SEHK Growth Leaders With High Insider Stakes May 2024

Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has recently faced significant pressures, with the Hang Seng Index experiencing a notable decline. In such an environment, discerning investors may find particular value in growth companies with high insider ownership, as these firms often demonstrate a strong alignment between management's interests and those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

New Horizon Health (SEHK:6606) | 16.6% | 61% |

Fenbi (SEHK:2469) | 32.1% | 43% |

Meitu (SEHK:1357) | 38% | 33.7% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Beijing Airdoc Technology (SEHK:2251) | 27.2% | 83.9% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 15.7% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 17.7% | 93.7% |

Here we highlight a subset of our preferred stocks from the screener.

iDreamSky Technology Holdings

Simply Wall St Growth Rating: ★★★★★★

Overview: iDreamSky Technology Holdings Limited is an investment holding company that operates a digital entertainment platform, publishing games through mobile apps and websites in the People’s Republic of China, with a market cap of approximately HK$4.88 billion.

Operations: The company generates revenue primarily through its game and information services, including SaaS and related services, which amounted to CN¥1.92 billion.

Insider Ownership: 20.1%

Revenue Growth Forecast: 27.8% p.a.

iDreamSky Technology Holdings, despite a significant net loss reduction from CNY 2.49 billion to CNY 556.35 million year-over-year, remains unprofitable with expectations of turning a profit in three years. Insiders have shown confidence by acquiring more shares recently, underscoring potential internal optimism about future growth. The company's strategic alliance with Saudi Cloud Computing Company to expand into the Saudi gaming market highlights its proactive steps towards global expansion and revenue growth forecasted at an impressive rate of 27.8% annually, outpacing the Hong Kong market's average.

Dongyue Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited operates as an investment holding company, primarily engaged in manufacturing and distributing polymers, organic silicone, refrigerants, and other chemical products across the People's Republic of China and globally, with a market capitalization of approximately HK$16.95 billion.

Operations: Dongyue Group's revenue is generated from polymers (CN¥4.55 billion), refrigerants (CN¥5.48 billion), organic silicone (CN¥4.86 billion), and dichloromethane PVC and liquid alkali (CN¥1.21 billion).

Insider Ownership: 15.4%

Revenue Growth Forecast: 15.4% p.a.

Dongyue Group Limited, a Hong Kong-based company, is experiencing significant challenges despite high insider ownership. Its earnings are expected to grow by 35.7% annually, outpacing the local market's 11.9%. However, recent financial reports indicate a substantial decline in net income from CNY 3.86 billion to CNY 707.79 million year-over-year and a drop in sales revenue from CNY 20.03 billion to CNY 14.49 billion due to lower product prices and raw material cost impacts. Leadership changes with new executive appointments may influence future strategic directions amidst these financial pressures.

CanSino Biologics

Simply Wall St Growth Rating: ★★★★★☆

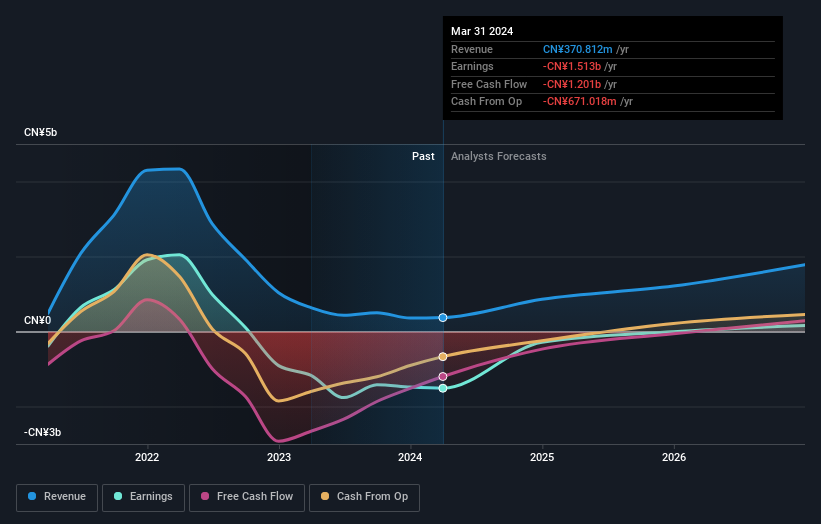

Overview: CanSino Biologics Inc. is a company based in the People’s Republic of China that specializes in the development, manufacturing, and commercialization of vaccines, with a market capitalization of approximately HK$9.29 billion.

Operations: The company generates revenue primarily from the research and development of vaccine products for human use, totaling CN¥370.81 million.

Insider Ownership: 27.9%

Revenue Growth Forecast: 34.3% p.a.

CanSino Biologics, a growth company with high insider ownership in Hong Kong, is set to become profitable within three years, with earnings expected to grow by 124.55% annually. Despite recent quarterly losses increasing from CNY 139.55 million to CNY 170.1 million, the firm's revenue growth forecast at 34.3% per year significantly outpaces the local market's 7.9%. Recent approvals for clinical trials of new vaccine candidates underscore its commitment to expanding its innovative product pipeline, enhancing future growth prospects despite current financial setbacks.

Taking Advantage

Dive into all 52 of the Fast Growing SEHK Companies With High Insider Ownership we have identified here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1119 SEHK:189 and SEHK:6185.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance