider of water infrastructure solutions, reported a revenue of $633 million, which includes a significant 24% growth in Shimmick Projects revenue to $434 million. However, the company faced challenges with a reported net loss of $2.54 million and a diluted loss per share of $0.11, which did not align with analyst estimates of an EPS of -$0.08 and an estimated net income of -$1.85 million.

Shimmick Corp specializes in water treatment, water resources, and other critical infrastructure projects, including desalination plants, dams, flood control systems, and military infrastructure. The company's growth in Shimmick Projects revenue is a testament to its strategic focus on high-quality, shorter-duration projects with improved margins. Despite this, Shimmick Corp encountered headwinds with its Legacy Projects, which have been impacted by cost overruns due to the COVID pandemic, design issues, and other factors. The gross margin on these Legacy Projects was negative, reflecting the ongoing challenges in winding down these projects.

From a financial perspective, Shimmick Corp's selling, general, and administrative expenses saw a slight increase, while equity in earnings of unconsolidated joint ventures decreased significantly. The company did benefit from a notable gain on the sale of assets, which increased by $32 million, primarily driven by the sale of non-core business contracts.

The company's balance sheet shows a solid position with total assets of $426.65 million and total liabilities of $356.16 million. The balance sheet also reflects a decrease in cash and cash equivalents from the previous year, which stood at $62.94 million as of December 29, 2023.

CEO Steve Richards emphasized the company's unique position and competitive advantage in the water infrastructure space, while CFO Devin Nordhagen noted the fluctuating quarter-to-quarter results due to the transition from Legacy to Shimmick Projects. The company's backlog and the strategic focus on water infrastructure are expected to drive future growth.

Looking ahead, Shimmick Corp provided guidance for fiscal year 2024, expecting Shimmick Projects revenue to grow 7 to 13 percent with gross margins in the same range. The company anticipates that results will be back-half weighted in 2024, with strong momentum for growth in 2025.

Investors and interested parties were invited to a conference call to discuss the results and future outlook. Shimmick Corp's full financial statements and management's commentary provide further details on the company's performance and strategic initiatives.

For more detailed information, readers are encouraged to review the full 8-K filing and to stay tuned to GuruFocus.com for the latest financial news and analysis.

Explore the complete 8-K earnings release (here) from Shimmick Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance