Roper (ROP) Rewards Shareholders With 10% Dividend Hike

In a shareholder-friendly move, Roper Technologies ROP announced a 10% hike in its dividend payout. The move underscores the company’s sound financial health as it utilizes free cash flow to enhance shareholders’ returns. This marks the company’s 30th consecutive year of dividend increase.

Roper raised its quarterly cash dividend to 68.25 cents per share ($2.73 annually) from 62 cents. The new dividend will be paid to shareholders on Jan 23, 2023, of record as of Jan 9, 2023. The dividend yield, based on the new payout and its Nov 14 closing price, is 0.6%.

Strong cash flow generation capacity supports Roper’s shareholder-friendly activities. In the third quarter of 2022, ROP generated an adjusted free cash flow of $353 million, up 9% year over year. The same was $252 million in the second quarter. In the first quarter, free cash flow was $459 million. In the first nine months of 2022, the company rewarded its shareholders with dividend payments of $196.2 million, up 10.9% year over year. Previously, in November 2021, the company hiked its dividend by 10%.

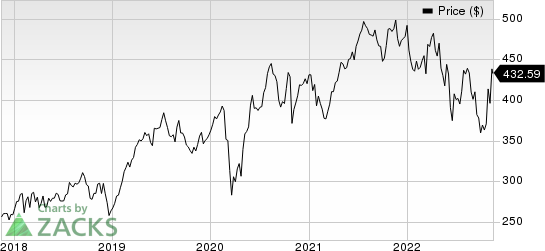

Roper Technologies, Inc. Price

Roper Technologies, Inc. price | Roper Technologies, Inc. Quote

Zacks Rank & Other Key Picks

Roper currently carries a Zacks Rank #2 (Buy). Some other stocks worth considering within the broader Computer and Technology sector are as follows:

CoStar Group CSGP presently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter average surprise of 22.4%. You can see the complete list of today’s Zacks #1 Rank stocks.

CoStar Group has an estimated earnings growth rate of 8.8% for the current year. Shares of the company have increased 14% in the past month.

Amdocs Limited DOX currently carries a Zacks Rank #2. The company delivered a trailing four-quarter average surprise of 6.5%.

Amdocs has an estimated earnings growth rate of 11.7% for the current fiscal year. Shares of the company have gained 3.4% over the past month.

Taboola.com Ltd. TBLA currently carries a Zacks Rank #2. The company delivered a trailing four-quarter average surprise of 189.5%.

Taboola.com has an estimated earnings growth rate of 234.6% for the current year. Shares of the company have gained 13% in the past month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amdocs Limited (DOX) : Free Stock Analysis Report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

CoStar Group, Inc. (CSGP) : Free Stock Analysis Report

Taboola.com Ltd. (TBLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance