Semiconductor Stocks in Focus After Micron's Solid Q3 Earnings

Amid the coronavirus mayhem, chipmakers’ impressive performances are highlighting the companies’ resilience to the pandemic’s crippling economic impact compared with other industries.

For instance, Micron MU reported better-than-expected results for third-quarter fiscal 2020 on Jun 29. The company’s upbeat Q4 outlook further boosts confidence over chipmakers’ growth prospects this year.

Data-Center Demand Fueling Chip Sales

During its fiscal third-quarter earnings call, Micron stated that the industry is witnessing a different demand scenario for its memory chips. The company noted that the coronavirus-led global lockdown is thwarting demand for smartphone, automotive and consumer electronics.

Nonetheless, social-distancing measures have spurred significant chip demand from data-center operators, which mainly drove Micron’s quarterly results. During the earnings call, Micron stated that the work-and-learn-from-home necessity is boosting demand for cloud storage.

Furthermore, the coronavirus crisis has enhanced the usage of online services globally. Therefore, data-center operators are boosting their cloud-storage capacities to accommodate the growing demand for cloud services.

Additionally, Xilinx’s XLNX latest revised revenue outlook for first-quarter fiscal 2021 also suggests higher chip demand from data-center and telecom operators. The company, on Jun 29, raised its fiscal first-quarter revenue guidance range to $720-$734 million from the $660-$720 million predicted earlier.

The chipmaker stated that while it is witnessing some COVID-19-related impacts presently, higher-than-expected sales in Wired and Wireless Group (24% of Q4 2020 total revenues) and Data Center Group (10% of Q4 2020 revenues) are covering for weak sales in consumer-oriented end markets, including automotive, broadcast and consumer.

The latest demand trend will, undoubtedly, benefit other players in the industry too, including graphics or processor chip makers. Additionally, the companies, which provide design and other components for chip making, are anticipated to benefit from this trend.

Long-Term Prospects Look Promising

Semiconductors are the backbone of the current-day technology-driven economy. The digitization across industries, adoption of cloud computing, as well as the integration of AI and machine learnings are likely to fuel demand for semiconductors.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to propel further growth. Apart from this, blockchain, IoT, autonomous vehicles, AR/VR and wearables are other growth prospects.

What Should Investors Do?

Considering growth prospects of the chip makers, it makes sense to invest for long-term gains. Furthermore, the recent sell-off significantly lowered the valuations of semiconductor stocks, making those even more attractive for investments.

The memory-chip maker — Micron — currently carries a Zacks Rank #2 (Buy).

Apart from Micron, there are much more attractive bets in the semiconductor industry. Here, we have taken the help of the Zacks Stock Screener to shortlist four stocks that are incredible for investments. These stocks carry a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Also, the stocks have a VGM Score of A or B. Per the Zacks’ proprietary methodology, stocks with such favorable combinations offer solid investment opportunities.

Our Picks

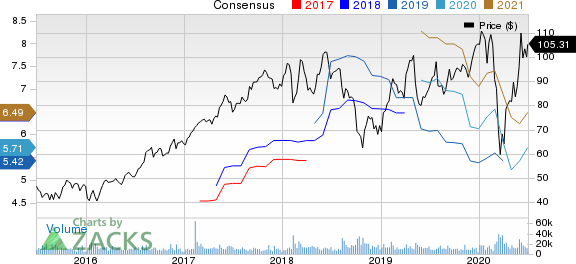

Microchip MCHP is riding on solid demand for its microcontrollers. Moreover, this Zacks Rank #2 company is anticipated to witness strength in the medical end market, driven by growth in hospital equipment demand. Improving demand across office equipment and communication infrastructures, courtesy of requirement for cloud-computing solutions amid the coronavirus crisis-led work-from-home wave also bodes well.

The stock has a VGM Score of B. The Zacks Consensus Estimate for fiscal 2021 earnings has moved 9.4% north in the past 60 days to $5.71 per share.

Microchip Technology Incorporated Price and Consensus

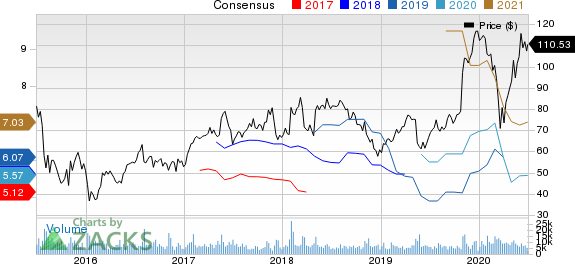

Qorvo QRVO is benefiting from the consistent solid demand for ultra-high band front end modules (FEM) owing to the launch of next-gen 5G smartphones. In addition, the company’s Bulk Acoustic Wave (BAW)-based multiplexers that enable advanced carrier aggregation are witnessing robust traction owing to their importance for the next-gen higher data-rate applications.

Further, growing momentum for the company’s solutions in defense (advanced radars and other electronic warfare products) and connectivity (Wi-Fi 6) is a positive. Additionally, increase in work-from-home trends owing to the COVID-19 pandemic is driving demand for Wi-Fi 6, which is expected to boost revenues over the long run.

Qorvo currently carries a Zacks Rank #2 and has a VGM Score of B. The consensus mark for fiscal 2021 earnings has been revised upward by 3.3% to $5.57 per share.

Qorvo, Inc. Price and Consensus

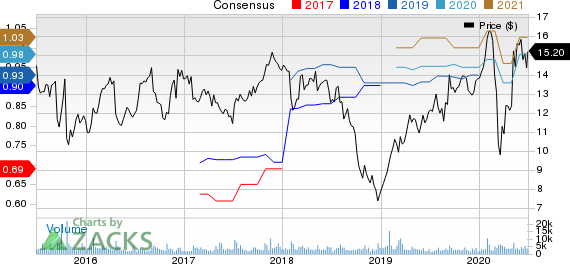

Rambus RMBS is gaining on the growing momentum of tokenization solutions. In addition to mobile payments and retail, the company has expanded tokenization offerings in markets like account-based payments, e-commerce and blockchain. Rambus has also rolled out Vaultify Trade that provides bank-grade tokenization for blockchain.

Currently, Rambus holds a Zacks Rank of 2 and a VGM Score of B. The consensus mark for 2020 earnings has been revised upward by 7.7% in the past 60 days to 98 cents per share.

Rambus, Inc. Price and Consensus

FormFactor FORM is benefiting from solid demand for both Foundry & Logic probe cards. Growing probe-card demand, customer node transitions and new design releases are major positives for this Zacks Rank #2 company. Furthermore, its increasing focus on Mobile SoC and Mobile DRAM probe-card segments is another key growth driver.

The stock has a VGM Score of B. The Zacks Consensus Estimate for ongoing-year earnings has moved 14.7% north in the past 60 days to $1.09 per share.

FormFactor, Inc. Price and Consensus

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Click to get this free report Rambus, Inc. (RMBS) : Free Stock Analysis Report Micron Technology, Inc. (MU) : Free Stock Analysis Report FormFactor, Inc. (FORM) : Free Stock Analysis Report Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report Xilinx, Inc. (XLNX) : Free Stock Analysis Report Qorvo, Inc. (QRVO) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance