Seeing Machines'(LON:SEE) Share Price Is Down 41% Over The Past Five Years.

It is a pleasure to report that the Seeing Machines Limited (LON:SEE) is up 38% in the last quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 41% in that time, significantly under-performing the market.

See our latest analysis for Seeing Machines

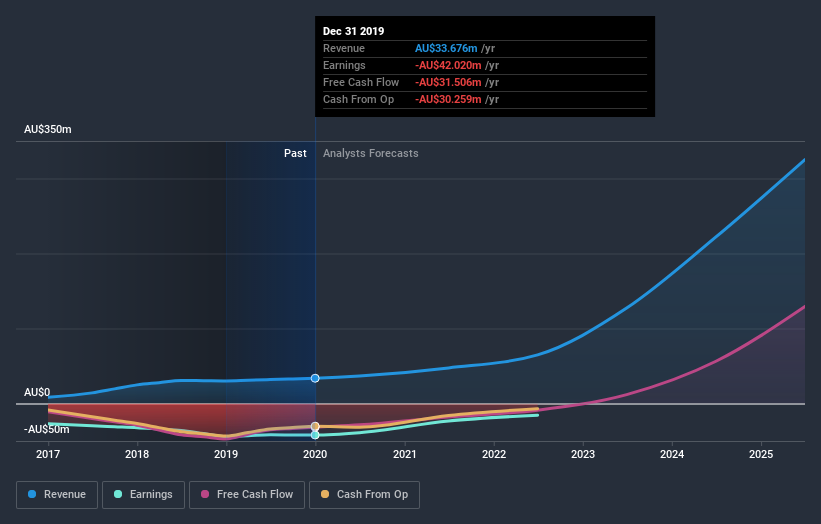

Seeing Machines wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last half decade, Seeing Machines saw its revenue increase by 12% per year. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 7.1% per year, for five years: a poor performance. Those who bought back then clearly believed in stronger growth - and maybe even profits. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Seeing Machines' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 14% in the twelve months, Seeing Machines shareholders did even worse, losing 32%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7.1% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Seeing Machines .

Of course Seeing Machines may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance