Shake Shack (SHAK) Stock Down Despite Q1 Earnings Beat

Shake Shack Inc. SHAK reported first-quarter fiscal 2022 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate.

Despite reporting earnings and revenues beat, the company’s shares have declined 2% in the after-hours trading session on May 5. Investor sentiments were hurt as the company’s second-quarter guidance fell short of the street estimates.

Earnings & Revenue Details

During the first quarter, adjusted loss was 19 cents per share, narrower than the Zacks Consensus Estimate of a loss of 22 cents. In the prior-year quarter, adjusted earnings came in at 4 cents. Quarterly revenues of $203.4 million beat the Zacks Consensus Estimate of $201 million. The top line improved 31% on a year-over-year basis.

Shack sales during the reported quarter rose 30.6% to $196.8 million, while licensed revenues surged 43% to $6.6 million year over year. Shack system-wide sales in first-quarter fiscal 2022 climbed 35.6% year over year to $309.5 million.

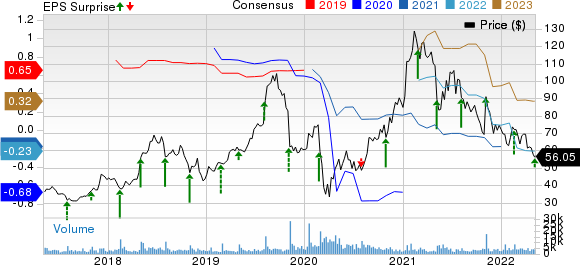

Shake Shack, Inc. Price, Consensus and EPS Surprise

Shake Shack, Inc. price-consensus-eps-surprise-chart | Shake Shack, Inc. Quote

Comps Discussion

Same-Shack sales rose 10.3% in first-quarter 2022, primarily driven by urban same-Shack sales growth of 19% over the last year. The company anticipates the trend to improve further in second-quarter 2022.

During the quarter under discussion, total digital sales, including orders placed on the Shake Shack app, website as well as third-party delivery platforms, accounted for nearly 43% of Shack sales.

During the first quarter of fiscal 2022, its average weekly sales amounted to $68,000, down from $742,000 in fourth-quarter 2021.

Operating Highlights

During the first quarter, the company’s operating loss totaled $14.9 million, compared with operating loss of $10 million in the prior-year quarter. Shack-level operating profit margin came in at 15.2%, compared with 15% in the prior-year quarter.

Total expenses (as a percentage of company revenues) increased 80 basis points (bps) year over year. Food and paper costs (as a percentage of company revenues) increased 80 basis points (bps) year over year. Labor and related expenses declined 10 bps year over year to 30.7%.

Adjusted EBITDA for the reported quarter amounted to $9.6 million compared with $7.1 million in the year-ago quarter. Adjusted EBITDA margin expanded 10 bps to 4.7%.

Balance Sheet

As of Mar 30, 2022, cash and cash equivalent totaled $279.3 million compared with $302.4 million as of Dec 29, 2021. Total long-term debt at the end of the quarter increased to $243.8 million, compared with $243.5 million at the end of Dec 29, 2021.

Q2 & 2022 Outlook

For second-quarter 2022, the company expects total revenues between $233.8 million and $239.5 million. The Zacks Consensus Estimate for revenues is pegged at $246 million. Shack sales are anticipated in the range of $227 million to $232 million. The company’s second-quarter licensed revenues are expected between $6.8 million and $7.5 million.

For second-quarter 2022, its Same-Shack Sales are expected to increase in low-mid-teens digits. Meanwhile, Shack-Level operating profit is projected to be 16-18%.

For 2022, the company anticipates opening 40 shacks to 45 shacks. Depreciation expense for 2022 is expected in the range of $70 million to $75 million.

The company currently has a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks in the same space are BBQ Holdings, Inc. BBQ, Arcos Dorados Holdings Inc. ARCO and Kura Sushi USA, Inc. KRUS.

BBQ Holdings sports a Zacks Rank #1 (Strong Buy). BBQ Holdings has a long-term earnings growth of 14%. Shares of the company have increased 16.5% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BBQ Holdings’ 2022 sales and EPS suggests growth of 40.9% and 66.2%, respectively, from the year-ago period’s levels.

Arcos Dorados sports a Zacks Rank #1. Arcos Dorados has a long-term earnings growth of 31.3%. Shares of the company have risen 25.2% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2022 sales and EPS suggests growth of 16.6% and 66.7%, respectively, from the year-ago period’s levels.

Kura Sushi carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 23.7%, on average. Shares of the company have risen 17.3% in the past year.

The Zacks Consensus Estimate for Kura Sushi’s 2022 sales and EPS suggests growth of 111.9% and 81.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Shake Shack, Inc. (SHAK) : Free Stock Analysis Report

Kura Sushi USA, Inc. (KRUS) : Free Stock Analysis Report

BBQ Holdings, Inc. (BBQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance