Schlumberger Dips Despite 4th-Quarter Revenue Beat

- By James Li

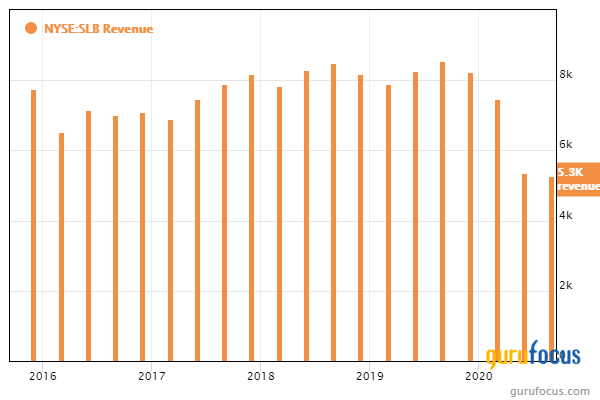

Schlumberger Ltd. (NYSE:SLB), a leading supplier of products and services to the oil and gas industry, reported on Friday that fourth-quarter revenues outperformed consensus estimates, driven by growth in several key business segments.

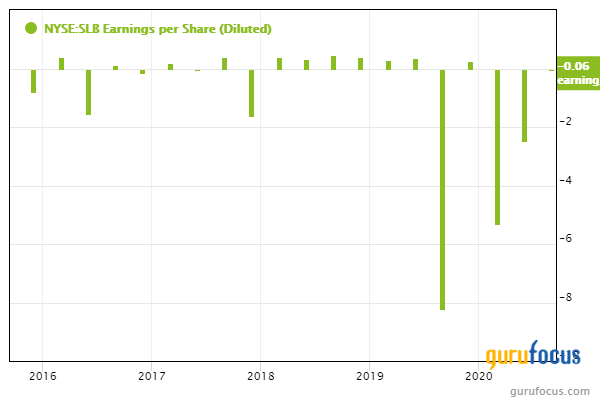

For the quarter ending December 2020, the Houston-based company reported net income of $374 million, or 27 cents per share, compared with net income of $333 million, or 24 cents per share, from the prior-year quarter.

Company beats top-line estimates

Schlumberger CEO Olivier Le Peuch said revenues increased 5% quarter over quarter driven by strong activity and solid execution in domestic and international markets. The CEO noted that revenues increased sequentially in all divisions for the first time since the third quarter of 2019.

Le Peuch added that revenues in the Digital & Integration division led results, increasing 13% quarter over quarter driven by high Asset Performance Solutions products and increased multi-client seismic license sales. Chief Financial Officer Stephane Biguet added in his prepared remarks that strong growth occurred in APS products in Ecuador.

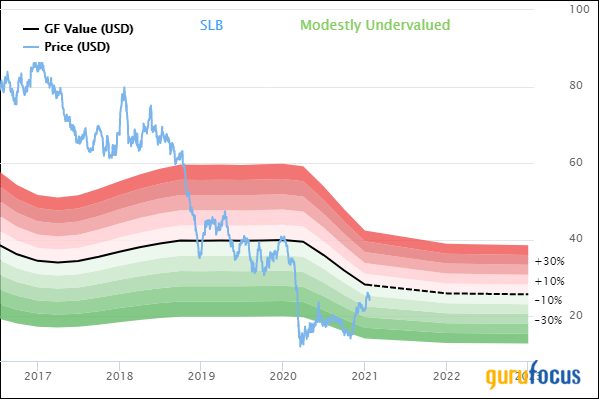

Stock trends lower despite strong revenue

Shares of Schlumberger traded around an intraday low of $23.45, down over 2% from Thursday's close of $24.17, but recovered the losses by midday. The stock is modestly undervalued based on Friday's price-to-GF-Value ratio of 0.85.

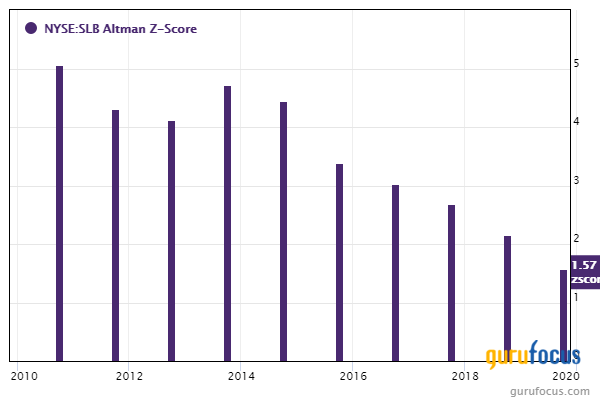

GuruFocus ranks the company's financial strength 4 out of 10 on the heels of a low Piotroski F-score of 2 and a weak Altman Z-score of 0.72.

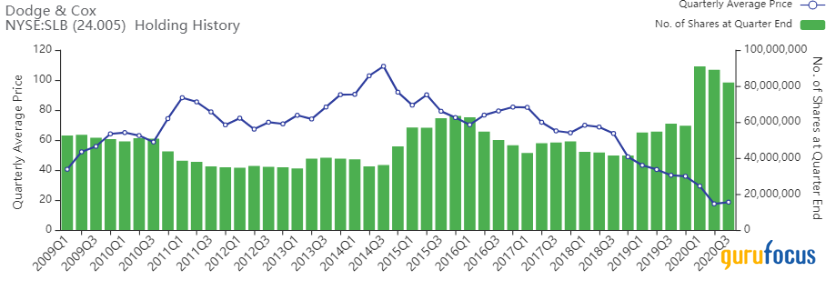

Gurus with large holdings in Schlumberger include Dodge & Cox, First Eagle Investment (Trades, Portfolio) and Ken Fisher (Trades, Portfolio).

Disclosure: No positions.

Read more here:

IBM Sinks on 4th-Quarter Sales Decline

5 Oceania Companies With Good Financial Strength and Profitability

FPA Capital Fund's Top Trades of the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance