The Sabra Health Care REIT (NASDAQ:SBRA) Share Price Is Down 17% So Some Shareholders Are Getting Worried

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Sabra Health Care REIT, Inc. (NASDAQ:SBRA), since the last five years saw the share price fall 17%. And the share price decline continued over the last week, dropping some 7.3%.

Check out our latest analysis for Sabra Health Care REIT

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Looking back five years, both Sabra Health Care REIT's share price and EPS declined; the latter at a rate of 39% per year. This fall in the EPS is worse than the 3.6% compound annual share price fall. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline. The high P/E ratio of 416.97 suggests that shareholders believe earnings will grow in the years ahead.

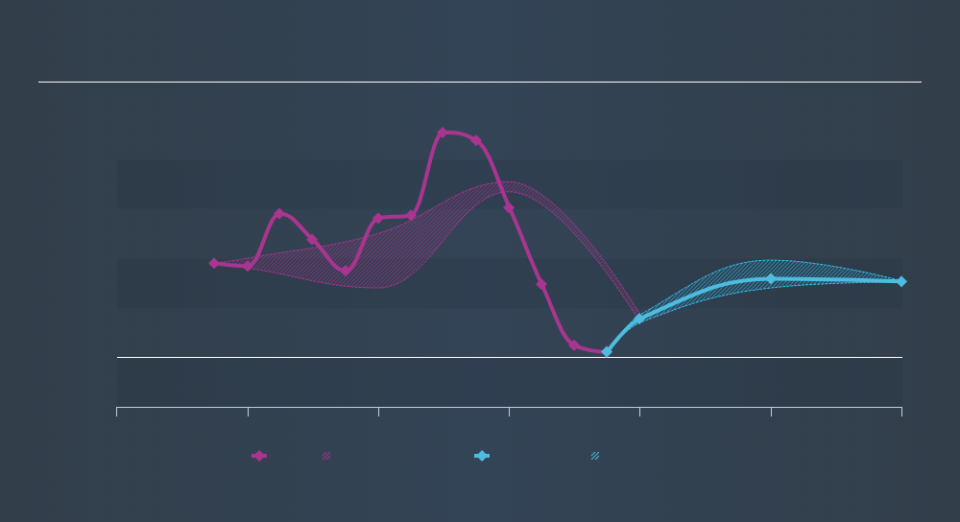

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Sabra Health Care REIT's TSR for the last 5 years was 22%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Sabra Health Care REIT shareholders have received a total shareholder return of 16% over the last year. Of course, that includes the dividend. That's better than the annualised return of 4.1% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before spending more time on Sabra Health Care REIT it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance