Sedlmayr Grund und Immobilien AG (FRA:SPB) Not Flying Under The Radar

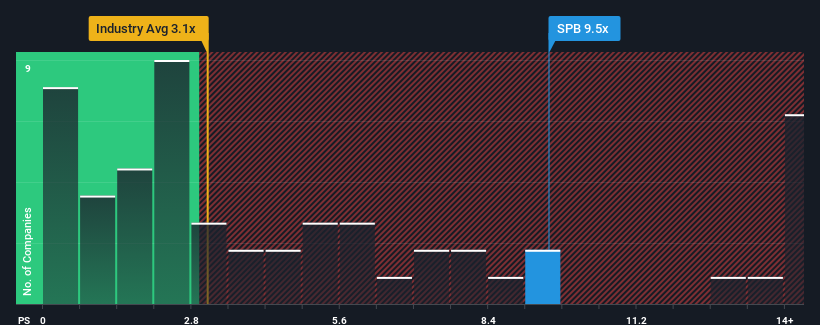

When close to half the companies in the Real Estate industry in Germany have price-to-sales ratios (or "P/S") below 3.1x, you may consider Sedlmayr Grund und Immobilien AG (FRA:SPB) as a stock to avoid entirely with its 9.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Sedlmayr Grund und Immobilien

How Has Sedlmayr Grund und Immobilien Performed Recently?

Revenue has risen at a steady rate over the last year for Sedlmayr Grund und Immobilien, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sedlmayr Grund und Immobilien will help you shine a light on its historical performance.

What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Sedlmayr Grund und Immobilien's to be considered reasonable.

Retrospectively, the last year delivered a decent 3.8% gain to the company's revenues. Still, lamentably revenue has fallen 7.5% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 37% over the next year, even worse than the company's recent medium-term annualised revenue decline.

With this information, it might not be hard to see why Sedlmayr Grund und Immobilien is trading at a higher P/S in comparison. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What Does Sedlmayr Grund und Immobilien's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Sedlmayr Grund und Immobilien revealed its narrower three-year contraction in revenue is contributing to its higher than industry P/S, given the industry is set to shrink even more. At this stage investors feel the potential for outperformance relative to the industry justifies a premium on the P/S ratio. We still remain cautious about the company's ability to stay its recent course and avoid revenues slipping in line with the industry. Although, if the company's relative outperformance doesn't change it will continue to provide strong support to the share price.

Plus, you should also learn about these 5 warning signs we've spotted with Sedlmayr Grund und Immobilien (including 2 which don't sit too well with us).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance