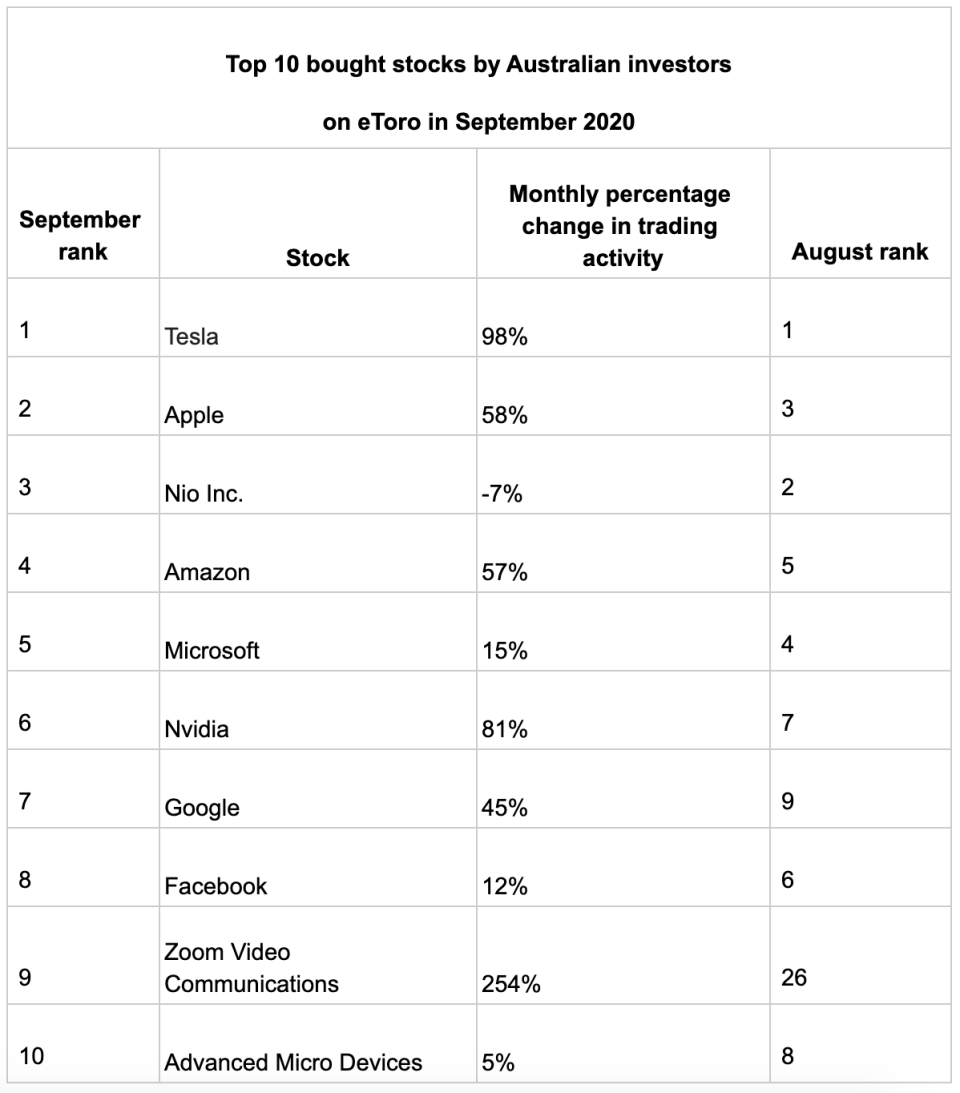

5 most-bought stocks by Aussie investors during September

Australian investors flocked to tech stocks in the month of September, with Tesla and Apple taking out the top two spots of most-bought stocks for the month, according to online trading platform eToro.

New data from the platform revealed that Tesla was the favoured stock among Aussie traders for the second month in a row.

“The electric vehicle giant had a volatile month, with its share price falling as much as 30 per cent at the start of the month before finishing down around 9 percent,” said eToro analyst Josh Gilbert.

“With a 98 per cent increase in trading activity, it’s clear that many investors saw this recent dip from Tesla as an opportunity to get their hands on this stock at an attractive price.”

However, Musk recently disappointed investors on its battery day at the end of September, with Gilbert remaking that Musk’s promises are “a long way off and may require a lot of work”.

The second most-bought stock in September was Apple, with the tech giant seeing a 58 per cent increase in trading activity last month.

“This time of year is very strong for Apple, with the holiday season just around the corner and a 13 per cent drop in September. Many investors have clearly seen this as a great opportunity to purchase Apple shares,” said Gilbert.

The third-most purchased stock is a company few have heard of: Nio Inc, a Chinese manufacturer and designer of electric vehicles. Investors have been scared off by US-China tensions, with TikTok bans making headlines recently, the eToro analyst noted.

“Many investors felt anxious with any stocks exposed to China or Chinese stocks listed in the US. As Nio Inc is a speculative stock compared to Tesla and has only been listed since 2018, many investors are more likely to be cautious about buying its stocks when it dips compared to big names like Apple and Tesla.”

E-commerce giant Amazon ranked fourth on the list, followed by Microsoft.

Stock to watch: Zoom

Although video conferencing platform Zoom was ninth on the list of most-bought stocks last month, this stock’s trading activity has actually increased by 254 per cent over September, noted Gilbert.

The rising star impressed investors with its growth amid the pandemic, with the company reporting revenue increase of 355 per cent in the 2019 financial year.

“Zoom shares then jumped higher at the end of September as increased COVID-19 cases and looming lockdowns continue across Europe. With a huge increase of 254 per cent in trading numbers throughout September, we can clearly see that investors believe Zoom still has a huge part to play in the remote work space over the next few months,” said Gilbert.

“As Zoom’s earnings reports have been historic over the last two quarters, it will be important to see whether they can sustain this growth going forward.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance