Scalp Webinar: USD Correction In Focus- Kiwi at Risk Sub 7700

DailyFX.com -

Talking Points

Weekly DailyFX Scalp Webinar Archive covering featured setups

Updated targets & invalidation levels

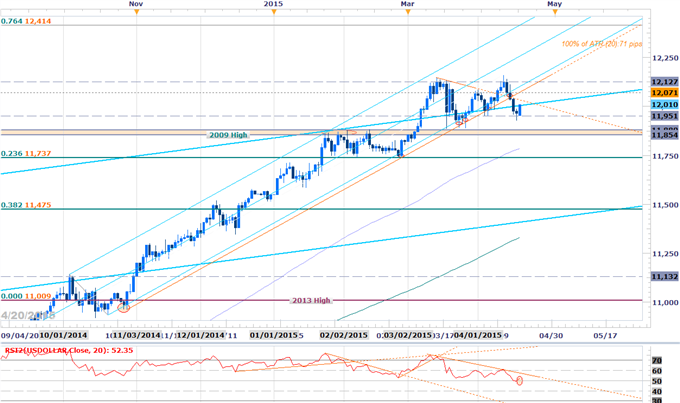

USDOLLAR Daily

Chart Created Using FXCM Marketscope 2.0

Notes: The USDOLLAR has finally cleared the slope support range we’ve been tracking for month’s with the decline stalling at the April opening range low (11,951). We are looking to sell strength in the greenback while below former slope support, now resistance into 12,071 (4/14 daily reversal resistance). A break below the monthly ORL targets key near-term support at 11,854/80 backed by the 100-day moving average at 11,785 & the 23.6% retracement / February lows at 11,737.

NZD/USD 30min

Notes:Scalp targets have been updated from last week’s kiwi setup with the our outlook unchanged. The risk for a material turn around remains while below 7700 with a break sub-slope support today putting the focus near-term support at 7660/64. Subsequent support objectives are eyed at 7617/24 & the 50% retracement at 7580. Interim resistance stands with the figure and is backed by 7726/33 (bearish invalidation).

Bottom line: Looking for a break of the weekly OR with our immediate bias weighted to the short-side sub-7700. A breach above invalidates our bias with such a scenario targeting the 2015 open / the 1.618% Fibonacci extension at 77921-7800. Event risk is limited this week so we’ll be watching broader price action in the greenback for guidance with Friday’s US Durable goods orders highlighting the economic docket.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

NZDUSD Breakout Stalls at 7700 Resistance- Short Scalps Pending

AUDJPY Snaps 9 day Losing Streak- Long Scalps Favored Above 91.20

Scalp Webinar: USD at Risk Post Dismal NFPs- AUDUSD to Face RBA

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance